Case Study: ESPP Performance Across Economic Cycles

The recent market volatility has put employee stock purchase plans (ESPPs) at the front of our mind a lot this year. While much of the compensation focus has been on restoring incentives for performance awards, we see ESPPs as a sort of bellwether for a company’s employee sentiment.

For most companies, ESPP participation has remained steady or even ticked up. After all, ESPPs are a powerful engagement tool that delivers excellent value across business cycles (as we’ll illustrate in our case below). The data supports this view, too: In recent polling of webcast participants, about 64% of respondents with ESPPs observed behavior roughly similar to the past, and a further 22% observed more interest or participation than normal.

At other firms, employee participation has declined, perhaps due to pay cut or furlough concerns. Among our client base (where we have detailed participation data), a substantial number of firms saw withdrawals increase by 40% or more. At some companies in hard-hit industries, withdrawals rose more than tenfold.

There’s no compensation plan that can avoid the painful realities of economic distress. But as some companies look forward to building a future amidst volatility and uncertainty, we’re reminded that ESPPs are an excellent equity vehicle to help employees ride out this volatility. In this blog post, we’ll explore some of the costs and benefits that different ESPP types can deliver.

Note that we assume for the case study below that readers have a basic understanding of ESPP mechanics and features. If you’d like to brush up, we recommend the following articles:

The Key to Engagement: Designing an ESPP to Drive Your People Strategy (Workspan article)

ESPPs that Work for You: Top Five Lessons Learned (blog)

Five Ways that West Coast Companies Design ESPPs (blog)

ESPPs: Financial Reporting Complexity (issue brief)

The Case

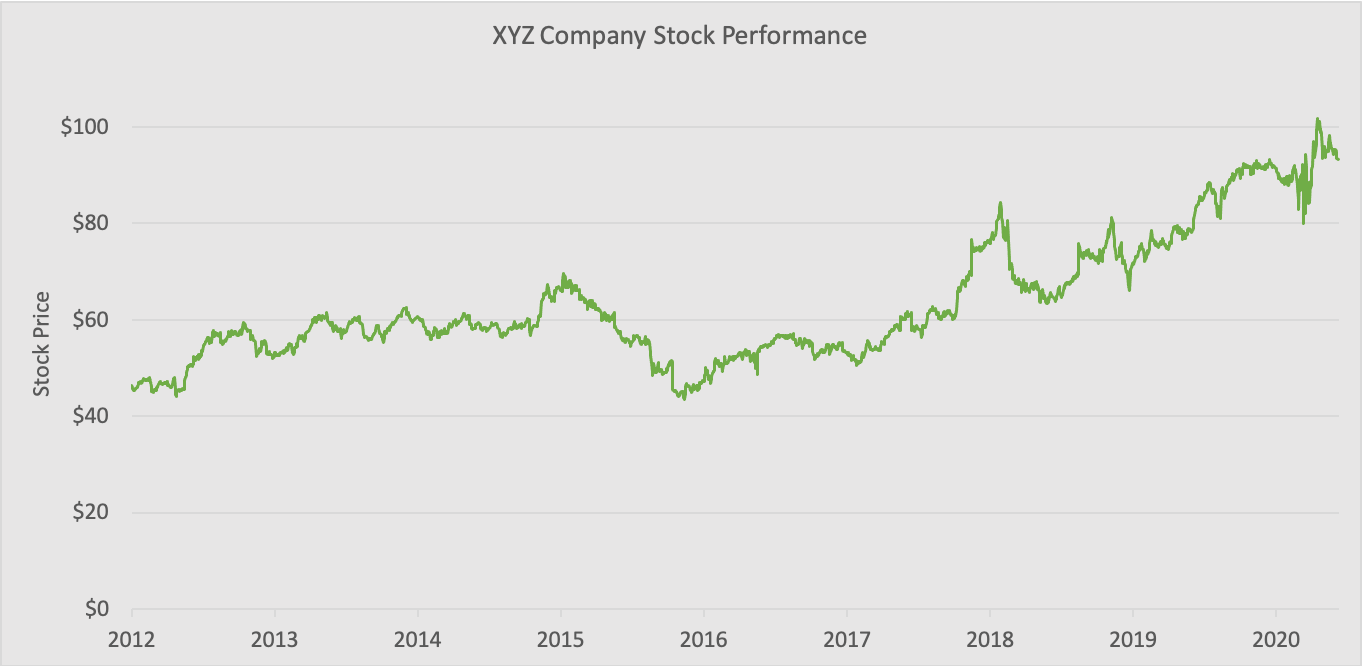

We selected a firm to study that we felt was fairly representative of a middle-of-the-road case over the last decade, with performance that roughly tracked the broader economy without unusual spikes or crashes in stock price. We’ll refer to them as Company XYZ (names have been changed to protect the innocent). The company is a Fortune 500 consumer staples firm, and our analysis is entirely at arm’s length—they’re not a client and we have no insight into any ESPP plan they may have.

For this case study, we did what we often do for our clients who are considering an ESPP: We ask, “What if this company had issued this plan over the past several years? What would have been the company costs and employee benefits?” So, in our never-ending quest to analyze as much data as possible, we simulated an employee contributing $5,000 during each purchase period in three enrollment designs, starting in May 2012 and running through April 2020. Here are the relevant plan attributes:

- Discount only. This is the most basic design we’ll cover. It assumes a six-month contribution period, at the end of which the total contributions are used to purchase shares at a 15% discount from the purchase date price.

- Lookback. This design also assumes a six-month contribution period, at the end of which the total contributions are used to purchase shares. However, with the lookback, the purchase price is a 15% discount from the lower of the enrollment date price and the purchase date price.

- Rollover. This plan design is the most generous we analyze here. It consists of a 24-month offering with four separate six-month contribution periods. Each period culminates with the contributions being used to purchase shares at a 15% discount from the lower of the enrollment date price and the purchase date price. However, if a new offering begins at a lower price while the current offering is outstanding, then the employee is rolled over into that new offering and locking in that lower price.

For each of these designs, we analyze the quantifiable costs and benefits for our simulated employee. Costs are measured as the compensation expense recognized by the company, and benefits are measured as the net gain to the employee at purchase, above and beyond their $5,000 contribution for that period.

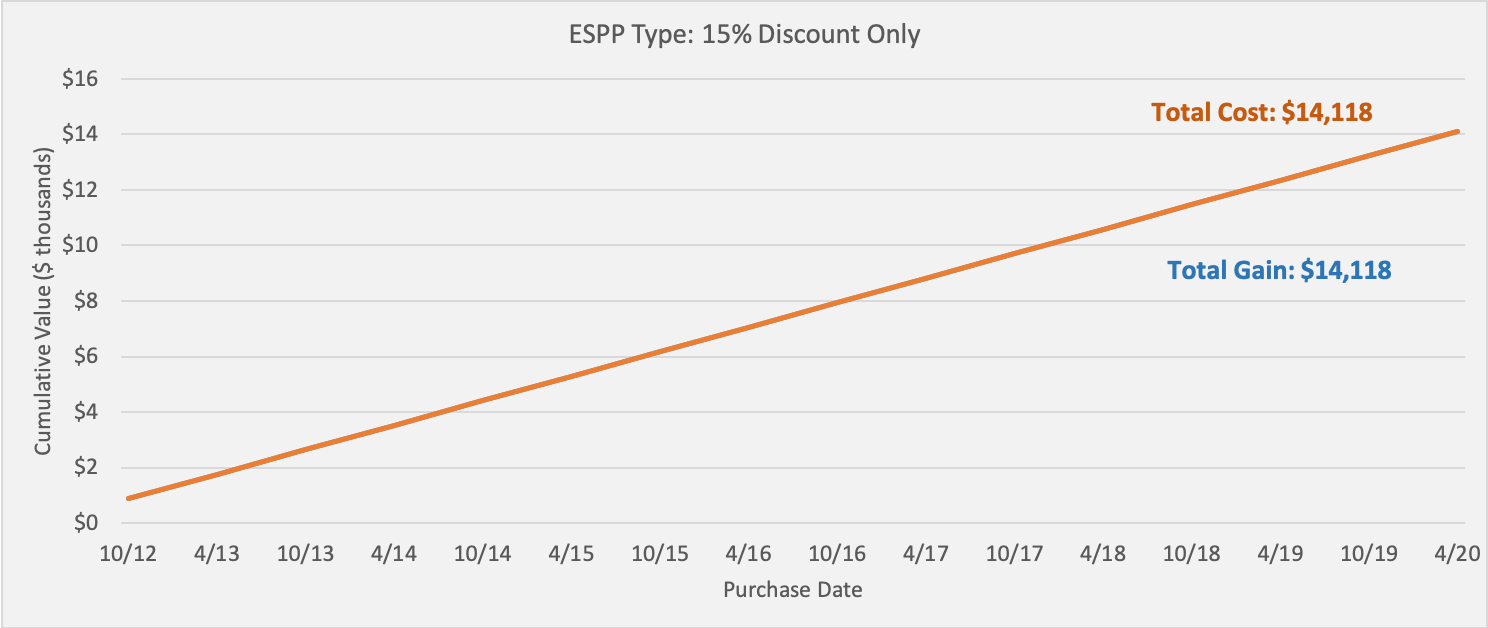

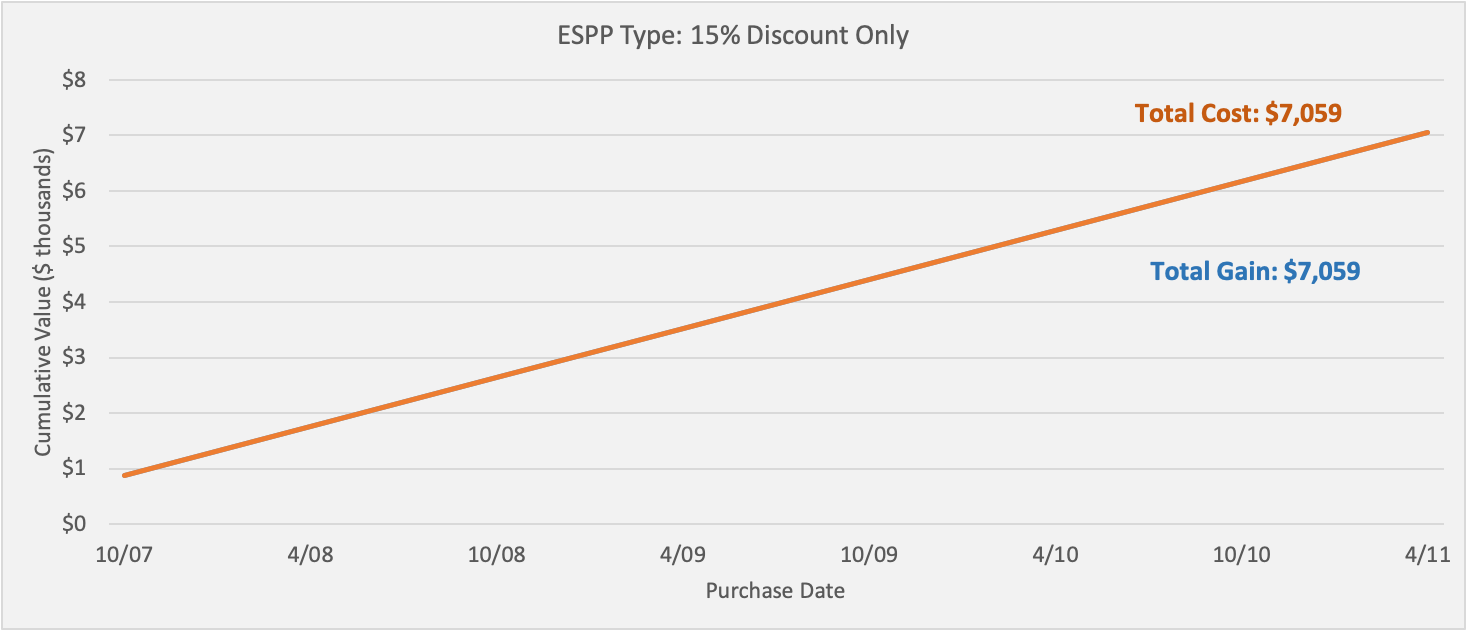

Analysis: Discount Only

First, let’s analyze a plan with only a 15% discount. The way these plans work, the cost and benefit will necessarily track almost identically to one another—the only small differences you might see are due to things like share rounding and particular systems conventions.

This makes discount-only plans relatively unexciting as a benefit offering. It’s certainly nice for the employee to gain access to that 15% discount, but it comes as cost straight out of the company’s pocket. It’s effectively a straightforward compensation arrangement with no further upside or downside.

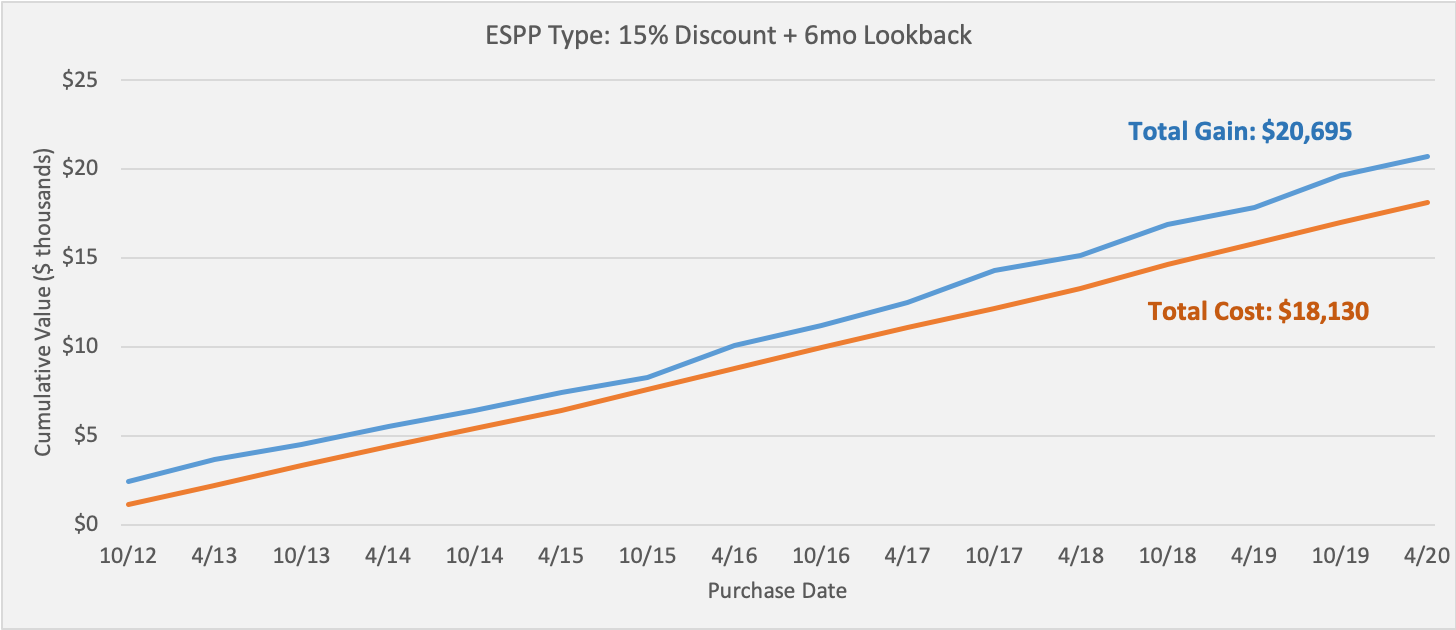

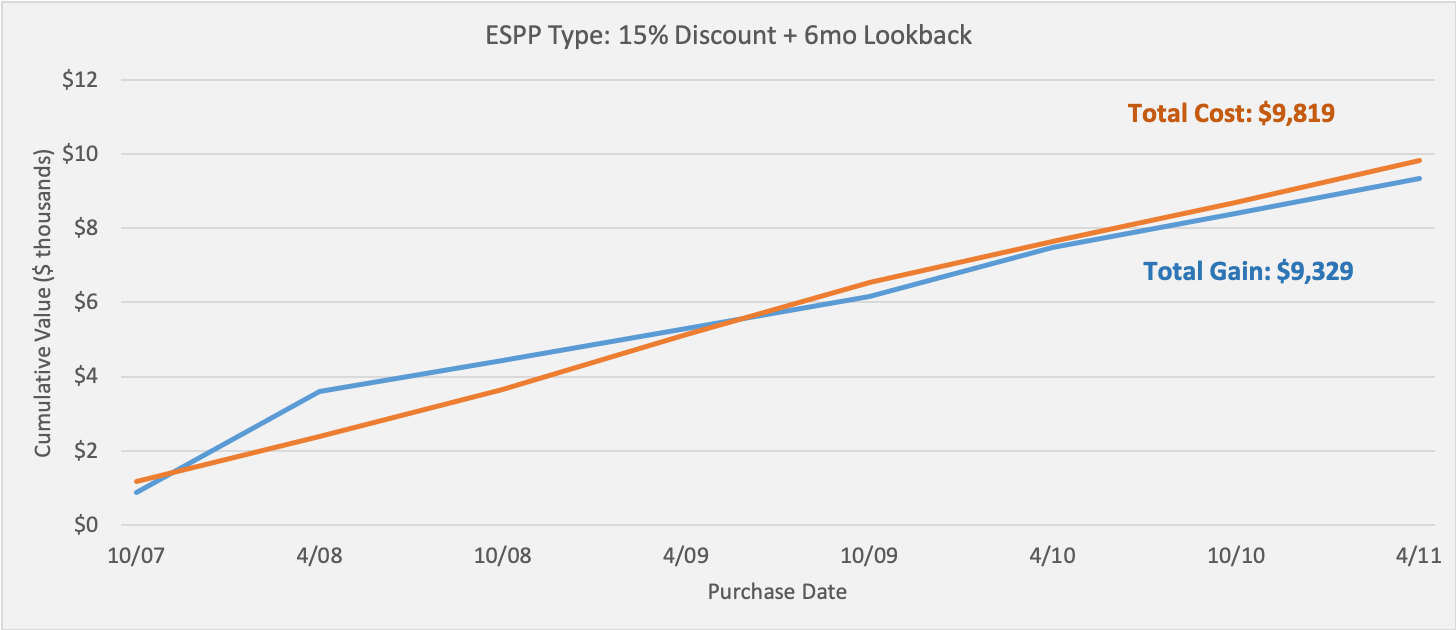

Analysis: Lookback

Next, we analyze the lookback design. Due to the way the lookback works, the employee is guaranteed a minimum gain equal to the discount-only design, but also has unlimited upside potential when the market value appreciates. In the example above, you can see the elevated gain in blue, which reflects the additional gains in a rising market. In some particularly bullish periods, the employee gain was as much as 50%!

The cost of a lookback design is also higher than discount-only, as it must capture the option-like value of the upside potential. The amount of this extra cost will vary from company to company (just like any award valuation), but will generally be steady and predictable, as shown by the straight orange line above.

The net effect in this case is an employee benefit that’s 53% higher than the baseline discount-only design, for a cost that’s only 29% higher—definitely a good bang for this company’s buck.

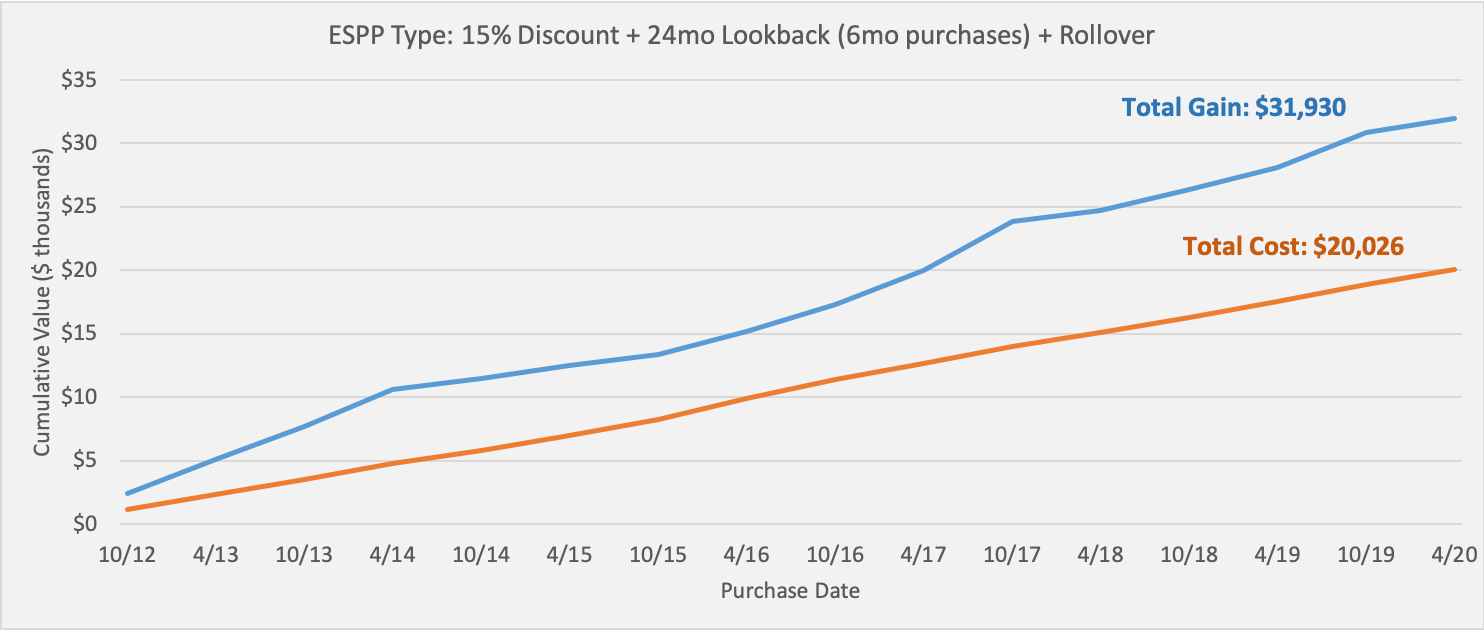

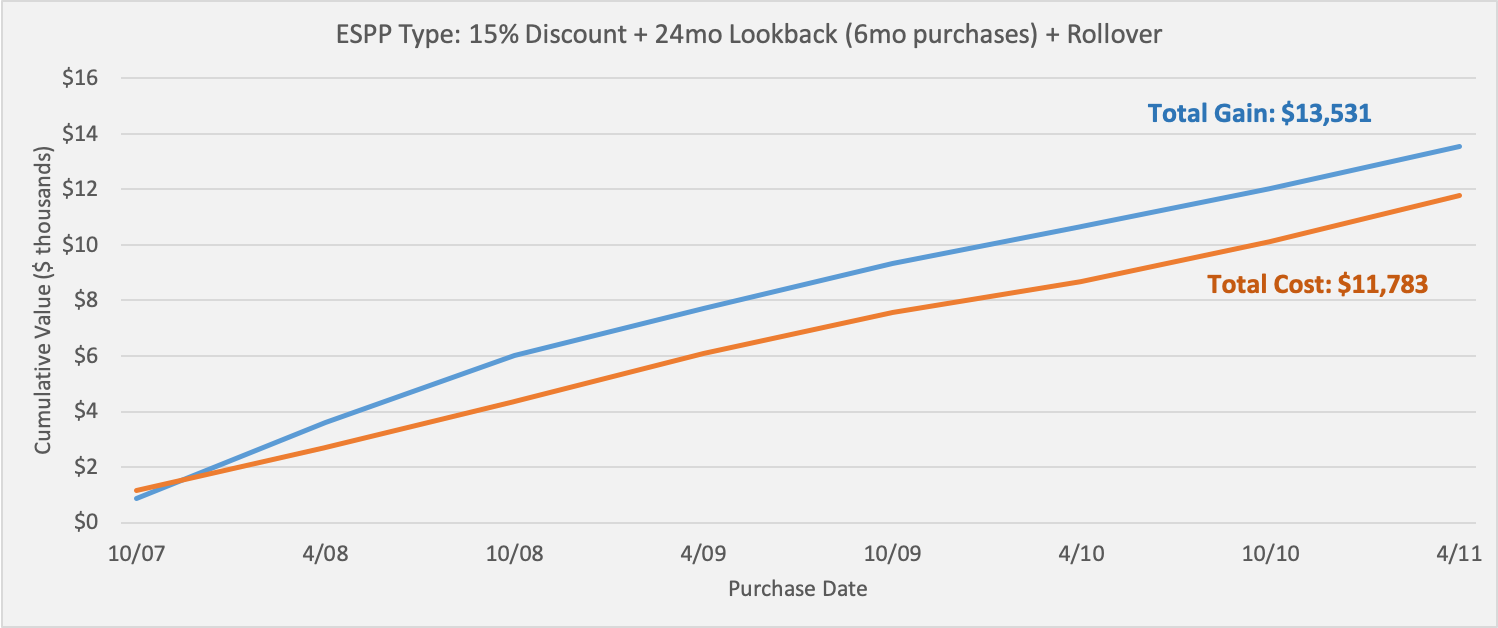

Analysis: Rollover

Next up is the rollover design. This design incorporates both the lookback and discount features, as well as having four purchases in one offering. The longer runway afforded by multiple purchases per offering adds a lot of value on its own: Since the lookback feature allows the participant to purchase at the lower of the purchase or enrollment date price, it gives the market price more time to climb without the lookback price ratcheting upward.

The other feature that adds a lot of value is the rollover itself, which helps further protect participants from decreases in the market price. If the price declines, which in this case occurs for the April 2015 purchase, the employee rolls over into the new offering at the lower price. This ensures that every employee can always buy at the most favorable price available, and leads to the steep gains seen above in 2016.

On the cost side of the ledger, two features of this design lead to higher expense for the company. One is the longer offering period to accommodate the four purchases. Because of the longer option term embedded in these purchases, the value is higher—just like Black-Scholes with a longer expected term. The other is that any time a rollover is triggered, it triggers an accounting modification and associated incremental expense.

On the whole, this is again a substantial value for the employee at a favorable cost. The employee sees a 136% gain over a discount-only plan—that’s more than twice the value—at only a 43% cost increase to the company. We caution that these results won’t be of the same magnitude for every company. This company had a lower volatility than others might, which leads to lower costs, and of course the last eight years have been a very positive period for stock performance. That said, we do consistently see good ROI for our clients’ money in implementing generous ESPPs like these.

Reviewing the Last Recession

Another angle we want to explore given the current economic uncertainty is what happened in the last recession, and what that can tell us about how ESPPs might behave in a future recession. With the above examples only running from 2012 to 2020, we also tested the period 2007 to 2011 on these same plan designs.

For a discount-only plan, we found again that the costs and benefits (by definition) are approximately equal, albeit with less value delivered in a down market. Keep in mind that this is already more favorable than a traditional equity plan—if you issue an RSU before a market decline, you’re stuck with the higher expense even when low value is actually delivered.

For a lookback plan, the lookback optionality provides less value to the employee when the price is declining. Employees will still be at least as well off as a discount-only plan, but can start benefiting from the recovery (and potentially from any volatility during the down period) immediately. For this company, we see that costs and benefits roughly align for this plan type.

Finally, we see that rollover plans significantly outperform in periods of recession and volatility. The longer lookback gives employees more time to ride out the down period and benefit from the recovery, while the rollover keeps their purchase price as low as possible if that recovery doesn’t happen smoothly.

Conclusion

We’ve always seen ESPPs as a cost-effective way to drive a lot of value to employees, both monetarily and in softer ways like creating engagement and encouraging an ownership culture. We see these advantages as especially true in uncertain times, where the unique combination of guaranteed gain and windfall upside opportunity can produce a truly differentiated employee benefit without breaking the bank.

Every company is unique, and the fact pattern shown in this case study is just one example that wouldn’t look the same for everyone. But the cost effectiveness of generous ESPPs, either as a supplement or a replacement for traditional equity plans, has driven a resurgence in their use that we expect to continue in the coming months and years.

If you have any questions about ESPPs, whether you currently have one or are just considering it, please reach out to us or your Equity Methods consultant.