Disqualifying Dispositions: Getting Tax and Administration Right for ISOs and ESPPs

Incentive stock options (ISOs) and employee stock purchase plans (ESPPs) are popular tools in the equity compensation toolbox, largely due to their tax-advantaged status. However, favorable tax treatment comes with strict IRS conditions. When the conditions aren’t met, a disqualifying disposition (DD) occurs. Failure to identify or correctly handle these DD events can lead to significant tax penalties.

This article highlights the key areas companies must consider. These include the tax requirements for participants and employers, implications for multinational and pre-IPO companies, and considerations for handling administrative data and trust transfers.

Triggering a Disqualifying Disposition

A DD occurs when shares are sold before the required holding period. ISOs and ESPPs have similar considerations, but different terminologies:

- ISOs are granted to the employee, then exercised at the employee’s discretion after vesting

- ESPPs are offered by the company for employee participation, then shares are purchased automatically at the end of a set period

For a tax-advantaged, qualifying disposition, ISOs must be held at least one year from the exercise date and two years from the grant date. Meeting these requirements allows any profit from the sale of the shares to be taxed at lower long-term capital gains rates. However, selling sooner triggers a DD, resulting in ordinary income tax on the spread between the strike price and the fair market value at the time of exercise.

Similarly, ESPPs must be held for at least one year from the purchase date and two years from the offering date. The purchase discount is included in ordinary income on the W-2. Any additional gain on the sale date is taxed as either short-term or long-term capital gains depending on whether the shares were held for one year after the purchase date. Short-term capital gains are taxed at ordinary rates versus the more favorable long-term capital gains rates.

Employee Taxation

ISO Example

To illustrate the tax differences between qualified and disqualified dispositions, consider the following ISO example for one employee:

- 10 ISOs granted on 1/1/2023 at $20 per share

- Exercised on 2/1/2024 at an FMV of $30 per share

- Sold on 3/1/2025 at $45 per share

This would constitute a qualifying disposition since the employee held the ISOs for one year after exercise and two years after grant. The employee’s result is a long-term capital gain of $250. This is calculated as (sale price – strike price) * shares, or ($45 – $20) * 10.

Now let’s assume the participant sells one month after exercise at the same price of $45. Since the holding requirement hasn’t been met, the sale becomes a disqualifying disposition. The employee recognizes $100 as ordinary income, calculated as (FMV at exercise – strike price) * shares, or ($30 – $20) * 10. This $100 of ordinary income is known as the bargain element.

The gain from exercise date to sale date is ($45 – $30) * 10. This additional $150 is a short-term capital gain, which in most cases is taxed at ordinary rates.

ISO DDs also have an Alternative Minimum Tax (AMT) impact. Exercising an ISO adds the bargain element to AMT income (Form 6251), even if the shares haven’t been sold and no tax is due yet.

ESPP Example

Now let’s consider an ESPP scenario:

- Offering price: $20

- Purchase price: $17 (15% discount)

- FMV at purchase: $30

- Sale price: $45

If the employee satisfies the holding period requirements for a qualifying disposition, ordinary income on the W-2 would be the lesser of the discount based on the offering price or the gain on sale. Here, the discount is $3 per share ($20 – $17) and the gain on the sale is $28 per share ($45 – $17), so the ordinary income is $3 per share. The long-term capital gains would then be calculated as the excess over the discount received, or $25 per share ($45 – $20).

In the case of an ESPP disqualifying disposition, the ordinary income calculation changes to be the FMV at the purchase date. In our example, that comes out to $13 per share ($30 – $17). The capital gain would still be the excess over the discount. However, the calculation would now result in $15 per share ($45 – $30).

Ordinary Income Cap for ISOs

Under IRC 422, ordinary income is capped at the excess of the sale price above the cost basis of the shares. If the sale price is less than the FMV at exercise, ordinary income is calculated as (sale price – strike price).

In our example, if the employee sells the shares at $25 per share, the employee recognizes only $50 as ordinary income, which is calculated as ($25 – $20) * 10 shares. Since the price declined from the exercise date, there’s no capital gain.

If the shares are sold at $15, the employee has no ordinary income and instead records a short-term capital loss of $50, or ($15 – $20) * 10.

The company’s tax benefit always follows the employee’s final ordinary income, which is why tracking sale activity is vital to avoid overstating the tax benefits when the basis (current stock price plus dividends received) declines between the exercise date and sale date.

This cap applies only to ISOs, not ESPPs. Additionally, it doesn’t apply when a loss wouldn’t be recognized for tax purposes (e.g., due to a wash sale). Understanding these differences helps both employees and employers correctly report income and deductions.

Corporate Tax Reporting

When a DD occurs, the company recognizes a tax benefit equal to the ordinary income portion in the employee’s W-2. Like other compensation arrangements, because the employee recognizes income due to the DD, there’s a corresponding deductible expense for the employer.

Conversely, a qualified disposition generates no employer deduction, since the employee’s gain is a capital gain.

Companies are also responsible for issuing tax statements to employees, per Section 6039 of the IRC. The IRS publishes the deadline each year, which is typically before January 31. The employer must file Form 3921 for ISO exercises and Form 3922 for ESPP purchases. Companies may request an automatic 30-day extension for filing these forms by submitting IRS Form 8809 by the original deadline.

It’s important to note that companies must file a separate form for each transaction within the given year, even if an employee has multiple transactions. Participant statements can be provided using the official forms mentioned above or in a different format that complies with the substitute form requirement in IRS Publication 1179. If the company elects to use an alternative format, it can aggregate the information for employees with multiple transactions in the year.

For DDs, companies must report the resulting income on the employee’s W-2. This income is subject to payroll tax withholdings, including income and FICA taxes. Depending on the situation, the company may also need to issue state wage forms or local wage forms in foreign jurisdictions. Brokers will issue Form 1099-B to report sales proceeds.

There are significant penalties for failure to comply with these reporting requirements. The IRS may impose fines up to $340 per incorrect or unfiled statement, with a maximum annual penalty of $4.1 million.

Administrative System Consideration

Often, the biggest challenge is identifying and recording dispositions. From a data perspective, several elements should already be recorded by the admin system, including the grant date, strike price, exercise date, and FMV at exercise. Ideally, the system would continue to monitor such awards through the final sale, including the sale date, sale price, and the number of shares.

If a system doesn’t automatically track sales, companies must rely on manual controls to ensure compliance. For example, some companies conduct a survey of employees and ex-employees to determine disposition status, which can be difficult in practice, especially for ex-employees.

Clear and timely employee communication is critical, especially around DD triggers and post-termination exercise windows. Without reliable processes, classification errors can cascade into payroll reporting or tax deductions.

International Tax Reporting

ISOs and ESPPs offer tax advantages specific to the US tax code. These tax benefits often don’t apply to employees outside of the US. Many foreign jurisdictions treat ISOs as non-qualified stock options, resulting in ordinary income tax at exercise (with no deferment until sale). International ESPPs also have special considerations since laws, tax withholdings and benefits, and reporting requirements vary widely across jurisdictions.

The tax considerations become significantly more complex when the employee is a US citizen residing abroad. DDs can trigger taxation in both the US and the country of residence. Income tax treaties might eliminate this double taxation, but we recommend discussing with your tax advisor.

Pre-IPO Companies

ISOs are especially common among pre-IPO companies, which have unique challenges related to DDs. On the employee side, there’s limited liquidity, which means employees are more likely to sell when there’s simply an opportunity rather than wait for the holding period. This is especially true for pre-IPO companies that periodically hold tender offers. Additionally, a sale of the company itself can force a DD event.

There’s also the question of what price to use for an instrument without a public trading market. Many pre-IPO companies update their valuation only periodically, such as during a funding round or at some point annually. For high-growth companies, stale 409A valuations can lead to an incorrect FMV and the resulting tax calculation.

Finally, all tracking and tax compliance must still be performed for disqualifying dispositions, which can be more challenging without the mature systems and controls of a larger public company.

Trust Transfers

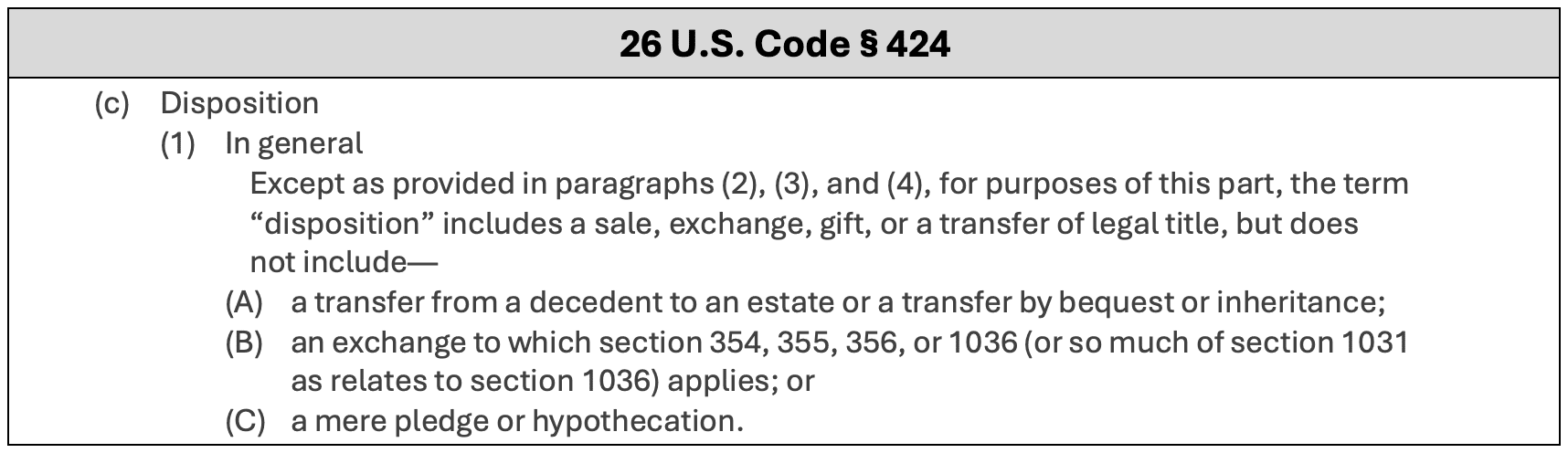

A Grantor Retained Annuity Trust (GRAT) is a popular tool for employee estate planning. Here’s what Section 424(c) of the IRC says about determining whether a transfer to a GRAT or living trust constitutes a disposition.

In most cases, a transfer to a GRAT would trigger a disposition. However, many ISO plans prohibit transfers. So the plan must explicitly allow it, and to trigger a DD, the transfer would need to occur before the IRS holding requirements have been met. If holding periods are already met, the transfer is a qualifying disposition, taxed at capital gains rates.

Summary

Despite the complexities, ISOs and ESPPs can deliver meaningful upside to employees so long as the tax impacts and reporting obligations are thoroughly understood.

Like other areas of equity compensation, DDs require close coordination between different functions. In this case, the main stakeholders are finance, administration, HR, and payroll teams. Supported by the right systems, these teams can prevent surprises, maintain compliance, and help participants capture more of the value that their equity is designed to provide.

We’ve helped many companies automate and streamline this process, ensuring that all nuances are handled appropriately. If you have any questions, please don’t hesitate to contact us.