2019 Group Five Stock Plan Administration Benchmarking Results and What’s Ahead in Stock Compensation Reporting

Study Results

Cross-Functional Integration

Recession Readiness

Planning for the Future

A Closer Look

The annual Group Five stock plan financial reporting benchmarking survey is out. Every year we take stock of the results from this cornerstone resource for corporate stock plan sponsors. At the same time, we take the opportunity to share our thoughts on the most pressing and salient issues we see up ahead in stock-based compensation financial reporting.

I’ll begin with a brief summary of the results, then pivot to some themes I think you’ll find relevant to your stock-based compensation process. As a quick preview of those themes, I’ll cover:

- How do best-in-class finance organizations build deeper and stronger bridges with related functions?

- What implications could a macroeconomic slowdown have for equity compensation and how will equity reporting processes need to adapt?

- How should growing and changing organizations plan for future equity compensation challenges today?

I think all three are critical questions for financial reporting leaders to ponder while making preparations for 2020. But first, let’s walk through the results of Group Five’s 2019 survey.

*****

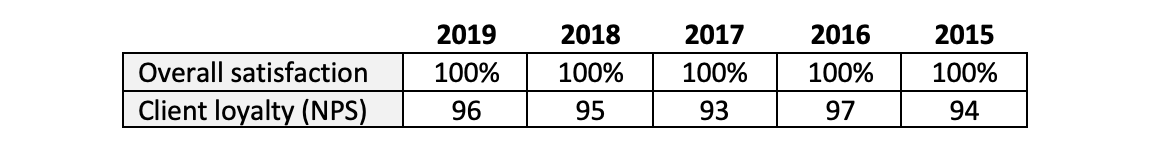

For the sixth year in a row, we’ve received the highest overall satisfaction and loyalty ratings among the financial reporting service providers included in the study. Group Five uses the Net Promoter Score (NPS) to measure client loyalty. Our NPS is 96 and the industry average is 44. Here’s the rolling five-year track record:

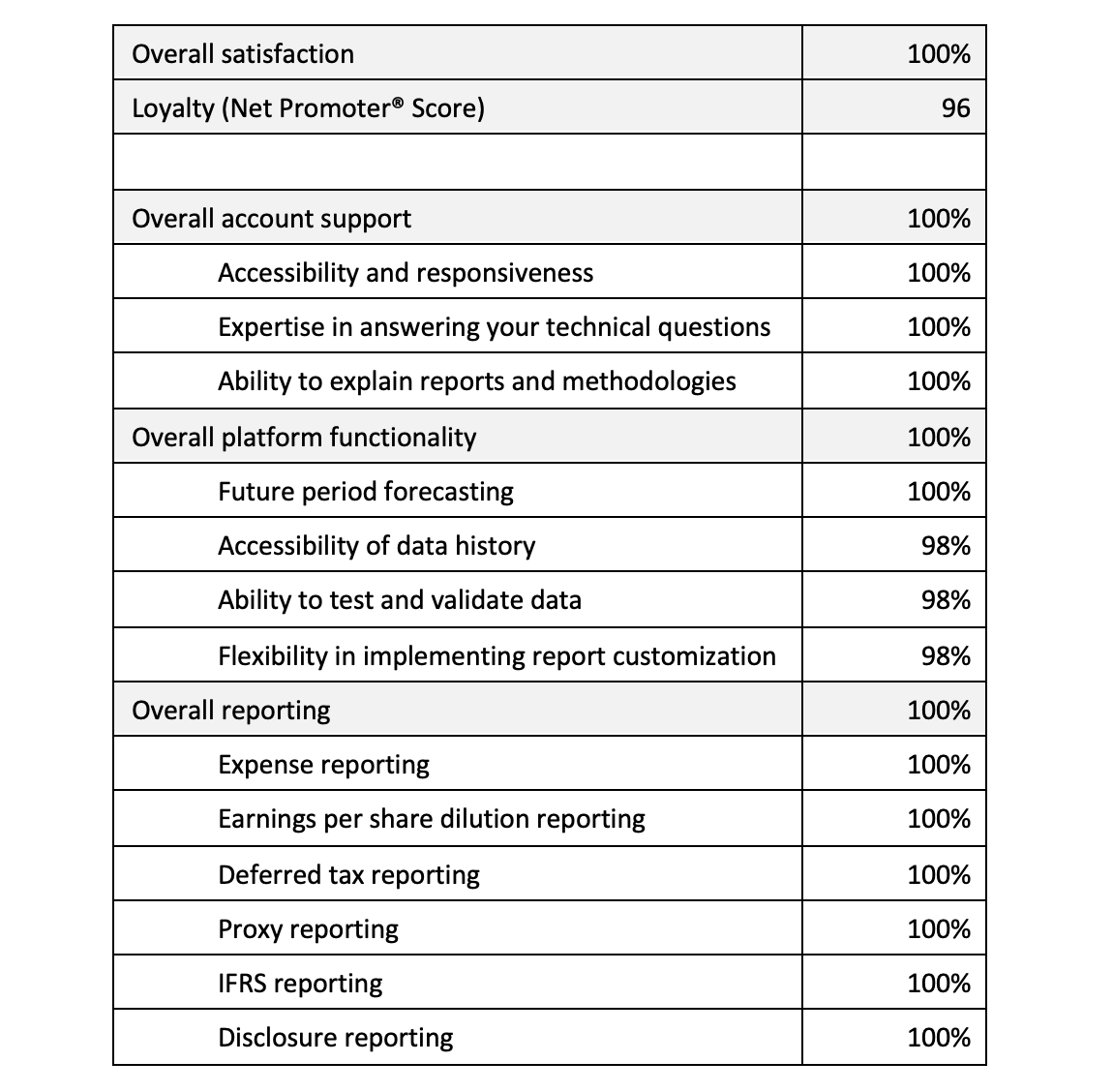

A more detailed breakdown of the 2019 results is:

A key reason these metrics are so important to us is that we’re always trying out new ways to improve the client experience. Behind the scenes, our employee training and development programs—along with our tools and methodologies—are in a mode of constant upgrade. Up front, we go to bat for our clients, coming together as a team to deliver bold impact. Everything we do is aimed at empowering our clients with insight, control, and expanded capability.

As longtime friends of Equity Methods know, we use the occasion of Group Five’s annual report to reevaluate the state of stock-based compensation. Here’s what we’re watching right now.

Theme 1: Cross-Functional Integration

Our financial reporting practice began as a service for Fortune 100 companies with large, complex equity plans that wouldn’t fit cleanly into out-of-the-box software. Since then, we’ve expanded our offering to companies of all sizes and at all life cycle stages—including private companies, pre-IPO emerging growth companies, and small public companies with a lean accounting department. In working with so many diverse organizations, we’ve come to appreciate the importance of integration between related organization functions.

Let’s talk about four flavors of integration:

- Accounting and tax

- Accounting and executive compensation

- Accounting and stock plan services

- Accounting and international controllers

Here, I’m going to focus on why integration is critical, not so much on how to facilitate it. (The answer to “how” depends on what’s getting in the way of better collaboration, which can be anything from under-communication to politics and turf wars. I’m happy to discuss this offline if you’re interested.)

Accounting and Tax

Without tight integration, there’s no way that accounting and tax teams can effectively handle equity compensation.

The normal division of labor is for accounting to calculate and book monthly expense values and potentially set up deferred tax assets (DTAs) on those amounts, thus leaving tax with the responsibility of unwinding those DTAs when the awards eventually settle.

Audit partners, CFOs, and standard-setters tell us that tax is among the most misunderstood areas of reporting—and a major priority for reducing risk. Let’s talk about where close alignment between the functions matters most:

Tax reform. As you probably know, the exclusion for performance-based compensation has been removed from Section 162(m). This means that, of all compensation paid to “covered employees,” the portion in excess of $1 million is no longer deductible even if it’s performance-based. Additionally, the number of covered employees will increase over time.

The end result will be more complex bifurcations of equity awards between the component that’s deductible and the component that is not. What’s more, this split will change over time as the value of awards rises and falls. Creating a process to track this, and make sure the right balance sheet and income statement entries get made, requires close collaboration between accounting and tax.

FICA taxes. Many companies overlook the FICA taxes that are due on shares to employees when those employees become retirement eligible. It’s critical to make sure tax knows how to identify these awards, since the legal vesting date and transfer of shares postdate when they become earned and trigger a FICA tax liability. (For details, please see our issue brief on FICA withholding for retirement-eligible awards.)

M&A. Equity awards assumed in a business combination give rise to special treatment under ASC 805, as the equity is remeasured at fair value and then bifurcated between go-forward expense and consideration transferred (goodwill). DTA mismatches can easily occur. Spinouts have their own entirely unique considerations based on how the equity is converted.

Mobility and international issues. Companies with mobile employees and international recipients face unique challenges that require careful attention. Examples include mark-to-market DTA under IFRS, country-by-country recharge agreements, distinct tax rates at the foreign jurisdiction level, periodic changes to those tax rates, and foreign currency fluctuations.

Forecasting. Given the materiality of equity compensation to many companies’ financial statements, predicting the impact of tax effects in the current year and beyond is essential. The big result of ASU 2016-09—and its decision to flow windfalls and shortfalls through to earnings—is the need to forecast across a range of positive and negative scenarios. This too requires close collaboration between tax and finance. (For more, see our issue brief on tax settlement forecasting.)

Accounting and Executive Compensation

Switching gears entirely, this is a tough collaborative relationship to get right—but when you do get it right, magic happens.

In our experience, there are numerous types of scenarios to prepare for:

New award designs. Executive compensation announces a new award design at the last minute, throwing the process into upheaval. This is especially tough given that annual grants are made in Q1 when accounting is already scrambling to prepare the year-end audit and Q1 quarterly reporting.

Executive departures. A last-minute executive termination occurs. Friction ensues when executive compensation learns from accounting that there’s a much larger modification charge than anticipated, and that charge will show up in the proxy.

Onboarding grants. I’ll never forget the case of a newly-hired CTO who, thanks to midyear issues driving down the TSR award valuation, received more shares than the CEO received in his annual grant just a few months earlier. Collaboration helps hedge against a risk like this.

M&A. Equity awards need to be remeasured at fair value in both a business combination and a spinout. This poses a host of complications relative to the normal procedures used to value a new equity grant.

Goal-setting. With the push to make long-term incentive awards span a full three years, goal setting is only getting tougher. Add to this the complexity of applying non-GAAP adjustments and it’s clear that finance and executive compensation need to be closely connected.

Accounting and Stock Plan Services

The fundamental problem that arises here is that information accounting needs often clash with the information the stock services team wants to show to participants. Usually stock services wins this arm-wrestling match because it doesn’t seem worth it to confuse hundreds of award participants just to simplify the accounting.

The way this plays out is that awards get loaded in a particular way such that accounting finds that their calculations don’t work. They request a different loading configuration, but—lo and behold—this doesn’t work for stock services given the goals they’re driving. What are some examples?

Performance awards. Accounting may need tranches broken out separately in order to apply distinct multipliers and treatments, whereas stock services usually wants to show the aggregate award in order to keep things simple.

Modifications. To get the accounting right, you need to see the terms of the award before it was modified as well as after. Of course, showing participants their old award terms would be highly confusing and strange.

M&A. Equity awards assumed in an acquisition need to go through multiple conversion steps. These don’t always leave accounting with information in the format it needs. Spinoffs are even more arduous.

Accounting and International Controllers

Statutory reporting under IFRS is a big deal that can appear dormant until there’s a problem. Quite simply, statutory financial reporting can create extreme cost and risk that never makes it to the CFO’s office until a lot of damage has already been done. We’ve encountered dozens of companies that pay hundreds of thousands of dollars to multiple third-party vendors because each country is taking its own independent approach.

Setting cost aside, the risks associated with poor statutory reporting are also nontrivial. The principal risk is on the tax side where tax authorities closely reference the published financial statements as part of their effort to review and approve tax deductions. Penalties and steep audit costs are also likely when problems come up in the statutory financials.

The upshot is that IFRS 2 statutory reporting for equity requires close connectivity between the home office accounting team and various international controllers at the foreign entities. Reasons include:

Data access and clarity. The simplest challenge international controllers face is that they’re not set up on equity administration platforms. Even if they were, equity administration is extremely peripheral to their area of responsibility. This makes it harder to troubleshoot issues. It also means that if they have to manage their own calculation process, they can end up flying blind.

Mobility management. Mobility affects where expense is recorded, how forfeiture reversals should be bifurcated between entities, how to properly set up deferred taxes, and how to maintain accurate share roll-forward reports for disclosure purposes. Complicating matters is that international controllers at the local entity level won’t have the data access they need to fully understand the consequences of mobility.

IFRS 2 technical complexity. At a conceptual level, ASC 718 and IFRS 2 are considered converged. But when it comes to execution, reality is vastly different. Straight-line versus graded vesting is a basic point of difference. However, the deferred tax side is where it gets onerous. Under IFRS 2, the DTA needs to be marked to market each period and there’s a grant-level “APIC pool” concept that partially shields earnings from share price volatility. In our experience, international controllers struggle with the complexity of the accounting models and need help from their counterparts in the home office.

Theme 2: Recession Readiness

News stories and CFO surveys are laced with concern that the protracted bull market we’ve been in might be slowing down. Whether a recession hits next year or later, and whether it’s gradual or sudden, is anyone’s guess. But it seems imprudent to plan for 2020 without thinking about how an economic slowdown might affect equity compensation design and reporting.

I think this is important to talk about. Best-in-class finance and HR functions make a concerted effort to look around the corner and align on how their processes and strategies will need to evolve in response to broader changes in the macroeconomic or regulatory environment. This is part of the CFO office’s ongoing transformation from reporting the news to predicting and using the news to effect positive organizational change.

Let’s talk about three implications we expect if the economy catches cold:

- Tax shortfalls stemming from ASU 2016-09

- Award design revisions

- Modification mania

Tax Shortfalls

As of 2016, book-tax temporary differences no longer run through the off-balance sheet “APIC pool.” Instead, they flow directly through earnings. In windfall cases where the intrinsic value at settlement exceeds the grant-date fair value, there’s a lift to earnings and a reduction to the effective tax rate. (For more on the tax-related implications of FASB’s amendments to ASC 718, see our issue brief on ASU 2016-09.)

To date, this is what most companies have experienced—and, of course, it’s been very positive. But if the markets turn, tax shortfalls become more likely, which have the opposite effect: They reduce earnings and increase the effective tax rate. Suddenly, companies are hit with a triple whammy of declining share price that cascades to worsen earnings and boost the effective tax rate.

Leading accounting functions understand this mixed-bag aspect of ASU 2016-09. They’ve made investments in tax settlement forecasting procedures reflecting different scenarios and granular assumptions about hypothetical future awards.

New Award Designs

We’re deeply skeptical that the current flavors of equity awards are going to work should the economy head south. Let’s think about what’s happened in the past 10 years:

- Relative TSR (rTSR) designs proliferated, then came under fire

- Use of stock options continued to decline

- Expectations have tilted toward three-year performance periods (versus one-year periods)

- Performance metrics became more complex, as reflected in the growth of capital efficiency metrics like return on invested capital (ROIC) and application of non-GAAP adjustments

- Concerns over goal-setting rigor led to more variation in threshold, target, and stretch performance levels

A greater emphasis on awards with absolute performance metrics spanning three years hasn’t been easy, but it’s been possible given the relative stability of the capital markets over the past decade. As we know, when the markets contract and volatility spikes, all bets are off. Goals set even six months earlier become useless as the pace of economic change and turbulence intensifies.

Overall, we agree with much of the criticism of rTSR awards. We like the shift toward multi-metric designs that aim to balance incentives across a few metrics instead of relying on just one. However, if recessionary pressures rise, we expect to see further evolutions in award designs.

More relative awards. Yes, we expect to see more companies adopt rTSR, but the real growth will be in relative accounting metrics like revenue, EBITDA, and ROIC. Practitioners—including ourselves—have historically been skeptical of relative non-TSR designs since it’s tough to normalize such metrics across companies. But we think these challenges are surmountable and that the simplification to goal-setting will often be worth the increased complexity.

More options. Options are most motivating during bad economic times since their upside potential is that much higher. Many companies have also successfully experimented with making options performance-based so they count toward the 50% target.

More employee stock purchase plans (ESPPs). Many companies are transitioning away from broad-based award grants, designing ESPPs as an alternative means toward share ownership. As this trend continues, we expect to see the rollout of more lucrative ESPP designs. ESPPs with reset and rollover clauses, for instance, strike a nice balance of encouraging employee investment while insulating them from macroeconomic shocks that are outside their control.

Modification Mania

Another lesson from the last few recessions is that no matter how bad the economy is, retention risks actually grow during rough economic times. That’s because top talent is always in demand, and it becomes easier to poach critical talent when equity values are depressed and fluctuating wildly. Just think, if an executive’s unvested equity value drops from $1,400,000 million to $450,000, it’s not that hard to assemble an elegant buyout package.

What’s changed since the last recession is that the corporate governance climate is much more complex, from ISS’ powerful role in shaping say-on-pay outcomes to investors themselves asking more nuanced questions. We don’t think this spells the end of modifications. Instead, modifications will need to be more elaborate in order to balance competing retention and shareholder perspectives.

Here are some flavors of modifications you should anticipate:

Performance target resetting. Given the proxy disclosure implications, this one is especially controversial at the named executive officer (NEO) level. But we may see it outside the NEO group.

Performance target substitution. A softer approach to resetting, this involves replacing one metric with a different one. For example, we may see companies replacing an absolute EBITDA metric with a relative EBITDA or relative TSR metric.

Option exchanges. These were prolific during the last recession and we expect to see them again—maybe not at the same volume, but they clearly make sense for some organizations.

Accelerated vesting. Divisions get sold or shut down through restructuring, and often these are handled as a Type 3 modification via vesting acceleration.

Theme 3: Planning for the Future

As I mentioned, we’ve been working with companies of all sizes and at all stages of development. We’re finding lean teams, key person risk, and constant change create an acute level of need.

Along these lines, I’ve spent a lot of time talking to chief accounting officers who thought their process was fine only to encounter a negative surprise upon someone leaving, or the CFO asking for more analytics, or the board redesigning the equity program. They wonder: What did I miss? How come our capabilities were so much lower than I thought they were?

A Suitable Yardstick

The problem is the yardstick being applied. Typically, a suitable yardstick is whether the audit process is clean and smooth. This works for revenue recognition, leases, derivatives, and many other areas of SEC reporting. But it’s really not the right one for equity compensation. Here’s why:

Audits are quick and unable to delve into the details. When a company comes to us after encountering a large error on their prior platform, it can take weeks to uncover the root causes. Equity compensation is truly unique by virtue of combining voluminous data with theoretically complex issues that cut across multiple areas of GAAP. For example, the cause could be some highly nuanced retirement eligibility provision that affects only some of the awards or a disconnect between the expense and tax reporting process. The depth of data research and theoretical expertise needed to find these issues exceeds what exists in a customary audit.

Success in audit doesn’t speak to management reporting capabilities. Equity compensation programs go hand-in-hand with management reporting—requests for more granular forecasts, what-if scenarios, dashboards, fluxes, etc. None of these needs get assessed in the audit where the focus is high-level substantive testing and sampling specific records to ensure they can be reperformed.

Audit success also doesn’t address process scalability. A process that works today may be too rigid to handle a new ESPP design or the rollout of multi-metric performance awards. As a company grows, its equity compensation program usually takes on more moving parts via new award designs, non-standardized terms, one-off activities, modifications, and statutory reporting abroad. The audit being done today doesn’t gauge how smoothly the process can expand to handle these sorts of needs.

Proactive Leadership

Finding out your process isn’t quite as capable and robust as you thought is painful. That’s because this usually occurs precisely when you need your process to be more capable and robust.

To assess whether you might need to fortify your process, start by asking the following:

Is organizational growth expected? Growing organizations inevitably sign up for new award designs, more one-offs, more forecasting, and so forth. Stock compensation may begin as an uninteresting non-cash expense but that doesn’t last forever if growth is expected.

Does your compensation committee take bold measures? If they’re frequently looking to innovate, then it’s probably just a matter of time before they deliver an equity program that taxes the process.

Does your CFO or CAO have a high appetite for analytics? Detailed, dense expense reports don’t work with these senior audiences. At the same time, if they value analytics, it’s a safe bet they’ll ask for more in the area of equity compensation.

Will departmental capacity be a challenge? If the vision is to maintain a lean accounting function without sacrificing analytical horsepower, this could also suggest the current process may run out of steam and fail to meet expectations.

The Right Questions

But how do you know whether your current process is in need of an upgrade?

We think it begins with asking the right questions. Ever heard the phrase, “Dress for the job you want, not the job you have”? Something similar applies here: Design the process you’ll need for the organization you’re trying to become. When we ask CAOs about the qualities they look for in their staff and how they gauge promotability, this is the single most consistent answer we hear. They want their teams looking around the corner, anticipating needs, and building the function that the future will demand.

This boils down to gauging whether today’s process is ready for tomorrow’s needs. For instance, you could ask for:

- A more robust forecast that is scenario-based across performance outcomes, stock prices, and other factors

- Reports that are set up as if a multi-metric performance award were granted

- A series of fluxes (current period to prior period, current YTD to prior year YTD, current period actual to current period forecast, etc.)

- Variance analytics that explain the top five drivers behind the forecast and actual

- Reports that apply IFRS 2 in anticipation of statutory reporting

- Someone uninvolved in the process to run the process to see how turnkey it is

These are just a few examples out of hundreds of potential requests.

As you start asking a wider array of questions, you’ll get a better sense of how far you can stretch the process boundaries. None of this is intended to create stress for your team, but rather to get a clear reading of how hardy the process is so that you can strategically plan for the future.

A Closer Look

Many thanks as always to our clients who so generously gave their time to Group Five’s benchmarking effort. We greatly appreciate the feedback.

Request a complimentary copy of the summary benchmark report from Group Five.

Visit the knowledge center for more on the above topics.

Tell us about any other topics you’d like to see us cover.