2020 Group Five Stock Plan Administration Benchmarking Results and What’s Ahead in Stock Compensation Reporting

Study Results

Theme 1: Modification of Outstanding Awards

Theme 2: Forecasting

Theme 3: Designing Resilient New Awards

A Closer Look

Recently, Group Five published their annual Group Five Stock Plan Administration Benchmarking Study, marking Equity Methods’ seventh consecutive year as the top-rated financial reporting service provider. As I do every year, I’ll go over the results first, then reflect on some of the issues that are currently top of mind for stock-based compensation.

This year’s issues are very much tied to the COVID-19 (Covid) environment we find ourselves in. I’ll cover:

- Modification of outstanding awards to restore incentives and retention

- Forecasting to manage extreme uncertainty and volatility

- Award designs that can stand up to unplanned exogenous shocks in the future

More on each of those in a bit. Now let’s get to this year’s benchmarking results.

*****

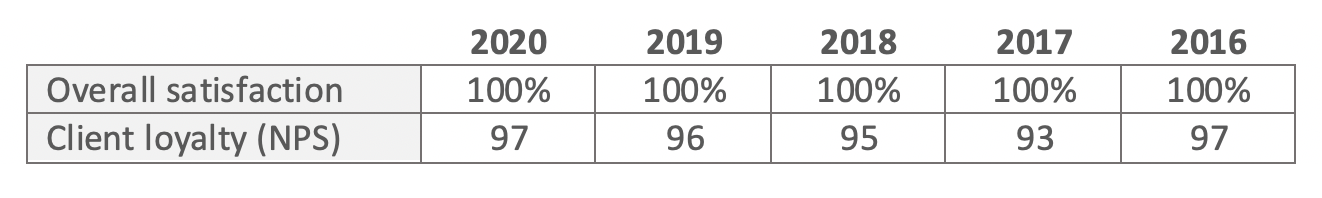

This is the seventh year we’ve earned the highest overall satisfaction and loyalty ratings among the financial reporting service providers included in the study. Group Five uses the Net Promoter Score (NPS) to measure client loyalty. Our NPS is 97 and the industry average is 59. Here’s the rolling five-year track record:

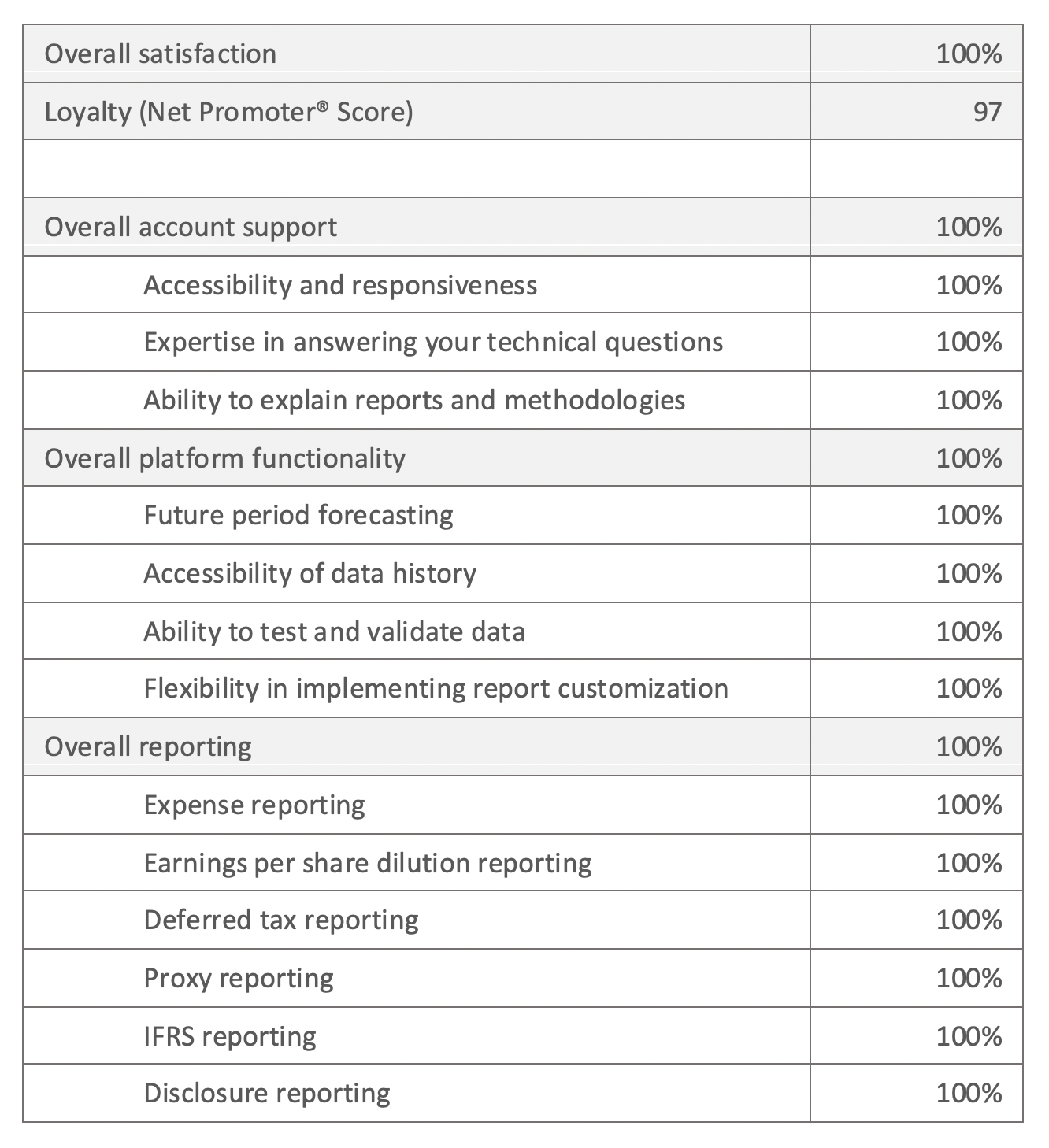

Here’s a more detailed breakdown of the 2020 results:

We’re especially grateful for these results. When Covid hit, it was relatively straightforward to transition to remote work given our state-of-the-art technology environment. Quarter-end reporting in March 2020 went off without a hitch.

Then came the steady uptick in requests from CFOs’ offices to understand how core reporting areas (expense, taxes, EPS, and disclosure) might fluctuate. We also began hearing from cross-functional finance, HR, and legal teams exploring creative award modifications, future redesigns, or chapter 11 restructurings. Throughout, we tried to be ever-present and flexible to the intensity of our clients’ forecasting and what-if needs. Our greatest aspiration is to be a trusted advisor and expert on all areas of equity award design and financial reporting.

This is why the open-ended feedback included in the Group Five report is purpose-affirming. I’ll share just a few quotes and if you would like a copy of the full report, just reach out.

- “The Equity Methods team is attentive to detail and forward thinking to help mitigate issues before they arise.”

- “Stellar customer service—great about answering questions on technical issues. Great audit support. Timely responses. Love that a short variance explanation is provided with every expense file.”

- “They took a very manual system that we had been using for years and walked us through step by step over the course of multiple months the implementation of an automated solution. It has been invaluable.”

- “I have never worked with a company that provides such top-notch customer service, from accessibility and responsiveness, even down to special touches like hand-signed and personalized holiday cards.”

- “EM is our go-to source for all complex equity transactions, and they always have an answer or recommendation. They always go above and beyond to accommodate our requests.”

We love reading comments like these. There’s nothing more meaningful to us than being at each client’s side and caring about their success as much as they do.

With that, let’s turn to the three top-of-mind themes I brought up earlier.

*****

Theme 1: Modification of Outstanding Awards

Many long-term incentive awards are now deeply underwater and pose incentive and retention challenges. Even with the stock market rebound in the late spring and summer, corporate earnings have been a mixed bag. As a result, some companies are weighing their alternatives on whether and how to restore broken incentives. Adobe, for instance, revised the minimum performance threshold and payout scales for their long-term incentive awards. Medical service provider Hanger truncated their performance period by three months to minimize the pandemic’s impact. Nike replaced absolute performance targets with relative targets while also making changes to their new awards.

Other companies, such as Hertz and JC Penney, were modifying their equity awards in anticipation of an overall chapter 11 restructuring. (If you’re interested in learning how compensation strategies change in a bankruptcy context, we recently published an issue brief on the topic.)

All of these actions are considered modifications under ASC 718 because they revise award terms and conditions in a way that increases the value or alters the timing of vesting. Although modifications can be an appropriate response to exogenous shocks, there’s considerable controversy as to when they’re appropriate and how much is too much. Needless to say, modifications can create unexpected costs and complicate the underlying accounting.

For these reasons, many companies have been looking for a lighter approach to repairing broken incentives—one that balances shareholder and executive preferences more holistically. Strategies for adjusting in-flight performance awards include:

- Using compensation committee discretion to adjust performance outcomes instead of effectuating a formal modification

- Changing the weighting on absolute and relative metrics to favor a metric that fared better during the turbulence of 2020

- Swapping out old metrics for new ones that make more sense in the current economic climate, such as dropping an absolute EPS goal for a relative TSR goal

- Adding new metrics to existing awards to provide an additional avenue for payout

- Accelerating the vesting or extending the post-termination exercise window for terminated or soon-to-be terminated employees

- Canceling nearly worthless outstanding equity awards on the eve of a restructuring and issuing cash-based retention or incentive awards in their place

All of these strategies have legal, compensation, and accounting implications that are much more complex than the modifications of the 2008 recession. They make the repricings from the dot-com crash look like a walk in the park. There are a few fundamental issues:

- The incremental accounting cost will vary tremendously depending on the specific design of the modification, meaning the first idea on the table may not be the best one.

- Valuation and accounting assumptions add further noise. Often there’s a realm of reasonable assumptions instead of one bright line answer. Sensitivity-flexing the results is key to arriving at a supportable, yet favorable, outcome.

- The proxy rules follow the accounting, but they can give rise to a double-counting effect that causes the values reported in the summary compensation table and grants of plan-based awards table to spike. Always trace potential actions all the way through to the proxy tables and narrative.

- Actions labeled as one thing (e.g., compensation committee discretion) may be automatically reclassified as something different (e.g., an equity modification), resulting in last-minute surprises. Especially since the types of awards and modifications being done today didn’t exist when ASC 718 was written, careful accounting policy formation is key.

In fact, we’ve had so many conversations with clients, auditors, lawyers, consultants, and accounting standard-setters on the topic that we published an FAQ booklet on the most salient issues. You can request your copy here.

Theme 2: Forecasting

Corporate earnings and forward-looking guidance ran into a sandstorm of ambiguity as the pandemic took hold. According to an analysis by IR Magazine, between March 16 and May 31:

- 851 companies withdrew their annual guidance

- 71 companies withdrew their quarterly guidance

- 108 updated their guidance

Rallying equity markets aside, volatility and uncertainty remain high for many companies. Long-run budgets have more margin of error and scenarios are more widely dispersed. What’s more, future outcomes are tightly linked to uncontrollable factors like the scope of a future stimulus package, vaccine timing, and so on.

As a result, forecasting for everything—including equity compensation—became the name of the game in 2020. Forecasting by itself is nothing new and you might be thinking, “But Takis, these inputs were hard enough to nail down even before COVID-19! What’s the point in even trying today?” It’s worth trying because of three trends:

- Forecasts are becoming more layered with rich scenario modeling. In general, the higher the uncertainty, the more important it is to model wide ranges of potential outcomes. This also bolsters the narrative because you gain insight into the magnitude of external events that must occur in order to trigger a particularly favorable or unfavorable scenario.

- Forecasts are becoming more granular in terms of the inputs. For instance, we’re seeing more companies forecast at the individual award level so they can model headcount changes, promotions, and turnover. This also allows scenario flexing related to potential divestitures or reductions in force. Importantly, a granular forecast makes variance analysis easier since you can more directly see which variables led to a budget-to-actual difference down the road.

- Companies that didn’t implement robust tax settlement forecasting are now doing so. Even though the equity markets recovered, the volatility of early 2020 was the first major dip following the release of ASU 2016-09. Remember, tax shortfalls at settlement now flow through the P&L and influence the effective tax rate, so share price declines can have a snowball effect on earnings and tax rates. Tax settlement forecasting, and shoring up your tax reporting in general, is an important priority going into 2021.

What does robust tax settlement forecasting entail? If you grant options, it begins with using lattice models to predict the timing of future exercise and post-vest cancelation. Even RSU granters need to embed rich sensitivity modeling related to future stock prices, performance award payout percentages, and future grant populations.

Looking ahead, as I’ll discuss in a moment, plan for more complex award designs in 2021 and beyond. As CHROs and compensation committees push new award designs down the pike, forecasting is critical to answering specific CFO and CAO questions about the new design, such as on compensation expense and diluted EPS. A robust forecasting model can also compare the ways that different design features affect the accounting fair value and financial reporting.

Theme 3: Designing Resilient New Awards

The events of 2020 are a reminder that exogenous shocks are more frequent than we may care to imagine. They devastate incentive goals and demonstrate the importance of designing equity programs to be more resilient to unexpected volatility and market redistribution.

We have a few predictions for how equity programs will evolve in the years ahead. Finance and stock plan professionals may not be able to directly influence these design decisions, but you can prepare by strengthening your existing processes to be more flexible. As our clients make structural program changes, we take pride in how quickly we can help them model the impact and update the current process to absorb the change. Here’s what we see on the horizon:

First, plan for more relative performance metrics. Not as substitutes for existing metrics, but as complements to round out the overall incentive portfolio. Relative metrics insulate payouts from secular shocks by measuring a performance metric (like total shareholder return) against a group of peers rather than by its absolute value. Even companies with relative metrics will be reconsidering the peer group in light of how differently COVID-19 affected each industry.

Investors generally like relative metrics, with Vanguard going so far as to say so in their policy documents. Of course, relative metrics are far from perfect and create line of sight challenges for participants. As such, expect to see more hybrid awards with multiple metrics that are either independent or serve as a modifier.

Either way, as more metrics are added to awards the accounting becomes more complex. Processes need to be flexible enough to track different metrics that are handled differently under ASC 718, such as market and performance conditions coexisting in the same award. Real-time performance tracking for diluted EPS and compensation committee updates will also be particularly important as more metrics find their way into single award designs.

Second, plan for more employee-friendly ESPPs that provide market insulation. Employee engagement is one of the biggest themes in HR strategy today. Our research has shown that ESPPs are a key lever to driving a sense of employee ownership and solidarity. The data bears this out as more and more companies adopt ESPPs with favorable features like resets, rollovers, lengthy offering periods, and flexible contribution rate provisions. In high tech and other human capital-intensive sectors, generous ESPPs are quickly becoming table stakes in the competition for talent.

Of course, appealing features tend to bring accounting complexity. Many companies approach ESPP accounting by treating all employees within an offering as a general pool. Auditors are increasingly objecting to this approach and pushing for more precise, person-level tracking. In short, look out for changes to your ESPP and strengthen your ESPP reporting process to handle any new features that add overall value.

Third, keep watch for special one-time awards with entirely different terms and scale. One-time mega grants often occur in the context of a CEO transition, but can also make sense during a business model transformation where the compensation committee is looking to rally the leadership team around a specific goal. Having worked on dozens of these in the last year, we’re seeing a resurgence of the market stock unit or MSU. We’re also seeing more price-vested and premium-price options, along with ultra-high leverage RSUs.

Since these are mega grants with many zeros behind them, a TSR provision is usually present to ensure shareholder alignment. As such, most of the risk from an accounting perspective pertains to the upfront fair value measurement and making sure the valuation is done right. We’ve written extensively on common grant agreement mistakes and published an e-book on performance equity accounting, valuation, and design.

A Closer Look

Many thanks as always to our clients who so generously gave their time to Group Five’s benchmarking effort. We greatly appreciate the feedback.

Request a complimentary copy of the summary benchmark report.

Visit the knowledge center for more on the above topics.

Tell us about any other topics you’d like to see us cover.