2022 Group Five Stock-Based Compensation Financial Reporting Benchmarking Results Plus Our Take on What’s Ahead in 2023

The Group Five Financial Reporting Benchmarking Study is out. For the ninth straight year, we topped ratings for loyalty and overall satisfaction from equity compensation plan sponsors. Each year, Group Five asks them to evaluate providers who offer financial reporting services.

We posted the high-level results a little while ago. We’ll cover the details in a bit. First, let me share the agenda for the discussion that follows, which is about some of the equity compensation financial reporting themes we’re expecting to see in 2023:

- The SEC’s pay versus performance (PvP) disclosure rule

- The impact of macroeconomic volatility on equity compensation design and financial reporting

- Challenges, opportunities, and risk in non-financial reporting (ESG and beyond)

Now on to the study results.

*****

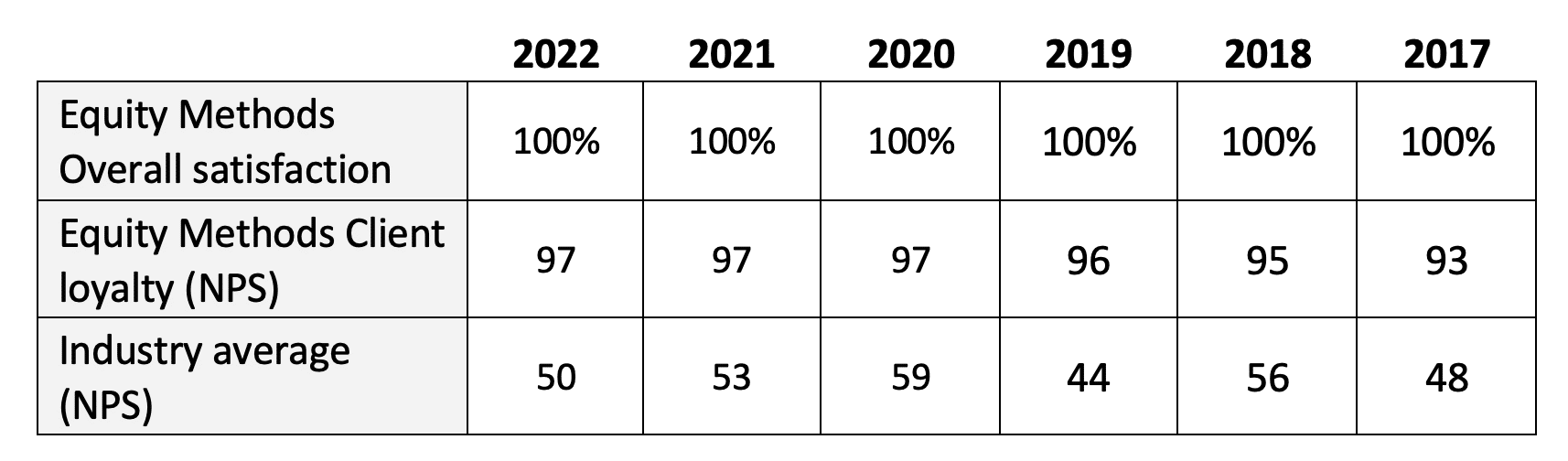

We’re honored to once again be recognized with the industry’s top satisfaction and loyalty scores in the industry. Group Five uses the Net Promoter Score (NPS) to measure client loyalty. Our NPS is 97 and the industry average is 50:

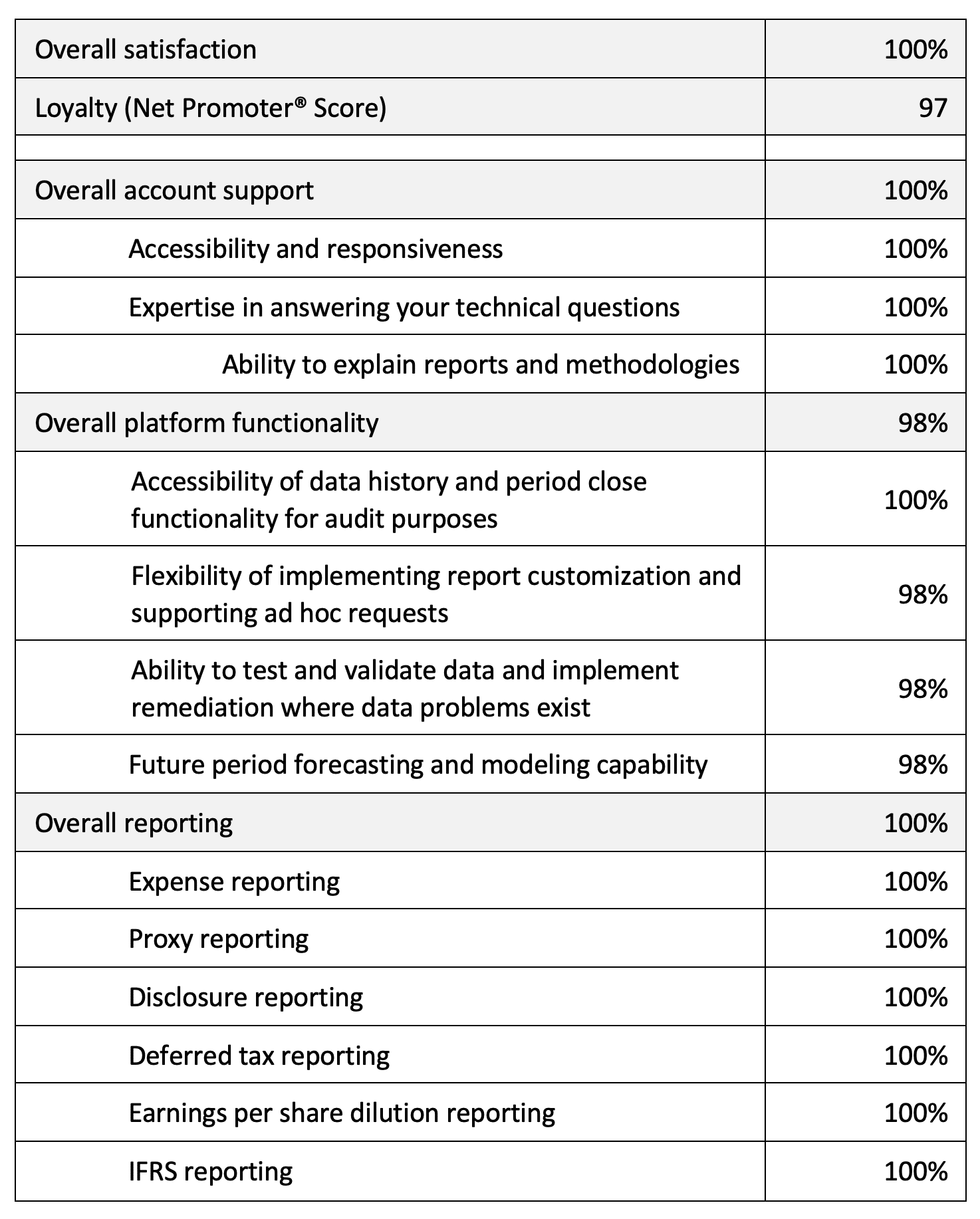

Here’s a more detailed breakdown of the 2022 results:

I’ve always said we have the best clients and professionals in the world, and this year’s comments are further proof. Feedback like this is what keeps us going. No, it does more than that. It inspires us to be better today than we were yesterday.

- “Equity Methods delivers high quality deliverables as well as great customer service. They meet their deadlines and are quick to respond to questions. They go out of their way to understand the question and then provide a thorough response.”

- “Accurate, timely delivery of reporting, provides insightful information on current market trends in SBC arena.”

- “Excellent service. They provide tailored reporting to suit our dynamic needs.”

- “Equity Methods have been instrumental in developing processes that are effective and streamlined and have tailored reports based on our specific facts and needs.”

- “Equity Methods makes you feel like you are their only client and is always available for questions or concerns.”

A heartfelt thanks to you all for your kind words.

We’re often asked how we achieve these results. After all, we work with some of the largest and most complex equity programs in the world. Tackling their intricate needs is nothing short of a full contact sport.

Besides hiring and training professionals with outstanding aptitude and a thirst for client service, stock-based compensation is unique in accounting—those doing the work need deep subject-matter expertise and acumen in programming and process automation. Our professionals who serve clients not only have the core finance and accounting backgrounds needed to understand the technical concepts, they’re also trained to design the algorithms that deliver the automation at scale needed for this type of work. Intentionally choosing to not separate the expert from the architect is what unlocks unbounded efficiency and speed.

On that note, let’s dive into the themes we’re seeing for 2023.

Theme 1: The SEC’s Pay versus Performance Disclosure Rule

On August 25, the SEC released the final rule on the long-awaited pay versus performance disclosure required under Section 953(a) of Dodd-Frank. The rule adds Item 402(v) to Regulation S-K, which companies are required to comply with in proxy and information statements for fiscal years ending on or after December 16, 2022. That means this is going live in 2023 proxies, which will be a ramp-up period of unprecedented brevity.

The PvP disclosure is an amalgamation of realizable and realized pay, and the required disclosure will easily rank as the most complex one in the proxy. It stands in contrast to the Summary Compensation Table (SCT) framework, which depicts the deal struck at grant without any mechanism for showing how performance-based features operate to index pay to performance.

In this article, we walk through what Item 402(v) requires companies to do. And in a follow-up article, we look at the logic and mathematics behind the core disclosure table, using a basic case study to illustrate the many moving parts. We’ve also hosted an introductory webcast and deeper-dive webcast on the topic. So rather than go into more of the mechanics, let’s unpack five ways this will change SEC reporting for both the finance and compensation functions.

- PvP and SEC reporting risk. Some investors may ignore the disclosure whereas others may leverage it in overly broad ways. Setting aside the question of how useful the disclosure is, assume that at least some investors will use it for investment decision-making purposes. This suggests risk, and it’s important for boards and management teams to understand the expanding role the proxy is taking on. In contrast to other elements in the proxy, the key component of the PvP disclosure—compensation actually paid (CAP)—will be a wholly unaudited number. The SCT values are replicas of values used in the 10-K for financial reporting. But CAP won’t exist anywhere else and therefore won’t be audited. This reflects a broader problem with ESG and non-financial reporting. Our advice is to invest in strong documentation, testing, and controls to make sure the results posted in the PvP disclosure are reliable. Pick the right external vendors, not necessarily those promising the fastest or cheapest delivery of results. Establish internal layers of review. Ensure clear roles and responsibilities across finance, legal, HR, and internal audit.

- PvP and media spin risk. There’s a lot of debate as to where to put the PvP table (with most thinking it should go next to the CEO pay ratio disclosure), but the bigger question is how it could be weaponized by outside parties. The media and activists are more likely candidates than large institutional investors or proxy advisors, who already maintain their own voting guidelines. Assume that PvP relationships will usually be sensible and explainable, but some fraction of companies will witness mischievous PvP relationships that don’t look very good on paper. Why? Setting aside an actual problem with the compensation program, there’s a lot of moving parts. A timing disconnect in market movements is all it takes to prop up pay but not performance. One solution is to use a supplemental disclosure, but this has its own problems, such as the ability to tell a good story year after year. Regardless of the position taken on supplemental disclosure, these supplemental analytics are worth running for internal purposes. They’ll be very helpful in preparing your investor relations and finance leadership with the “why” behind any problematic PvP relationships. Right now, most companies are squarely focused on running the numbers to produce a draft table. But as soon as this stage is complete, they’ll pivot to bringing investor relations up to speed on the SEC rule. They’ll also need to decide how to describe the PvP relationship in the proxy and the relative merits of graphical versus narrative discussion (or a combination of the two).

- PvP and internal risk. External parties aren’t the only risk. Executives will also see the table and they may form concerns of the opposite nature. In particular, sometimes the sensitivity of pay to performance might be too high, giving rise to a situation where the punishment (in declining CAP) doesn’t seem to fit the crime (in decent or lukewarm performance). Unsurprisingly, the compensation of the CEO’s direct reports is a highly sensitive and unpublicized issue. That’s a topic for another day, but needless to say, that sensitivity spiked in the wake of the Great Resignation and has stayed high amid today’s cooling equity markets.

- Supplemental disclosure risk. Be mindful with supplemental disclosures, both intentional and inadvertent ones. We think there are some booby traps here. Throughout the rule, the SEC invokes the framework and language used in the world of non-GAAP disclosure, stating that any supplemental disclosure must be clearly labeled as supplemental, not be misleading, and not be presented with greater prominence than the required disclosure.

- PvP volatility risk over time. Ongoing monitoring of PvP relationships is critical. If PvP relationships can be mischievous, this means they’ll ebb and flow in unexpected ways. We’ve partnered with Equilar to create an ongoing monitoring tool so that you can refresh estimates of CAP on a recurring basis to gauge how the story is unfolding throughout the year.

Theme 2: The Impact of Macroeconomic Volatility on Equity Compensation Design and Financial Reporting

Inflation has hovered near a 40-year high this year, causing ripple effects across the economy. Meanwhile, equity prices have come under considerable stress. The technology sector has fallen the most, but all sectors are affected as interest rate hikes and declining consumer spending impair demand.

We spent a lot of time in 2022 thinking about the confounding effects of inflation, a red-hot talent market, some signs of loosening in that market, and severe equity price volatility. All this is playing out against a backdrop of geopolitical instability and supply chain shocks, further impairing companies’ ability to forecast future performance goals.

Last summer, we hosted a webcast on market volatility and shortly thereafter shared survey findings from that webcast. We also outlined five major considerations in factoring inflation into your planning and strategy for cash and equity compensation.

As we head into 2023, we see five principles guiding planning and decision-making with respect to equity and executive compensation as a result of macroeconomic volatility:

- Plan for share pool scarcity and be prepared to make substantial adjustments to equity grant sizing. Beyond the mechanical effect that declining share prices have on burn rates, many companies have shifted to monthly vesting and therefore recoup fewer shares upon turnover. The market for niche talent remains red-hot, resulting in ongoing turnover and the need to make some bold offers. It’s been a number of years since many companies have needed to ask shareholders for additional shares. Even newly public companies enjoying the fruits of their evergreen programs will need to think carefully about share usage in 2023 if the equity markets continue to experience volatility and employee entry and exit stay high.

- Adapt performance goal-setting to the new normal of heightened uncertainty. Macroeconomic volatility makes it harder to set absolute financial goals because the range of future potential outcomes is much wider. For example, it’s unclear how the Russia-Ukraine crisis will unfold and what it will mean for commerce in Europe. One solution is to expand the goal ranges to factor in uncertainty. Be careful, because this is usually done symmetrically and therefore subdues access to upside, not only downside. Remember the general rule of thumb that long-term incentive awards should pay out around target 60% of the time, approach stretch 20% of the time, and approach threshold 20% of the time (with some healthy margins of error in there).

- Consider expanding the role of relative performance metrics. Economic uncertainty makes absolute goal-setting much tougher, but doesn’t affect relative metrics in the same way. The entire purpose of a relative metric is to neutralize the effect of macro uncertainty so that you can measure what companies do in relation to their peer cohort. Of course, this is easier said than done given the practical complexities of relative awards, but we think the pros far outweigh the cons in an environment like the present. Not to mention, disclosures like pay vs. performance (Item 402(v)) will continue to focus executive compensation assessments on both absolute TSR and relative TSR. Nonetheless, don’t forget about relative performance conditions, such as relative EPS growth or relative ROIC. These are fraught with additional complexities and will never reach the same level of prevalence as relative TSR metrics have. But they can make sense in industries like manufacturing and financial services.

- Plan for more volatile TSR valuation premiums and understand the impact these have on proxy disclosure and realizable pay. Earlier this fall, we discussed how TSR fair value premiums are trending upward due to macroeconomic volatility. This is relevant to TSR granters. Some use the ASC 718 fair value to set the number of shares granted, in which case high fair values cause fewer shares to be granted and therefore reduce the intended pay delivery. Others use the face value of the stock, but then run the risk of disclosing an inflated grant-date fair value in the summary compensation table of the proxy. Based on our surveying, approximately 60% of companies use the accounting value to calibrate the number of instruments granted. We’ve written dozens of articles on this topic and some of the creative ideas we’ve seen in practice. The reasons for large fair value premiums are varied (we touch on them in this article). One solution we like is to align the TSR performance period start date with the grant date. There are obvious cons to this approach, so some companies approach the matter by focusing on the other design features. The good news is there are numerous levers to push and pull. These include the peer group, the use of caps and other value regulators, and the option to have TSR operate as an independent metric or a modifier. Our TSR checklist is a handy tool to use as you perform a tune-up on your TSR metric(s) prior to granting new awards in 2023. We also ran a webcast in 2021 focused on last-minute checks to perform before launching a new TSR-based annual grant.

- Consider adopting an employee stock purchase plan (ESPP) with lucrative features. We expect turnover to remain high for many key roles even as the broader labor markets cool down. If the equity markets remain volatile, buyout values may fluctuate and it could be easy to poach top talent. Generous ESPPs, such as those with reset/rollover provisions or lengthy purchase periods, are tougher to walk away from. ESPP share requests are also virtually never denied. All this makes a generous ESPP a powerful addition to the retention toolkit.

- Plan for modification activity, but this time around, it’ll be a potpourri of strategies. In the 2008 recession, option exchanges became very popular. Nowadays, fewer companies grant options and investor opposition has intensified. We’re planning for option exchanges by controlled companies and newly public companies that have simpler shareholder approval constraints. But we’re also planning for a host of other activity. For instance, boards are inching up their use of discretion, primarily focused on the annual plan but occasionally the long-term plan. In cases involving layoffs or not-for-cause terminations of senior executives, concessions are often given on option post-termination exercise windows. We may also see pro-rata vesting applied to performance awards. In the other direction, Intel recently announced upward modifications to their new CEO’s stock price vesting hurdles due to investor opposition. During periods of market weakness, there’s generally an enhanced focus on CEO compensation.

The upshot? Expect more difficult tradeoffs. Monitor realizable pay levels to gauge when top talent becomes cheap to competitors on a poaching spree. Meanwhile, listen closely to shareholder feedback, especially with respect to CEO compensation and pay-for-performance sensitivities. While broad-based award modifications aren’t off the table, they’ll likely be one-offs for most companies. Don’t wait too long before building a plan to request more shares at the annual meeting.

Theme 3: Challenges, Opportunities, and Risk in Non-Financial Reporting (ESG and Beyond)

Non-financial reporting is our way of describing content that a company publishes and even files with the SEC, but which falls outside the scope of the external audit because it’s not part of the core financial statements that are subject to substantive testing.

It’s tough to escape a shareholder outreach session without environmental, social, and governance (ESG) performance coming up. Both active and passive investors are flocking to create ESG-focused funds given popular demand from retail investors. Exchanges like the Nasdaq have folded ESG policies into their listing rules. And the SEC has been on a warpath to create ESG-related disclosure rules.

The SEC’s strategic plan for fiscal years 2022 through 2026 explicitly speaks to its view that investors crave more information on ESG topics. As stated therein:

The markets have begun to embrace the necessity of providing a greater level of disclosure to investors. From time to time, the SEC must update its disclosure framework to reflect investor demand. Today, investors increasingly seek information related to, among other things, issuers’ climate risks, cybersecurity hygiene policies, and their most important asset: their people. In order to catch up to that reality, the agency should continue to update the disclosure framework to address these areas of investor demand, as well as continue to take concrete steps to modernize the systems that support the disclosure framework, to make public disclosures easier to access and analyze and thus more decision-useful to investors.

This rush toward everything ESG hasn’t been without criticism. These days, there are even anti-ESG activists vying for board seats. With the new universal proxy rules, this could make for some rather interesting board meetings (hopefully adult beverages will be available).

While this philosophical debate unfolds, there’s a more immediate problem to deal with, which is that new disclosure rules are far outpacing the development of standards and audit frameworks.

Before we cover the risks of this rapidly evolving wave of non-financial reporting, let’s look at where this reporting is materializing. We’ll focus on “S” and “G” reporting given we’re not experts on environmental topics (the “E”) and the SEC’s big climate rule is still in limbo.

- 10-K human capital management (HCM) disclosures. The Clayton SEC implemented mandatory HCM disclosure in the 10-K in 2020. These rules were principles-based, but still led to relatively dense and nuanced disclosures from large cap companies. SEC Chair Gensler has communicated an intent to modify the rules to be more prescriptive, which means specific metrics and disclosure archetypes. Most expected these new rules to appear in Q4 2022, but with the staff’s ambitious agenda, that date could slip.

- Diversity, equity, and inclusion (DEI) disclosures. These are appearing in a growing number of corporate social responsibility (CSR) reports and take on varying levels of granularity. The more involved disclosures provide both the adjusted and unadjusted pay gap, a slew of diversity statistics, and future quantitative goals. Unfortunately, there’s no common standard on how to conduct something like a pay equity study, which impairs comparability.

- Pay vs. performance disclosures. This is a classic “G” disclosure and, as we noted above, will be the most complex table appearing in the proxy. Unlike the SCT, which is based on audited 10-K values, the PvP table won’t be audited.

- Impending clawback disclosures. These disclosures will consist of two components. The first is a mere disclosure of the policy as an exhibit to the 10-K and with XBRL tagging of the policy and specific data within the policy. The second is a disclosure of any amounts recovered in the event of a financial restatement, including the methodology used to calculate those monies. As we’ve discussed, calculation of clawback amounts may require assumption-laden modeling, giving rise to another area within ESG where methodologies may substantially diverge.

- Improvements to segment reporting disclosures. This is currently in exposure draft format. It straddles the line between financial and non-financial, as it aims to expand the scope of reportable information at the segment level. If the final rule mirrors the exposure draft, companies will need to disclose considerably more segment-level data, especially significant expenses reviewed and considered by each segment’s chief decision-maker. We’re longtime proponents of direct tracing of stock compensation costs to granular levels (e.g., cost center, segment, business line, etc.). This rule may further the trend.

In summary, there’s a wave of non-financial reporting taking shape and few to no unified standards at a level of granularity equivalent to GAAP.

Why is this a problem? For one, comparability will be a pipe dream. Take a simple example of a turnover rate, which is a commonly requested human capital disclosure. Ostensibly, companies can develop a turnover rate in whatever manner fits their internal reporting cadence. This could be a rate that excludes anyone hired in the last six months, non-regrettable turnover, part-time employee turnover, involuntary turnover, etc.

Second, for many, internal processes can’t mature at the rate required disclosure is coming online. This could be due to multiple human resources information systems, manual data manipulation, or handoffs across departments. In any event, non-financial reporting is ripe for control problems and subsequent period adjustments. When we help companies in these reporting areas, we focus on designing automated processes to boost repeatability and reliability, which allows us and our client to focus on the desired methodologies and data integrity management.

Third, and relatedly, none of these non-financial reporting disclosures are audited. For de-risking purposes, most companies would like to include these new disclosures in the annual audit and have them be subject to a more rule-based framework like GAAP to provide structure and direction. But there’s zero appetite to pay significantly more for it. It’s a catch-22.

Finally, non-financial disclosures are getting pulled into shareholder litigation. So far, the cases we’ve seen are ones in which audacious ESG assertions turned out to be false. But an ominous sign appeared on September 22, 2021, with the SEC Corporation Finance division’s publication of a sample comment letter regarding climate disclosures. The comment letter focused on asymmetries between CSR and 10-K disclosures. Assume the SEC will be eying CSR reports and asking why information appears in them but not in the 10-K. This will likely be true across all ESG topics.

Our advice is to:

- Automate calculation processes wherever possible to improve repeatability

- Engage your external vendors for automation support and pressure-testing methodologies

- Document key assumptions and process steps to build institutional knowledge

- Test any disclosure internally for at least two years before publishing it externally

- Engage your internal audit function early on how to codify effective internal controls

In Closing

We’re so grateful for the opportunity to serve our clients and deliver best-in-class financial reporting. Our most sincere thanks to our clients who generously gave their time to Group Five’s benchmarking process.

Visit our knowledge center for more on the above topics.

Tell us about any other topics you’d like to see us cover.