The Destiny of Dodd-Frank’s Executive Compensation Provisions (June 2017 Update)

| We originally posted this article in February, when the administration was new and many ideas were in their early stages. Since then, much has happened – and much has notably not happened as expected. Below, the gray boxes contain updated information and expectations as of June 2017. |

A new executive is in Washington. What does this mean for the equity compensation provisions of Dodd-Frank? We have some ideas about that. However, there’s something you might have noticed: This administration has a knack for surprises.

The Law’s Current Status

The Dodd-Frank Wall Street Reform and Consumer Protection Act—a whopping 2,300 pages authorizing some 400 rules—became law in 2010. Since then, the SEC has been working with other federal agencies to drive both rule-making and enforcement. By early 2017, roughly 275 rules had become finalized and part of the law.

Originally, Dodd-Frank was intended for financial services firms. It was a response to the perceived lack of regulation that enabled the financial crisis of 2008. The bill includes executive compensation provisions, some say, only because that was the most convenient place to put them.

But the official reason for Dodd-Frank’s executive compensation section is to acknowledge the link between incentive program design and corporate risk taking. That might explain the proposed clawback rules, but it doesn’t fully explain how say-on-pay and CEO pay ratio ended up in the bill.

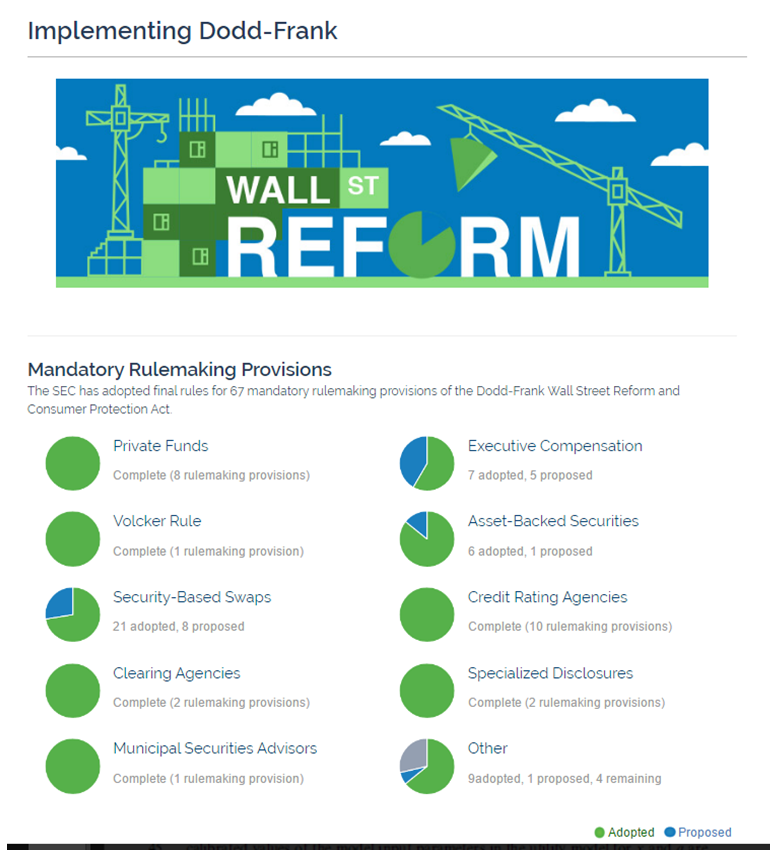

Below is a screenshot of the SEC’s Dodd-Frank portal as of February 3, 2017. It shows a full picture of Dodd-Frank’s components, sorted by status (adopted versus proposed).

June 2017 UpdateThere have been no changes yet to the finalized SEC rules under Dodd-Frank or the law itself, but that doesn’t mean there hasn’t been any movement. Whereas we struggled to form strong predictions in February, the writing on the walls is much clearer. In short, it seems like the implemented portions of Dodd-Frank, including CEO pay ratio, won’t be touched and the unimplemented portions won’t see the light of day. |

The New Administration’s Position

President Trump referred to Dodd-Frank frequently throughout his campaign. He pledged to “dismantle the Dodd-Frank Act and replace it with new policies to encourage economic growth and job creation.” He also called the bill a “disaster” and warned, “We’re going to be doing a big number on Dodd-Frank.”

Generally, the administration has taken a strong deregulation ethos, be it the promise to cut 75% of existing rules or the January 30 executive order that requires jettisoning two existing regulations for every new one enacted.

On January 23, Trump asked Michael Piwowar—one of two SEC commissioners—to serve as acting SEC chairman. With only two commissioner seats currently filled at the SEC (the other held by Kara Stein, a Democrat), the situation might look like a stalemate.

But this hasn’t stopped Piwowar one bit. On February 7, he reopened CEO pay ratio for public comment and in the week before that, he said the SEC would reassess its approach toward regulating the conflict minerals rule.

The 1:1 split between Piwowar and Stein will resolve itself shortly when Congress confirms Jay Clayton, Trump’s appointed SEC chairman. The broader question is to what extent the SEC can change Dodd-Frank rules, both the ones that are implemented and those that are not yet final. In practice, it’s much easier for the SEC to delay or dilute rules that have not yet been finalized.

Meanwhile, on February 3 Trump signed an executive order (EO) instructing his administration to review both Dodd-Frank and the highly controversial fiduciary rule. An EO can’t overturn laws, as we’ll explain later. The EO simply instructs Trump’s treasury secretary, Steve Mnuchin, to review Dodd-Frank and report on how it’s working—and where it can be revised.

June 2017 UpdateThe administration’s position hasn’t changed, but there also hasn’t been any substantial progress toward making changes. The February 3 executive order mandating a review of financial regulations is still active, although what we’ve seen so far has been focused on the banking system. Jay Clayton has been confirmed, and now sits as Chair of the SEC. This resolves the 1:1 split between Republicans and Democrats. However, that does not mean Republicans can now force their way. Kara Stein, the sole Democrat on the commission, can still block a quorum by simply not showing up to cast a vote. Coincidentally, her term will run out this June, leaving just the two Republican commissioners. Once a third commissioner is sworn in, Republicans will fully control the SEC…but going through the steps to nominate, confirm, and swear in someone doesn’t happen overnight. The reopened comment period on the CEO pay ratio rule came and went without much additional movement. While issuers were against the rule, the majority of the comments were written in support of it. The comments aren’t binding, of course, but the administration certainly did not get the open-and-shut support for doing away with the rule that they might have been expecting. |

The Influencers

This sets in motion how the administration intends to influence the legislature. To get an idea of what lies in store, let’s look at Trump’s top economic advisors: Gary Cohn, Steve Mnuchin, and Wilbur Ross.

Former Goldman Sachs president Gary Cohn is Trump’s director of the National Economic Council. Like Mnuchin, Cohn is a Goldman alum. Both men have spoken extensively about the problems they see in Dodd-Frank. Ross, the incoming Commerce secretary, has shown more interest in attacking trade agreements, but would likely also support deregulation.

Interestingly, Trump’s economic advisors disagree on numerous topics, such as the tension between free markets and protectionist trade policy. But the trio does seem united in their belief that Dodd-Frank should not remain in its current form untouched. Under the February 3 EO, Mnuchin has 120 days to present a plan.

Although Congress is charged with creating legislation, it’s normal for the president to initiate the legislative process and set the tone for priorities. Upon receiving Mnuchin’s plan, we expect Trump to propose a framework for dismantling Dodd-Frank. The key question is how far-reaching such legislation will be. There is a tradeoff between taking a narrower, less controversial path and attacking the entirety of Dodd-Frank.

June 2017 UpdateThe core of the Trump administration’s economic and financial team remains as it was in February, with the full Cabinet having been confirmed by the end of March. The general position of the administration on Dodd-Frank has not changed, although the tone seems to have shifted as other priorities have taken root. While we anticipated that recent and upcoming Treasury reports may address executive compensation provisions of Dodd-Frank, it appears these reports instead are focused on banking and other regulatory issues. |

What the Government Can Do

As we’ve said, an EO is limited in what it can accomplish and is an unlikely avenue for Trump to pursue. EOs are loosely permitted in Article II of the Constitution, but their scope is debatable. Since the Constitution establishes the separation of powers between the executive, legislative, and judicial branches, and Congress is charged with creating laws, most agree that executive orders should not directly reverse laws already in effect. There’s also consensus that the judicial branch can overturn an EO if it exceeds the president’s authority or is unconstitutional for some other reason. For these reasons, the judiciary will likely rebuff any attempt to overturn Dodd-Frank via executive order.

But Congress can amend or repeal the law. House Republicans have drafted the Financial CHOICE Act of 2016 , which is extremely broad in its rollback of Dodd-Frank provisions. Nearly all of Dodd-Frank, including the executive compensation components, runs through the turbines of the Financial CHOICE Act. If passed in its current form, the new act would:

- Eliminate the requirement to hold a say-on-pay vote at least once every three years. Instead, it would require a say-on-pay vote “each year in which there has been a material change to” executive compensation.

- Reduce the clawback scope so that a clawback is triggered only where the “executive officer had control or authority over the financial reporting that resulted in the accounting restatement.”

- Repeal the say-on-frequency vote.

- Repeal the CEO pay ratio disclosure.

- Repeal the new hedging disclosure.

The Financial CHOICE Act is so far-reaching that we expect it to run into trouble in the Senate. There, 60 votes are required for a bill to become law. Republicans control only 52 seats, meaning 8 Democrats would need to cross the aisle. That’s unlikely to happen, leaving its champion, Jeb Hensarling of Texas, to either make extensive compromises or float a new, much more targeted piece of legislation. He is currently working on a new version, “CHOICE Act 2.0,” soon to be unveiled.

More likely, the CHOICE Act will die on the vine altogether. Instead, we’ll see something from Trump and Mnuchin take hold. The practical thing would be to propose more surgical amendments to Dodd-Frank—ones that can garner support from enough Democrats to clear the Senate vote.

Another, faster option for curbing Dodd-Frank would be to use the Congressional Review Act, which gives Congress at least 60 days to review new rules that federal agencies issue as part of a law. During this time, legislators can rescind the rule with only a majority vote. But none of the executive compensation components of Dodd-Frank would be eligible, since they were all passed before June 2016.

What about the SEC? Does Piwowar’s reopening CEO pay ratio for comment suggest this might be the avenue through reform occurs? It’s actually very unclear, as the SEC’s general charter is to develop and enforce regulations, not undo them. A lengthy process exists should the SEC pursue efforts to unravel a rule that’s already on the books. A February 6 Wall Street Journal article offers color on opportunities and roadblocks the SEC may face. Here are some of the key ideas:

- Congress retains the sole ability to repeal laws. The SEC can provide relief by amending rules or granting exemptions, and such actions are subject to judicial review.

- The judicial review component is important, as market participants who believe an amendment harms them can litigate. The plaintiffs’ burden is to show that the amendment conflicts with the statute on the books.

- Per Dan Goelzer, a partner at Baker & McKenzie who was quoted in the article, “Staff would have to make sure amendments to the rules don’t run contrary to the underlying law.”

- For this reason, any amendment process is not quick, since revisions must be carefully drafted to avoid getting shot down via any ex post judicial review.

But then again, there might be so much pent-up frustration with CEO pay ratio and other components of Dodd-Frank that a “shoot first, aim later” approach ensues.

June 2017 UpdateThe barriers to changes remain as they were in February, and repeal through legislation still looks unlikely in current form. The CHOICE Act 2.0 was released in April, passed the Financial Services Committee in May, and just recently passed in the House. However, it still appears highly unlikely to garner the necessary 60 votes in the Senate. Given the political and judicial roadblocks to wholesale repeal, our best guess is that targeted reform is more likely, either via legislation or the SEC. The open question remains one of prioritization. Certain aspects of Dodd-Frank are higher priority than others, and even those may not top the list of issues the government is tackling. |

Where This Leaves Us

So with all this said, here’s what we predict about the fate of Dodd-Frank’s executive compensation provisions.

1. Rules that have been proposed but not finalized will not see the light of day. This includes the following sections: pay vs. performance disclosure (953(a)), clawbacks (section 954), employee and director hedging (955), and plan design restrictions for financial services firms (956).

All but the employee and director hedging disclosure are highly controversial. Section 956 is particularly far-reaching and would drive unusually material changes to how compensation is performed within financial services firms. Acting chairman Piwowar has even publicly stated that any further Dodd-Frank rule-making will not be a priority.

June 2017 UpdateThis still appears to be the case. It remains to be seen where repealing, delaying, or changing finalized rules will fall in the list of priorities, but the rules not yet finalized are at the very bottom of that list. |

2. Any rollback of existing Dodd-Frank rules will come through the SEC and not Congress. Any major revision is too unlikely to gain bipartisan support in the Senate, resulting in either perpetual gridlock or compromise that substantially shrinks and dilutes the scope of the revision to a level of irrelevance. On the other hand, the SEC isn’t wasting any time. While far-reaching amendments will be subject to judicial review, the SEC may be ready to have that fight.

June 2017 UpdateWith the CHOICE Act 2.0 having made its way through the House, this is less clear than it was earlier in the year. However, wholesale congressional action like the CHOICE Act still does not look likely to be successful. Unless Congress changes tack for piecemeal reform, SEC action remains relatively more likely. |

3. But beyond pay ratio, it’s hard to imagine any SEC revisions to Dodd-Frank’s executive compensation section. Whereas most investors couldn’t care less about the pay ratio disclosure, there would be an explosion of criticism if something like say-on-pay were targeted for rollback.

June 2017 UpdateProvisions like say-on-pay have proven popular with shareholders, and could be sustained by shareholder demand even absent regulatory requirement. Pay ratio is a different story, as issuers are largely against it and institutional shareholders are largely indifferent. Other constituencies, including unions, media, and advocacy groups, are still strongly in favor of the pay ratio rule and could cause some public backlash if it were repealed. |

4. SEC action to amend the pay ratio rule could take a few different forms. One, they could delay go-live. Two, they could water down the scope and requirements of disclosure. Or three, they could punch hard and simply try to repeal it. And, of course, they could do nothing. Choices one and two seem most likely, and both have problems.

If the SEC delays go-live, too long of a delay could trigger judicial review, and it would then be hard to circle back with a second amendment to delay further. If they water down the rule, it would put companies in an odd predicament. They would need to decide whether any cost/effort savings of doing the calculation in a simpler way outweighed any incremental risks of being dragged into a frivolous lawsuit or media-shaming ritual. This would also have the unintended consequence of further undermining comparability.

June 2017 UpdateThe comment letters received this year put the SEC in an odd predicament. Had they been largely against the rule, then delay or even repeal might have been easier. Since the comments went the opposite direction, major action may lack credibility. It’s possible that they enact targeted reforms aimed at provisions companies identified as onerous, but as we’ve mentioned elsewhere, this rule may not be a priority given limited bandwidth. Delaying the rule in the hope of a legislative solution is certainly still possible, but the rule remaining in place as-is seems more likely today than it did a few months ago. |

5. Ultimately, investors will continue to care about executive pay and how it relates to performance. To that end, even though we may never see finalized SEC rules on pay vs. performance, this is the question investors care about. Market forces will continue to push companies to explain, in their proxies and elsewhere, why their incentive programs make sense and reward executives for exemplary performance.

Similarly, certain clawback provisions will likely keep appearing, though the scope might be narrower to avoid some of the rule’s more awkward elements. And, of course, say-on-pay is unlikely to go anywhere as investors have become accustomed to the process and generally find the discipline it creates helpful.

As we say, though, anything can happen with this administration. Stay tuned. We’ll continue to monitor the new executive’s activity toward executive compensation, tax law, and other agenda items that affect equity granting.

June 2017 UpdateUltimately, even a law as far-reaching as Dodd-Frank is not the main driver of executive compensation decisions. These specific pieces may change, but the overall job of all compensation professionals remains to thoughtfully balance the competing concerns of recipients, shareholders, and other stakeholders. |

Don’t miss another topic! Get insights about HR advisory, financial reporting, and valuation directly via email:

subscribe