Equity Methods a Leader Once Again in the 2014 Group Five Stock Plan Administration Benchmarking Study

The 2014 Group Five Stock Plan Administration Benchmarking Study is out. You can get your copy of the report here.

Group Five is the corporate services research and consulting firm best known for its research in stock plan administration, shareholder services, and financial reporting. Every year, they survey client satisfaction with three kinds of services:

1. Stock plan administration

2. Administration systems

3. Financial accounting and reporting

That last one is Equity Methods’ wheelhouse. Our entire business is geared toward making financial accounting, valuation, tax, and reporting for equity compensation a center of excellence (CoE) for our clients.

So what were the findings?

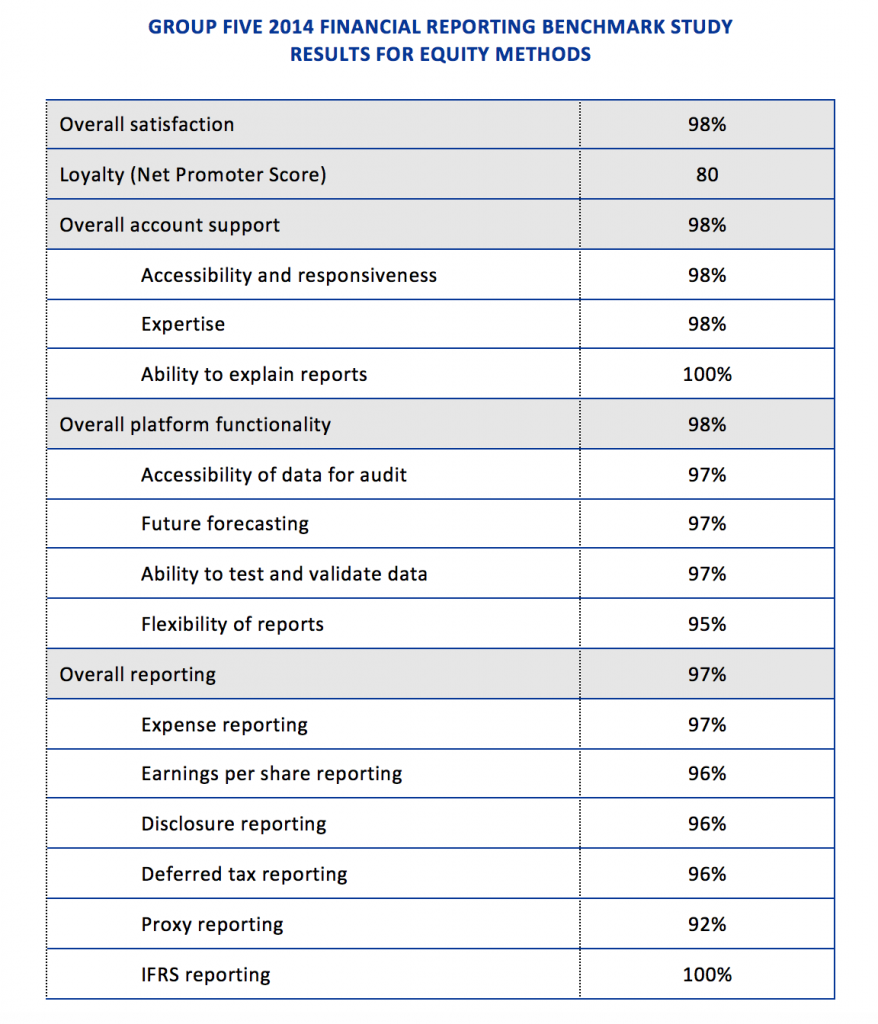

Equity Methods dominates every category of client satisfaction with financial reporting services.

That’s right—every one. Here’s a breakdown of the results:

Our overall client satisfaction rate is 98%.

And our client loyalty, as measured using the 100-point Net Promoter® Score methodology, is 80 compared with 41 for the industry overall. Both results—our client satisfaction rate and our client loyalty score—are the highest of any financial accounting and reporting service provider in the survey’s history.

When Group Five invited us to comment, here’s what our CEO, Takis Makridis, said:

“Equity Methods takes pride in creating robust, customized financial reporting solutions for our clients’ most complex plans. We’re privileged to have really amazing clients who are at the heart of everything we do. We’ve continued to expand our services in response to their evolving needs, and we’re thrilled that they’ve honored us in such a public way.”

And it’s all true. We have the best clients, and the best job, in the world.

Once we calmed down a little, we took a look at the rest of the study. This caught our eye: Group Five asked plan sponsors to identify the three most significant issues they faced in administering their stock plans.

Equity award plan sponsors say financial accounting and reporting is one of their top three challenges.

No surprise here. Some expected the reporting for equity awards to simplify after the adoption of ASC 718 (back then, SFAS 123R) in 2004. We’ve seen the opposite happen. The post-adoption world started out with basic compliance (i.e., “What does the guidance say?”). From there it became increasingly complex, driven by new award types along with efforts to integrate external reporting, management accounting for stock compensation, and compensation design and planning. HR, finance, accounting, and tax must collaborate more than they ever have needed to in the past.

Today, firms are turning to financial reporting centers of excellence, ushering in a new era of strategic value. It’s easy to see why a CoE makes sense. Mechanics are tough. Award terms and plans are changing so fast that administration systems struggle to keep up. On top of that, this year there’s been a record level of M&A activity, which just makes the accounting harder. And now performance-based compensation is proliferating, increasing the need for airtight reporting structures and analytics in the compensation planning phase.

Another big issue, say respondents, is plan participant education.

We agree, and here’s why. Especially for named officers in the proxy, it’s very easy for either shareholders or the executive recipients to get the short end of the stick. The onset of relative total shareholder return (TSR) awards creates particular dangers. That’s why it’s so critical that participants fully understand how their specific award works and are able to see how their performance is tracking in the moment.

We’ve also been seeing greater interest at the board level for retrospective analyses of awards that a company might be thinking of granting to its key leaders. Executive compensation professionals like being able to show, numerically, how a set of awards might have paid out differently had the award already been granted and the performance period already ended. It’s helpful for participants to see how an award’s terms work using familiar historical conditions.

Another broad trend in HR involves multimedia delivery of employee compensation and benefits education. Live or recorded, we think it works best when fully customized to reflect the specific awards that employees receive and numerical examples showing how they work. We have a particular passion for education in the compensation area, so this issue really resonates.

A third major issue? Tax compliance.

Makes sense to us. One recent trend is that more and more companies are implementing recharge agreements so they can repatriate cash back to the US tax-free and capture valuable deductions on equity awards issued abroad. Recharge agreements aren’t new, but they’re getting a fresh look. Meanwhile, many companies simply haven’t had time to create the internal accounting and reporting processes to make those recharge agreements work for them.

We’ve found, by the way, that tax reporting for equity compensation in general can reap big benefits from technology-enabled outsourcing. That’s because it’s a highly technical area often saddled with manual processes. From what we see, recharge and customized forecasting and management reporting, along with other reporting areas demanding wholesale process redesigns, are getting more attention as companies work to extract strategic value from this area.

It’s worth mentioning that 2014’s uptick in M&A activity has led to more inquiries about integrating and systematizing disparate equity compensation reporting processes. Again: This hits tax disproportionately because so many manual processes remain. We’ve been having more conversations along these lines, covering everything from APIC balance proofs to recharge implementation.

There’s much more in the 2014 Group Five Stock Plan Administration Benchmarking Study. The summary report is complimentary; be sure to get your copy.

Was this post helpful? Join our mailing list to receive alerts of future articles!