ESPPs that Work for You: Top Five Lessons Learned

We’ve spent a lot of time over the last year or two talking to companies and industry friends about employee stock purchase plans (ESPPs). It’s hard to shake the feeling that the pendulum is swinging back toward ESPPs in a big way. With traditional equity programs focusing more on the executive suite, it’s harder for many companies to make broad-based equity grants meaningful to employees. ESPPs are a great way to fill that void, especially since they can scale to employees’ preferred participation levels and come with a built-in profit for participants.

These conversations culminated this month at the WorldatWork Total Rewards conference, where I presented on the topic with Brit Wittman of Intel, Julie Mrozek of Leidos, and Cherie Curry of Hilton. Between the insights from that panel and the conversations in the hallways of the conference, there were some recurring points about how to make an ESPP suit your specific needs. Here are five key takeaways:

1. ESPPs are becoming more generous (again).

We all know the basic story: Everyone had great ESPPs in place 10-15 years ago before the accounting rules changed. But when FAS 123R went live in 2006, a lot of companies dialed back to “noncompensatory” plans with a 5% discount and no lookback in order to avoid any expense hit.

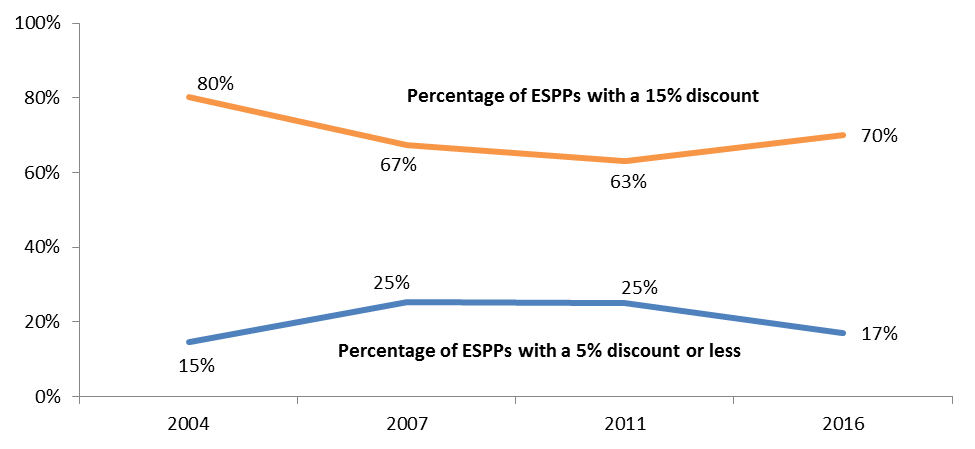

But the pendulum is swinging back the other way, toward more employee-friendly plans. For example, we can look at the reversal of the trend in the size of the purchase discount (Figure 1):

Figure 1: Purchase Discount Trends, 2004-16

In 2007, there was a drop in the number of 15% discount plans and a spike in the number of plans with a 5% discount or less. But in recent years, the trend has reversed. Plans with a 15% discount are at their highest prevalence since pre-FAS 123R, and 5% discount plans are at their lowest.

In any case, we’re very much looking forward to seeing next year’s data. Based on the conversations we’ve had, we expect to see a continuing trend of ESPPs becoming more generous and more prevalent.

2. ESPPs have more variety than plain vanilla options or RSUs. Use that to your advantage.

The accounting guidance in ASC 718 specifically lists out nine types of ESPP, but in reality, the subtle variations create an even wider range of plan types. Some are objectively more employee-friendly, but there is no single right answer for everyone. The key lies in perceived value by employees, or how much value they subjectively place on the plan.

This isn’t the venue to walk through every single possibility, but here are some of the main plan features to consider.

First is the discount, which is straightforward enough. Employees will typically perceive the value fairly close to its objective value.

Second is a lookback feature, where the purchase price is a discount from the lower of the beginning or ending stock price in the period. Objectively, this is extremely valuable, because it opens up a huge range of possible upside while maintaining downside protection. But it can be easy to understand just how much value it can add without the right communication. (Though of course, it’s easy for employees to understand once that first big windfall check hits their wallet!)

Third is the offering length. Again here, the longer runway objectively unlocks a wide range of possible upside, but communication and examples are key to employee understanding.

Finally, there are resets or rollovers, where the lookback price in a multi-period offering ratchets downward when the stock price decreases. For anyone looking to maximize employee upside while remaining in the realm of “standard” ESPPs, this is a great plan type to consider.

3. “Non-standard” plans may not be for everyone, but they’re the right answer for some.

There’s more reason than ever today to explore beyond the standard plans. If your employee base is unlikely to hold shares long enough to qualify for IRC §423 tax treatment—which is true for many companies—then the value in offering a qualified plan is limited. And if you don’t need your plan to qualify under IRC §423, then the design handcuffs are gone.

Without binding qualification criteria, a plan can give discounts greater than 15%, provide offerings longer than 27 months, or limit eligibility to a smaller employee population. Plus, a non-qualified plan always gives the company a tax deduction at settlement.

One of the more interesting features that’s come up lately is an auto-enrollment feature along the lines of what many companies do with 401(k) plans. Most often, we see these in companies that expect minimal withdrawals and who are undergoing a transition like an IPO. An auto-enrolling ESPP lets employees get in on the ground floor and helps kick-start an ownership culture.

4. Communication and education drive engagement and employee value.

Perhaps the biggest takeaway from the experience of my co-panelists at WorldatWork was the importance of communication. Regardless of the plan terms, they all reiterated the importance of being proactive in driving employee engagement.

We all know that just handing a prospectus to an employee isn’t sufficient, but what are some other avenues? Plain-English FAQs or reference slides are one, as is including ESPP information in annual total rewards statements. Town hall meetings or webinars are another, especially if they coincide with enrollment periods. And sometimes, going even bigger is necessary, such as a roadshow to support the launch of a new plan or the onboarding of new employees through a merger.

Intrigued by Intel’s astronomical participation rates (over 70% worldwide, and nearly 80% in the US), one audience member asked Brit how they managed to have such wide involvement. His answer was to embed the plan in the culture as much as possible. For example, splash purchase information onto the Intranet site and common area screens to reach as many people as possible. And once the plan really is part of the culture, fellow employees become the best salespeople for getting new folks to participate.

5. Use data and scenario modeling to inform your decisions.

It’s almost a cliché at this point, but data-driven decision-making is really important in this day and age.

Fortunately, ESPPs lend themselves very well to modeling. Sometimes, this is simple: What would our expense be if the stock price were $X, $Y, or $Z? And the participation rate were A, B, or C? And how would employee payouts compare to that expense?

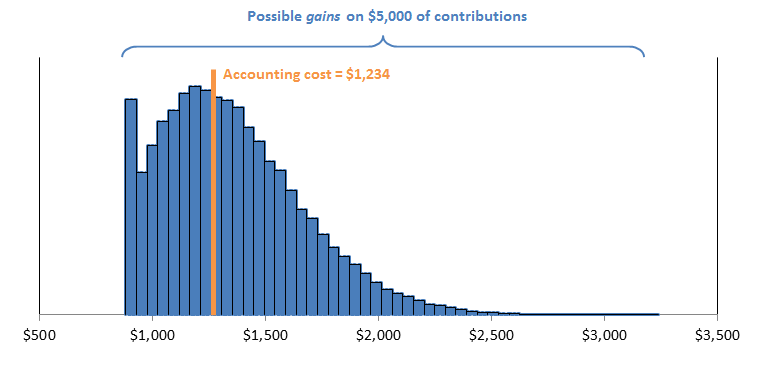

Some of our clients even go as far as to simulate the whole range of potential payoffs to get a clearer idea of costs and benefits (Figure 2):

Figure 2: Example of Potential Payoffs for an ESPP

This level of detail can give you solid estimates on questions like “what’s my average expected employee gain?” and “how likely is an employee to have a gain higher than our accounting cost?” (For our curious readers, the answers in the case shown here are $1,354 and 60%, respectively.)

While this level of sophistication isn’t needed in every case, some amount of quantitative modeling is table stakes in the world today. We recommend at least starting with A) scenario modeling high/medium/low stock price cases and B) backtesting the numbers over the last few years of actuals as a baseline for real-world outcomes.

A major side benefit of modeling and visualization is building the case for senior management that your ESPP recommendation is well-grounded. There are a lot of opinions about ESPP designs, some more insightful than others, and our encouragement is to analyze the data before you make your decisions.

Parting thoughts

All in all, this underscores the importance of being thoughtful. ESPPs are not one-size-fits-all, and there’s not a single answer that works best for every company and every culture. But by weighing a few alternatives, modeling out the possibilities, and communicating clearly to your employees, you can have a plan that works best for you.

Don’t miss another topic! Get insights about HR advisory, financial reporting, and valuation directly via email:

subscribe