FASB Standard-Setting Explained

At this year’s annual NASPP conference in San Diego, I delivered a talk on the aftermath of FASB standard-setting, joined by my friends Haleh Carillo (Rubrik) and Shayne Kuhaneck (Financial Accounting Standards Board).

There’s been a lot of change in the stock compensation world. In 2016, Accounting Standards Update (ASU) 2016-09 went live. A year later, FASB released ASU 2017-09, with ASU 2018-07 soon to follow.

The purpose of our session was to take inventory of what’s happened and where practices are evolving. I’m particularly keen to look at regulatory and other activity with an eye toward the opportunities it creates instead of just the compliance it requires. And amid the flurry of standard-setting, there are both new risks and opportunities to unpack.

I was excited to team up with Haleh and Shayne given the unique perspectives they brought to the discussion. Shayne was able to give some color into both the purpose of standard-setting in general and equity compensation specifically. Meanwhile, Haleh delved into applied topics within organizations, having extensively polled peers in advance of the session. I leveraged our experience as the leading service provider for equity award financial reporting, focusing on best practices and trends.

We had a lively and well-attended discussion. What follows is a summary, along with some thoughts of my own. Email me if you’d like a copy of the slides.

The Purpose of Standards

It’s tempting to view accounting standards as an endless series of rules. But they do play an important role in the US economy—one that’s easily forgotten. In that light, I asked Shayne to review FASB’s role and objectives in formulating accounting standards.

FASB aims to help foster economic growth by promoting more efficient capital allocation. Accurate, neutral information allows investors (“users” of financial statements) to make better decisions. The barometer of how effectively this is done is the cost of capital in a market—or, put another way, how easy it is to operate within that market. The US boasts the most liquid and efficient equity (and debt) market in the world. That’s due, in no small part, to the standards we have for synthesizing and disseminating useful information to investors.

At the same time, the cost of complying with accounting standards is a major consideration. An unduly-difficult compliance burden works against efficient capital formation and could even motivate companies to list their equity on foreign markets. So it’s a constant calibration to develop standards that help investors make useful decisions, avoid perverse incentives, and are clearly executable by those charged with implementing them.

How FASB Sets Standards

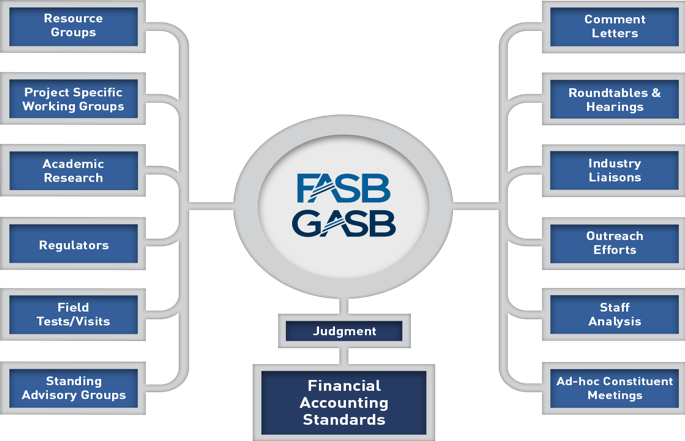

If standards are to promote efficient capital allocation, how does FASB know what to prioritize and what kind of standards companies can apply?

To begin, FASB solicits feedback from the community at large. This includes various forms of stakeholder communication and outreach so that FASB can understand how financial statement users (investors) and preparers (companies) view the issues at hand. This process takes place issue by issue, with priorities established across technical topic areas. Sometimes stakeholder outreach can turn up a problem with an accounting standard. While that’s good to know, FASB also needs to believe a practical solution exists that it can organize into an accounting standard update.

For example, ASU 2016-09 materialized from a post-implementation review requested by the Financial Accounting Foundation (FAF). To create its guidance, FASB reached out to users and preparers. It also deliberated on the technicalities internally.

FASB decisions reflect numerous objectives. One is to facilitate neutral, reliable information. Another is to reduce the cost and complexity of financial reporting. And then there’s addressing the issues that stakeholder bring up. For all significant projects, FASB forms transition resource groups to focus on education, interpretation, and amendments.

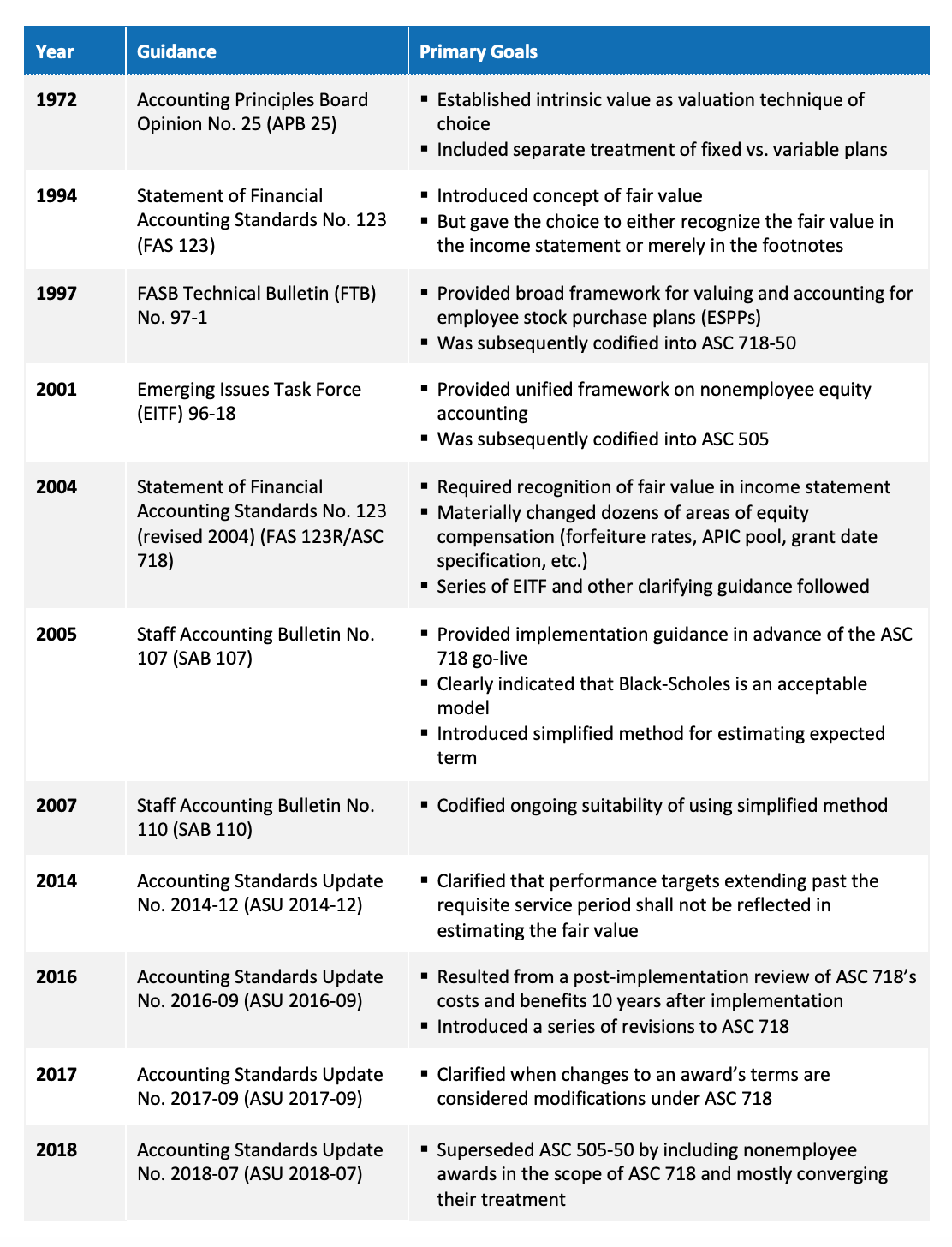

Recent Stock Compensation Standard-Setting

We’ve had a lot of standard-setting lately. The following table doesn’t show all the guidance that’s been released in the last few years. But it does offer a concise view into the evolution of equity compensation accounting.

Let’s go through the aftermath of the top three revisions, starting with the most significant: ASU 2016-09.

ASU 2016-09: APIC Pool Elimination

Why did FASB eliminate the APIC pool in ASU 2016-09 given the P&L volatility this creates? Because the outreach process yielded substantially negative feedback on the use of APIC pools, which prompted a search for alternatives. In the end, FASB found only two choices: Run excess benefits and shortfalls through equity, or run them through earnings. The former made little sense given how similarly book-tax differences are handled in ASC 740. That made the revised GAAP all but necessary.

The initial premise supporting the use of APIC pools was that equity awards are fundamentally two transactions. At grant, they’re compensatory arrangements. Afterward, as ownership stakes inflate or deflate, they become equity transactions. This is, in fact, how FASB initially accepted the use of APIC pools when drafting ASC 718 in 2003. But the so-called “two transactions theory” never was bulletproof and doesn’t conform with how income taxes are handled elsewhere in GAAP.

Some might think these revisions are so pedantic that investors don’t even care or notice. However, investors consistently told FASB that they considered stock compensation a real expense of the organization.

That’s also been my experience. Investors may not be subject-matter experts across every nuance of technical accounting, but they’re highly interested in the quality of accounting and the delivery of more reliable information. When I explain the issues to institutional investors, they usually respond along the lines of, “Oh, that makes sense. Yes, that seems to improve the quality of financial reporting. We would favor that.”

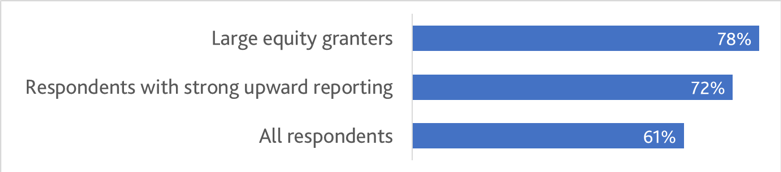

Even so, eliminating the APIC pool leaves organizations to contend with P&L volatility. Tax settlement forecasting is the best response to this. As the following from our 2018 stock-based compensation accounting best practices survey shows, the majority of companies perform tax settlement forecasting. The share is even larger among companies with strong managerial reporting processes (72%) and large equity granters (78%).

Tax Withholding Revisions

Shayne and Haleh segued into a discussion of FASB’s revisions to the liability trigger associated with tax withholding. As a reminder, the old rules said that partial cash settlement of an award in shares for tax-withholding purposes would trigger liability classification if the amount withheld exceeded the minimum statutory rate. ASU 2016-09 changed this to be the maximum statutory tax rate in the applicable jurisdiction. That same year, the International Accounting Standards Board (IASB) created a provision for full equity classification, though it doesn’t go as far as ASU 2016-09.

Either way, this change was overdue. Under prior GAAP, there was an inherent tension between complying with GAAP (withhold no more than minimum statutory tax rate) and complying with tax law (withhold at least the minimum). Stakeholder outreach made it abundantly clear that any theoretical merits to setting the liability trigger at the minimum rate were outweighed by the costs and complexity this imposed.

How does the revision play out in practice? The answer depends on whether we’re discussing US jurisdictions or non-US jurisdictions.

For the latter, the revision is working well. Non-US jurisdictions have no concept of a minimum statutory tax rate as we do in the US. To comply with the old GAAP, companies had to collect each participant’s marginal tax rate prior to vesting for tax withholding. Not every company did this, but it was the only way to prove that the liability trigger was not tripped.

By applying a single maximum marginal tax rate to the whole population in a jurisdiction, companies can now sidestep this work. Of course, this means excess withholding for some participants and the need to link withholding back to individual marginal tax rates so that refunds flow through. But that problem is much easier to solve than the one that existed previously. Overall, most companies report that the change in ASU 2016-09 has benefited them outside the US.

It’s a different story inside the US. That’s because IRS rules for granting haven’t changed, making it difficult to alter withholding approaches. For 2018, IRS rules instruct companies to apply a flat rate of 22% to supplemental wages until they hit $1 million, at which point withholding jumps to 37%. The IRS does allow companies to withhold above the 22% flat rate using a special-purpose W4. However, processing multiple W4s is administratively burdensome and error-prone. Neither does this approach allow participants to designate a tax withholding rate—only a lump sum (which they wouldn’t easily be able to compute).

All in all, most companies haven’t changed their withholding methods for US employees. The flat rate approach generally results in under-withholding such that executives need to make estimates tax payments via a separate process. IRS revisions could be useful and result in a faster, more streamlined distribution of withholdings. Until those revisions happen, however, expect little change in US withholding policies.

Forfeiture Rate Optionality

ASU 2016-09 affords companies the choice to recognize forfeitures as they occur or estimate them with a forfeiture rate (plus an ultimate adjustment for what vests). Complexity surrounding forfeiture rates was a hot topic of consternation from the Private Company Council (PCC), one of the stakeholder groups that FASB consulted with. This is because small, private companies generally have spreadsheet-heavy processes and limited data for estimating forfeitures.

FASB felt comfortable providing companies with a choice because both approaches ultimately satisfy the objective of linking the expense recognized to awards earned. So far, , and this percent is higher for large, publicly traded companies.

Forfeiture rates shouldn’t be difficult to apply. They help reduce forecast-to-actual variances, which is a significant issue for mature companies. Besides, forfeiture rates remain necessary under IFRS and in acquisition accounting, so it’s not possible to abandon them altogether. In general, most companies appreciate the flexibility afforded by this revision in ASU 2016-09, but not all are able to take advantage of it.

There are many other revisions to stock compensation accounting in ASU 2016-09, but these are the big three. Let’s move on to ASU 2017-09.

ASU 2017-09: Modification Revisions

ASU 2016-09 was the instigator of its successor, ASU 2017-09. Many companies needed to modify their plan documents to allow tax withholding at levels up to the maximum statutory rate, but found this triggered a modification since ASC 718 said that literally any term change is a modification.

The ASC 718 modification framework is somewhat complicated. In a nutshell, it requires comparing the fair value immediately before a modification to the fair value immediately after a modification to determine whether the modification created incremental award cost.

FASB had no intention of changing this. Instead, FASB said that if an award term revision doesn’t change the value, vesting, or balance sheet classification of an award, it needn’t run through the ASC 718 modification framework. We found this revision peculiar, since an award term revision of this nature mechanically does not create incremental cost and therefore is easy to handle regardless of whether it runs through the formal modification accounting framework. For example, revising a plan to allow for withholding at the maximum statutory tax rate clearly doesn’t create incremental cost under the modification accounting framework, so whether it runs through the framework or bypasses it altogether seems irrelevant.

Don’t assume that a modification can skip modification accounting, however. Our tax withholding example may not need modification treatment under ASU 2017-09, but other modifications do. For example, if an executive terminates and the board extends the post-termination exercise window on her options, this does change the value, and thus requires full-blown application of the ASC 718 modification logic. In short, the complex modifications remain complex and the simple ones stay simple (or become even simpler).

ASU 2018-07: Nonemployee Accounting

We closed the session with a discussion of ASU 2018-07, FASB’s recent update aiming to harmonize the accounting for nonemployee share-based payment awards with employee awards. Previously, nonemployee awards were subject to ASC 505-50, which prescribed a materially different framework. This incongruence was flagged as a problem during the ASU 2016-09 deliberations, but determined to be too large of a question to squeeze into the 2016-09 guidance. As a result, FASB went to work on a standalone ASU, which is what was published in June 2018.

The guidance in ASC 505 required that the fair value of instruments be remeasured each reporting period until the service is rendered (or goods are delivered)—in practice, that typically meant remeasuring fair value each period until vesting. In bringing nonemployee award accounting under the scope of ASC 718, a standard grant-date fair value model applies.

However, there was some confusion around interim period calculations for awards that were midstream in the mark-to-market process under ASC 505. Should the fair value calculated be as of the adoption date, or as of the beginning of the fiscal year in which the ASU was being adopted?

Fortunately, FASB has a process for fielding questions. In fact, a few of my colleagues at Equity Methods used this process and received a quick and clear answer. This is worth repeating: It’s all too easy to burn dozens of hours puzzling out the intent of certain guidance when a straight answer can be had directly from FASB. In the example noted here, FASB said their intent was to have fair value anchored to the adoption date but would accept either approach as reasonable.

Overall, ASU 2018-07 was a big win in terms of delivering simplification in an area where complexity was not creating any benefits. As it turns out, in their November board meeting, FASB determined to clarify a few additional areas of ASU 2018-07 pertaining to the use of share-based payment awards as sales incentives with customers. The open question is whether equity awards issued to customers should fall under ASC 606 or ASC 718. The board decided on the latter and asked the staff to begin drafting a new ASU.

As an aside, we’re surprised by how infrequently we see share-based payment awards used in customer transactions. If I’m a customer negotiating to pay $10 million for a service, I might ask for $500,000 in equity options to get me over the fence. We think these negotiating tools are underutilized and are interested in seeing whether their prevalence increases once FASB releases its new ASU.