GO Awards: A Proxy-Friendly Way to Realizable Pay

There’s an age-old tension in implementing equity incentive packages. Shareholders generally want lower net spend and tight performance linkage, whereas executives generally want higher and more guaranteed pay. The usual compromise on this tension is performance equity—high pay is possible, but only if performance merits it. And when it comes to special or outsized grants, including so-called mega grants, the performance metric of choice is stock price attainment. If shareholders win big, then a small slice of that value goes to the executives who drove the value creation.

The problem is that price hurdle awards can get expensive when there’s a large quantum or substantial above-target upside on the line. Even though the executive may never actually realize that value—after all, these are difficult stretch goals—the fair value of the award still must be disclosed in the Summary Compensation Table (SCT) of the proxy in the year of grant.

This huge spike in disclosed grant value can be fatal for governance optics. It leaves companies picking between two bad choices: risking the wrath of shareholders by granting what seems to be a lot of value, or not granting even though it’s the right strategy for the business.

But there’s a third way. The gated outperformance award, or GO Award, can create critical upside incentives while maintaining governance-friendly disclosures.

How Equity Award Values Are Disclosed

Let’s take a moment to review the SCT rules for equity awards. At their core, the mechanics of how equity award values are disclosed depend on the accounting rules in ASC 718 (the GAAP covering share-based compensation).

Within ASC 718, there are two types of performance goals. One type is a “market condition,” which covers metrics like stock price or total shareholder return, whether relative or absolute. The other type is a “performance condition,” which covers any other financial or operational metrics.

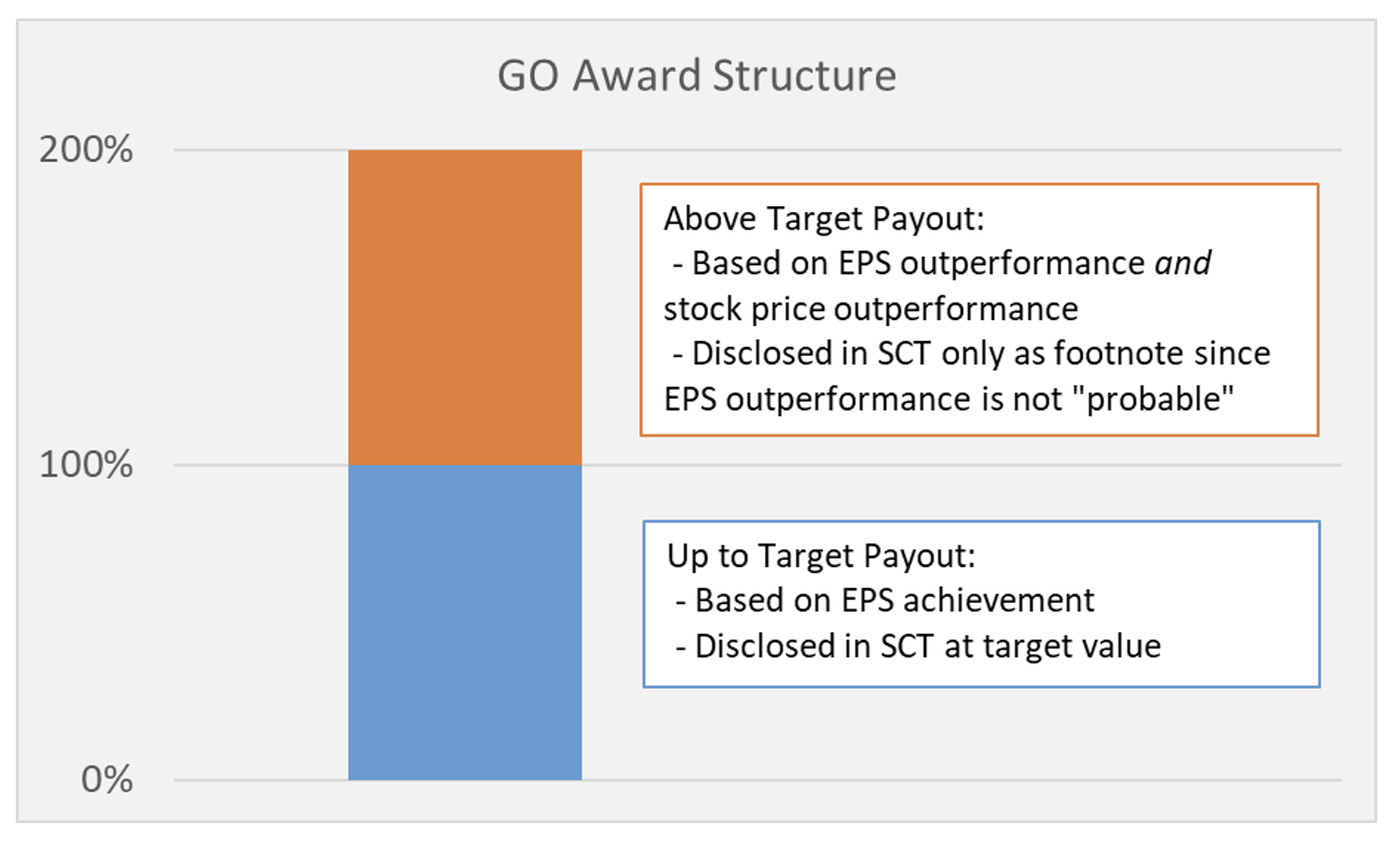

The SCT rules follow this distinction and analogize to the performance award accounting framework. Awards with market conditions are included in the SCT at their grant-date fair value, which typically comes from a Monte Carlo valuation model. Awards with performance conditions are disclosed in the table based on the probable achievement level of the performance metric(s) at the time of grant. For typical performance awards, this typically means a target level of achievement, but stretch goals may be improbable at grant by their nature.

SCT-Friendly Upside Amid Uncertainty

Now, let’s consider one use case where a GO Award can outshine the alternatives in meeting the needs of all stakeholders.

The Situation

XYZ Hospitality Co. has been hit hard by recent years’ events. They find themselves in need of a turnaround and have experienced some turnover in their leadership ranks. As part of their turnaround strategy, they would like to issue a one-time special incentive award to their executive team, totaling $20 million in target value, in addition to the team’s regular annual grants.

The initial goal for the award is to get back to materially positive earnings after having operated at a loss recently. This goal is simple, clear, and easy for them to set: EPS of $0.50. They consider this target to be rigorous yet achievable (and “probable” for accounting purposes), but getting much beyond that point would require levels of company performance that they can’t yet deem probable.

But beyond that target, they also want the award to have upside for the executives to incentivize and reward true outperformance outcomes. They consider three alternatives for achieving this, which we’ll call designs A, B, and C.

Design A: Financial or Operational Stretch Goals

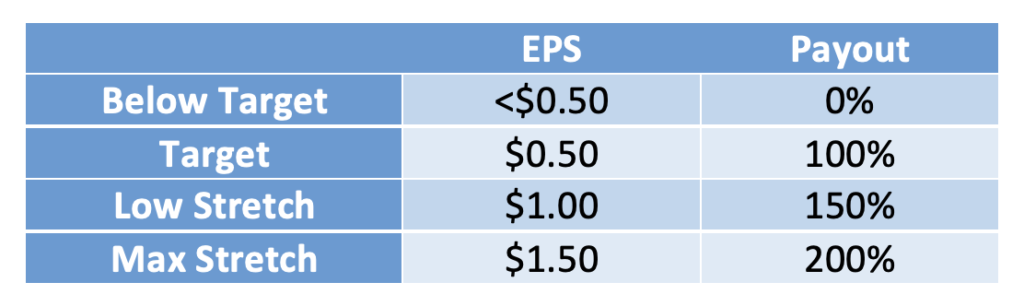

XYZ’s first inclination is to stick with the EPS metric and set stretch goals. They consider a stretch EPS goal of $1.50, with a sliding scale for above-target performance and payouts between $1.00 and $1.50.

This design would be SCT-friendly. Because only the $0.50 EPS outcome is probable, the SCT would only show the $20 million target value of the award.

But the compensation committee isn’t comfortable with this structure. First, it looks too similar to an ordinary performance award, so it may appear that the company is simply giving more standard equity this year—hardly consistent with an outperformance story. Second, there’s too much uncertainty around the EPS targets. Are $1.00 and $1.50 the right stretch goals? With all of the transformation facing the company, nobody really knows.

The nightmare scenario is that the stretch EPS is achieved, but in a way that doesn’t coincide with or drive a stock price increase. This would lead to a massive executive payout without a meaningful shareholder payout, which is a recipe for disaster. Further, they worry that shareholders will think upfront that the EPS goals may be sandbagged—after all, the relationship with shareholders is somewhat strained, given they’re in a turnaround situation to begin with.

Design B: Stock Price Appreciation Goals

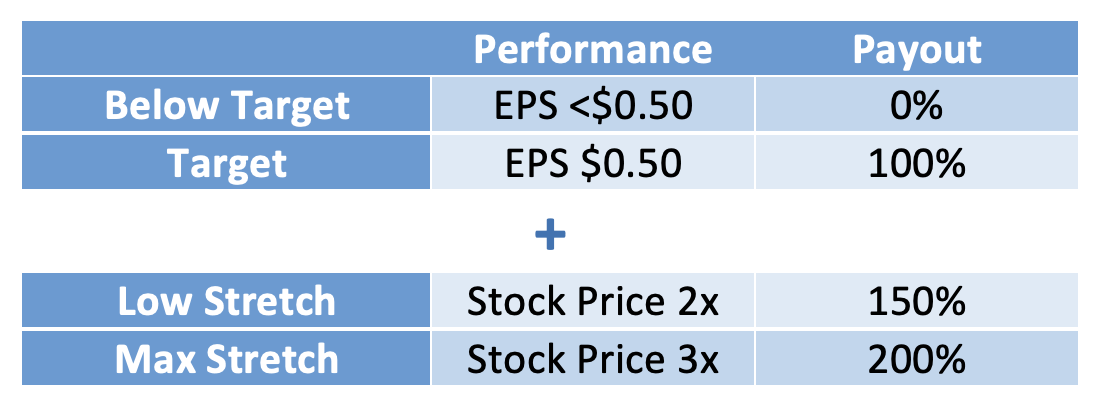

The flaws with stretch financial goals lead XYZ to consider stock price appreciation goals instead. In this structure, the upside is a sliding scale based on doubling and tripling the stock price.

This design cleanly achieves their incentive and governance goals. Executives win only when shareholders win. And there’s no way to sandbag market value creation, as it’s not an internally controlled metric.

But this design breaks, too. The SCT disclosed value will be unfavorable and lead to poor optics on its own.

This is because they would need to disclose the target value for the EPS portion plus the grant-date fair value from the Monte Carlo valuation model for the stretch price hurdle portion. The Monte Carlo model will discount the fair value for the possibility of non-attainment, but the result still may not be palatable—even a 50% discount would mean $30 million disclosed in the SCT rather than the $20 million target. That’s simply not a recipe for building shareholder goodwill.

So, is any award with upside doomed to have bad proxy optics in one way or another?

Design C: GO Awards to the Rescue

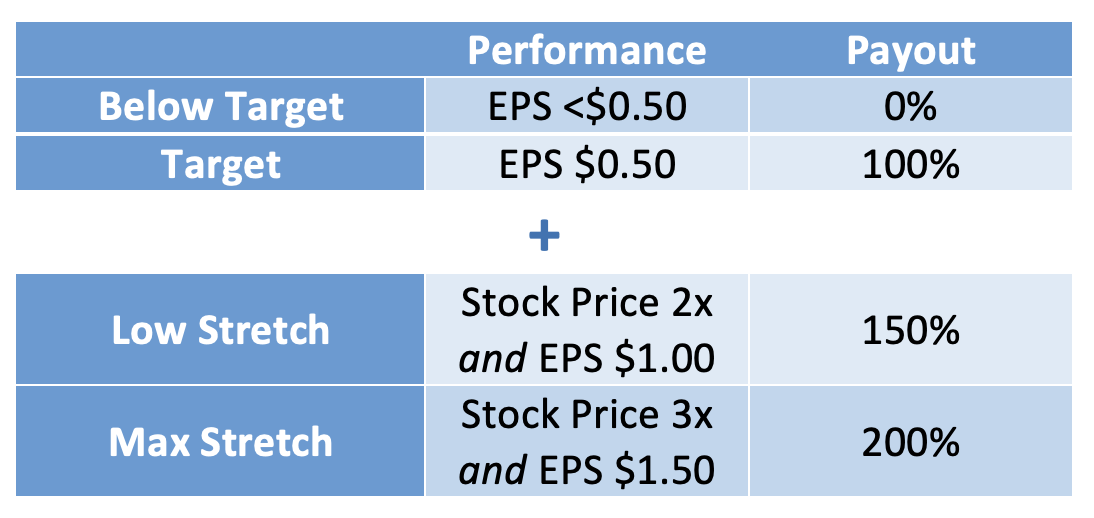

The solution to the problems posed by Design A and Design B is to combine them into a third type of award—the GO Award. In a GO Award, the upside of a grant is gated by two different stretch goals requiring outperformance.

Here’s the way it works for XYZ. First, the target portion of the grant is still based on the $0.50 EPS goal. Then, the upside portion of the grant requires both the price outperformance (2-3x) and the EPS outperformance ($1.00-$1.50) from the prior designs.

The stock price hurdle achieves the critical governance goals of Design B, in that the metrics are automatically rigorous and shareholder aligned. And it also achieves the SCT-friendliness of Design A. Because the upside portion of the grant requires both metrics to achieved, and the upside performance condition (EPS) is improbable, the SCT disclosure again is just the $20 million target value.

The GO Award gives XYZ the best of both worlds. First, earning the award requires substantial shareholder value creation, which is important to the compensation committee as well. The EPS goals are a second check on performance, but they’re not controversial to recipients since everyone expects that doubling or tripling the stock price would necessarily involve increasing earnings, too. But having those EPS goals, the second gate, enables good proxy optics.

This creates a win-win-win outcome:

- Win for executives: They receive an award with meaningful upside—tripling the stock price and earning a 200% payout would mean earning six times the target value, or $120 million

- Win for shareholders: Executives only receive that upside if shareholders get a tremendous amount more upside themselves

- Win for the compensation committee: The GO Award won’t create negative SCT optics and will be a fair reflection of the rigorous goals required to earn upside payout

Parting Thoughts

This use case describes just one way that a GO Award can be used to balance competing priorities in award design. While this construct isn’t common in the market yet, that’s because it solves a particular sort of problem that not every company faces in a given year. Rather, the GO Award is a simple extension of the logic behind now-common hybrid performance awards that combine market and performance conditions. No two circumstances are different, but any time you’re trying to balance between proxy disclosure rules and award design needs, creative thinking can help you thread the needle.

If you would like to discuss the topics covered here or other award design challenges you’re facing, please contact us. We would love to hear from you.