Prepayment of Debt in a High Interest-Rate Environment

Though interest rates have been climbing, at some point they’ll reverse course. Once they do, you can expect loans with a prepayment option to be refinanced at the lower prevailing rates, resulting in lenders missing out on big coupons and borrowers saving big on interest. With that said, not all debt can be prepaid, so some borrowers will be paying until the bitter end. What is this prepayment option we speak of, and how might one go about valuing it? Let’s find out.

Bond Prepayment Features

A prepayment (or call) feature of a bond gives the issuer the right to call the bond away from the investor for a given price. In other words, the issuer (i.e., borrower) can repay the lender (i.e., investor or holder) for the principal prior to maturity. In the case of personal loans like car loans or home mortgages, prepayment is typically allowed. If someone totals their car or moves out of their house, they’ll want to prepay the loan so they can purchase another asset. Banks also know that if interest rates drop, many of their high-rate mortgages will be prepaid so borrowers can refinance at the new lower rates. With corporate loans, however, prepayment isn’t guaranteed and is often outright prohibited.

In periods of high interest rates, lenders can generate more returns from their loans through higher interest payments. Since loans are often long term, these payments may go out into the somewhat distant future. But interest rates are cyclical. When they drop, debt issuers have a strong incentive to refinance their debt at lower prevailing rates.

Not so with lenders. They dislike prepayments as they lose the remaining interest payments on the loan. They can also incur additional costs as they rebalance their portfolio of long and short-term loans.

Prepayment Penalties

Lenders have two ways to encourage debt holders to hold debt for as long as possible. First, they can employ strict rules to effectively prevent prepayments. As we’ll discuss later, lenders may allow for reduced interest payments (if prepayment isn’t allowed) to keep it fair for the borrowers. The second way is through the use of prepayment penalties. These penalties can range from a small percentage of principal (often declining over time) to a full payment of all remaining coupons.

A common theme in our work is that you can’t get something for nothing. In this case, if you want a lower coupon rate, you must bear the cost of a prepayment penalty.

Prepayment features need to be factored into valuations. In some cases, often when triggered by an event unrelated to the general loan terms, prepayment features may constitute an embedded derivative. As a result, it’s important for borrowers to understand the cash flow and accounting implications.

Call Features in a Convertible Note

Call features in convertible debt allow the bond issuer (or borrower) to make a prepayment to the bond holder (or lender). When the issuer offers to prepay the bond, the holders can choose to either convert or take the payout that they’re eligible for if the note is prepaid. Most loans don’t have a conversion feature, so the loan holder is obligated to receive the prepayment.

We’ve seen a wide variety of prepayment terms over the years. Here are a few examples, from least to most restrictive:

- Upon a default or a change of control transaction, the holder has the right to demand prepayment from the issuer

- Borrower is allowed to prepay, but with a fee that includes a surcharge or compensation for any other cost or loss that the lender suffers due to the prepayment

- Borrower is allowed to prepay, but with a formula-based fee based on outstanding principal and the prevailing reinvestment rate at the time of prepayment

- Borrower is allowed to prepay, but the prepayment amount should be $100,000 or more in multiples of $10,000. If the outstanding principal is less than $100,000, then the prepayment amount should be the entire principal amount outstanding

- Borrower is allowed to prepay, but with a prepayment fee of 135% of the amount prepaid for the first 180 days after issuance date, after which prepayment won’t be allowed

- No prepayment is allowed at any time without the written consent of the investor

How Interest Rates Behave

Generally speaking, interest rates follow a mean reverting process. This means that unlike stocks, which trend upward over the long term, rates tend to move in the opposite direction to where they are until they arrive at a long-term average[1] rate.

When interest rates are low, people take out loans and spend more, increasing the demand for goods and raising prices. If prices rise too quickly, the economy can overheat, so the Federal Reserve responds by raising interest rates. Higher rates discourage people from borrowing. Instead, they deposit their money in a bank to earn greater returns on their savings.

High interest rates are unsustainable too. If people are saving and not spending, companies realize lower revenues. If this continues, people start losing jobs because the companies aren’t making enough money. Now the Federal Reserve steps in to stimulate the economy by lowering the interest rates so people can spend more money.

The Current Interest Rate Environment

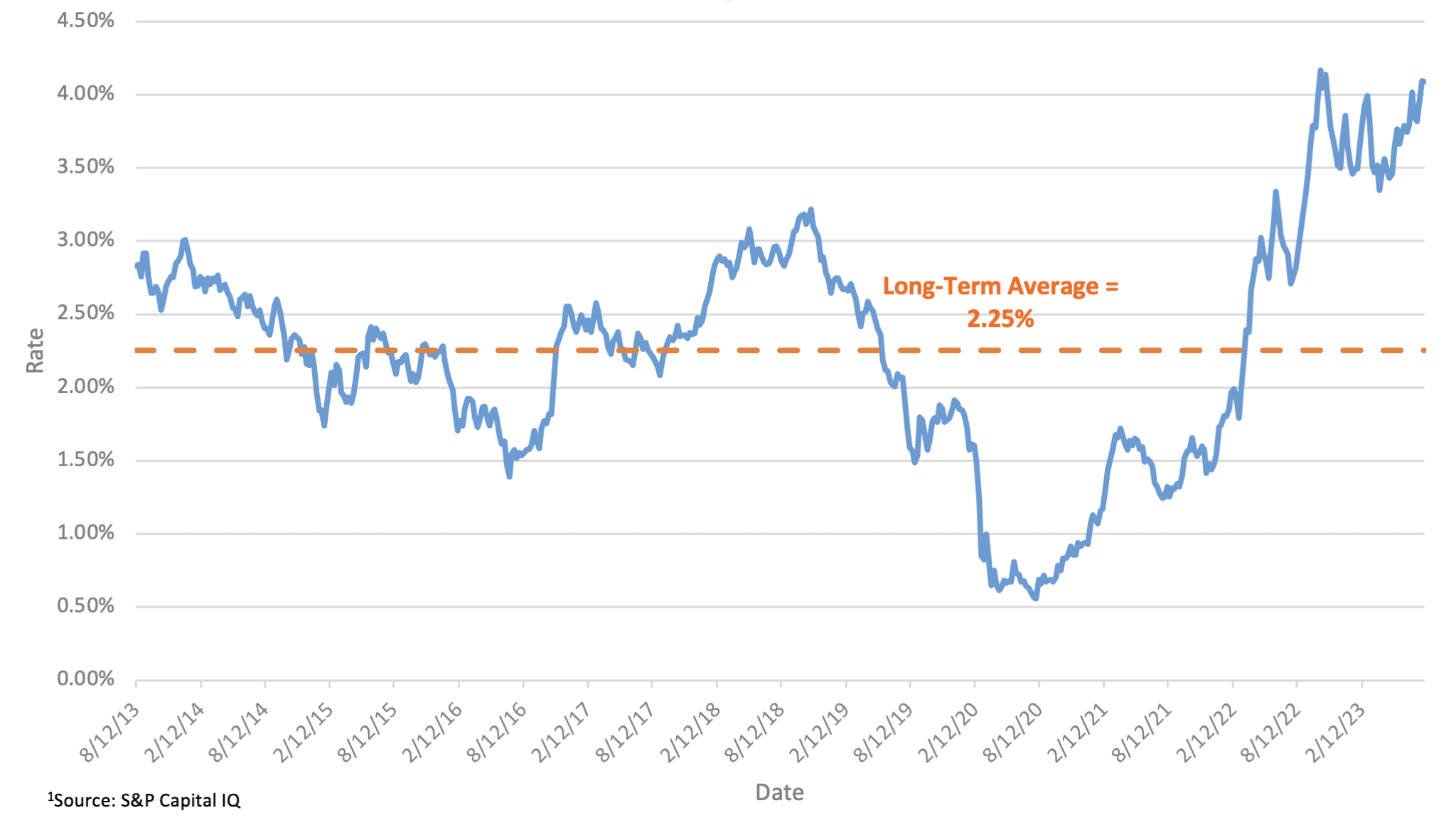

The figure below shows the historical movement of the US Treasury 10-year rate up to August 7, 2023. The rate has been above the long-term average of 2.25% since early 2022.

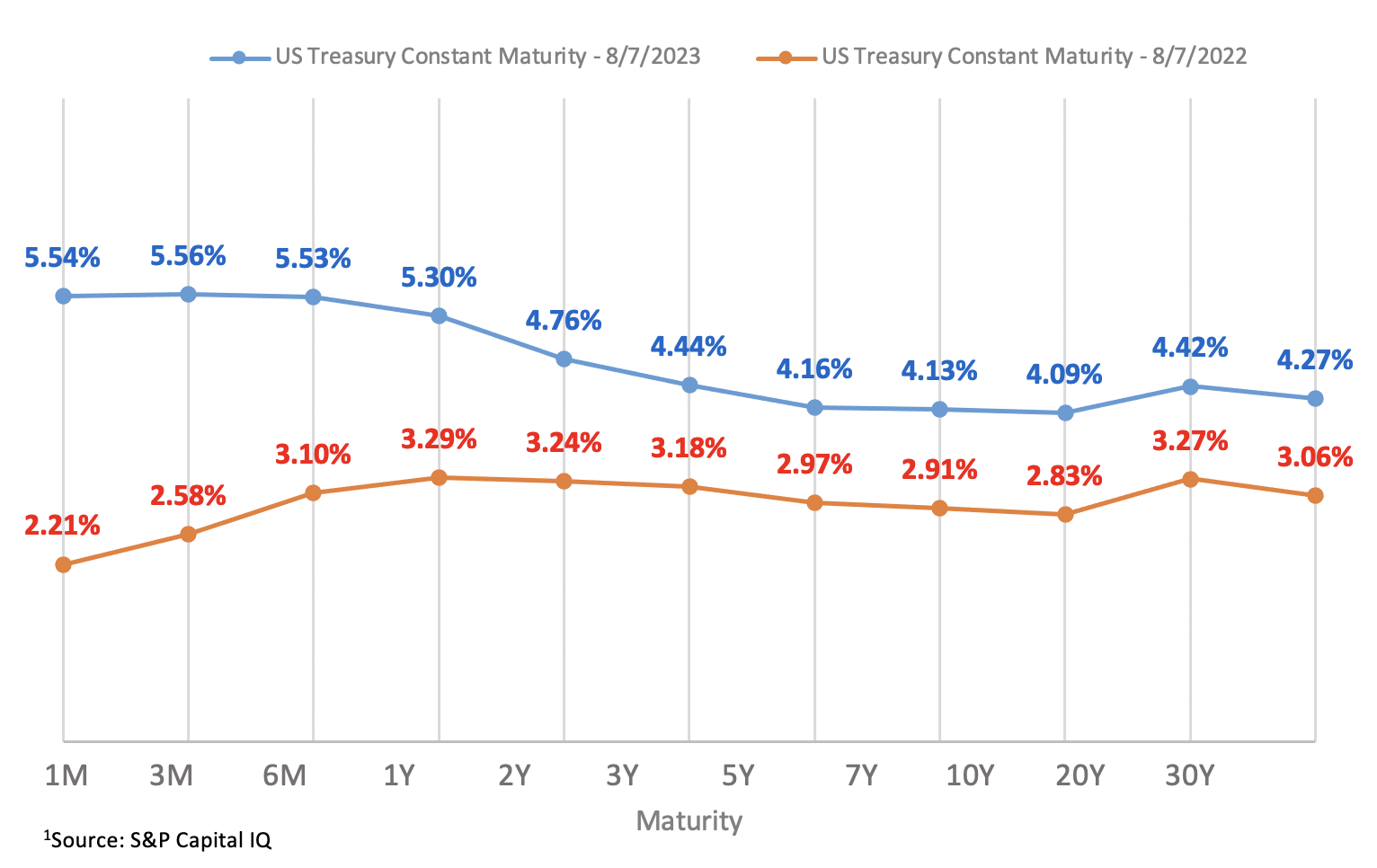

In fact, as shown below, the rates for all maturities have moved up over the last year. This gives strong evidence of the rates eventually reverting down toward their long-term average.

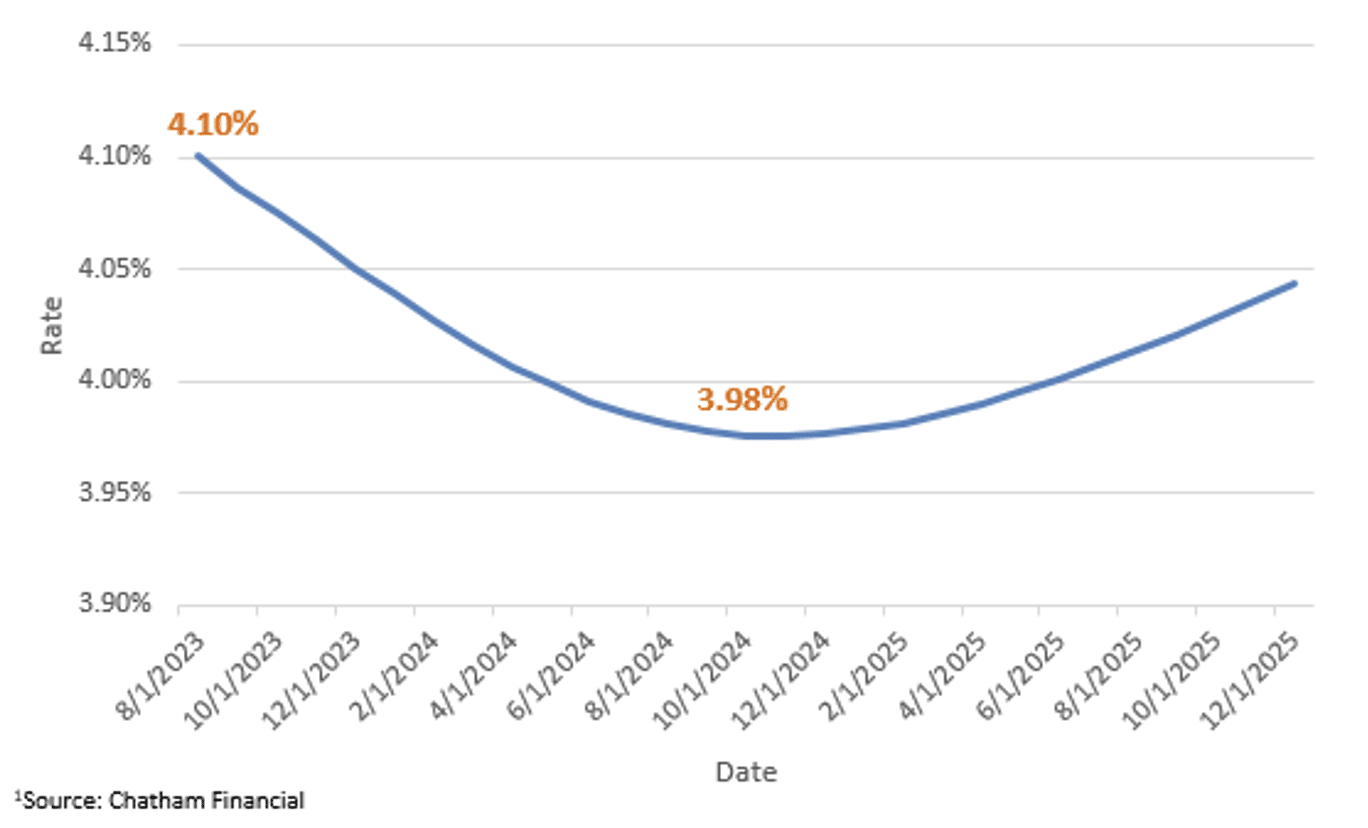

The next figure shows the 10-year US Treasury forward curve as of August 7, 2023. A forward rate is the expectation of what a rate will be in the future. The curve shows that the 10-year Treasury rate is expected to drop roughly 12 basis points over the next year. With this, borrowers will look for cheaper financing and prepayments are likely to increase.

Understanding Bond Valuation Models

A simple bond, or loan, is valued using a discounted cash flow (DCF) model. This model has four main inputs:

- Coupon rate

- Discount rate

- Principal amount

- Term

The model projects the dollar value of the cash flows (calculated as the coupon rate multiplied by the principal amount) according to the expected payment schedule (for example, a cash flow every six months for the remaining term). Using the discount rate, these cash flows are then discounted back to the present value to incorporate the risk of these cash flows.

Given that each cash flow has a different timing, the risk varies according to the prevailing interest rate at the time the cash flow occurs. As mentioned previously, the expectations around where the interest rates will be can be extracted from market data like forward curves or interest rate futures. So bonds can be valued without help from forecasting models.

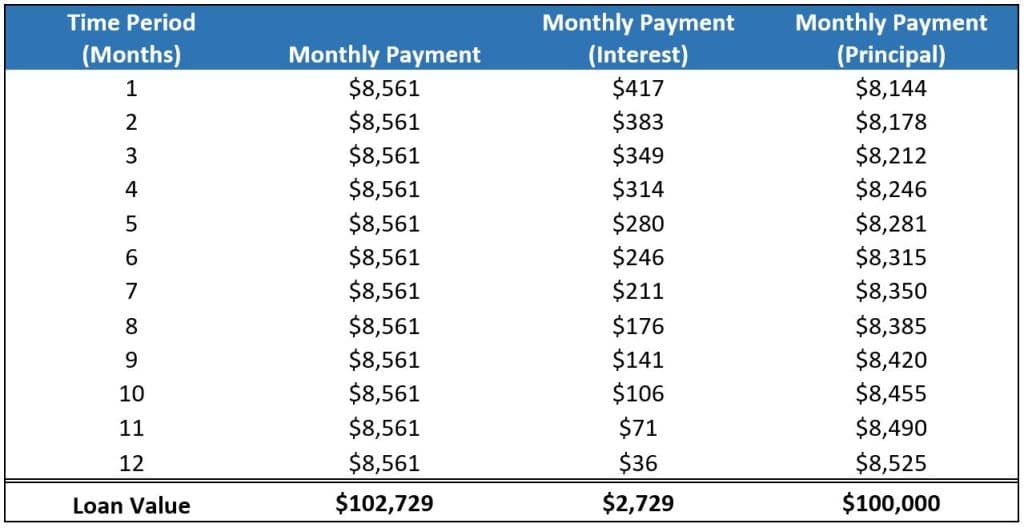

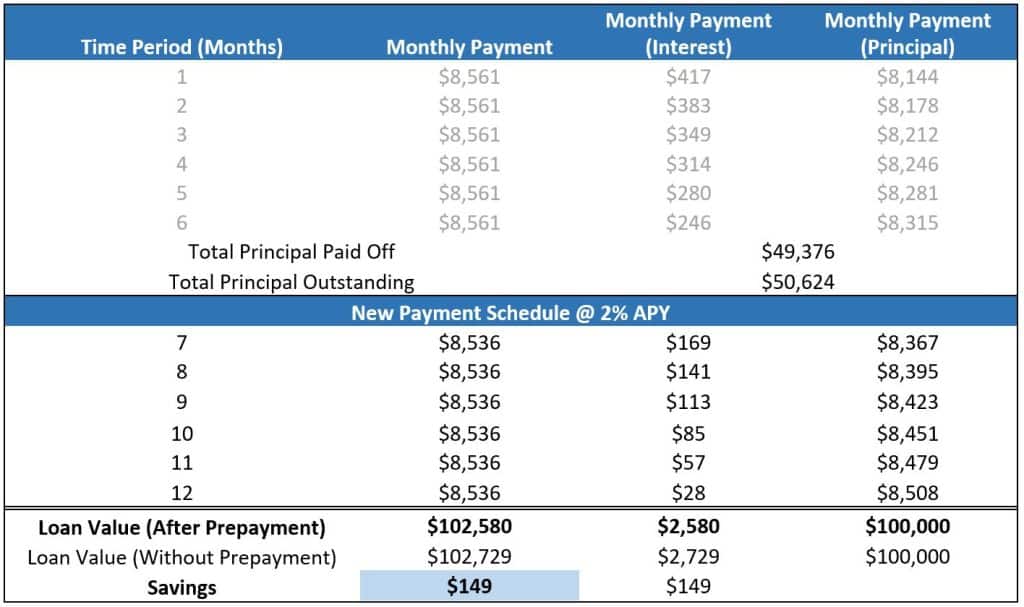

Here’s an example of the monthly payment schedule for a simple loan where the borrower pays a 5% annual percentage yield (APY) on a principal of $100,000 over one year.

Now, let’s say the borrower refinances at the six-month mark at a rate of 2% APY and there are no prepayment fees. The updated schedule for the remaining principal is as follows:

The borrower ends up saving $149 compared to the original payment schedule. This is an example of why borrowers have the incentive to refinance.

However, how do we predict if the rates would drop? This is where we can use models that forecast a range of interest rates similar to the way that the Black-Scholes model forecasts a range of stock prices. The key difference is that these interest rate models can be calibrated to the range of future rates and mean reversion of interest rates.[2]

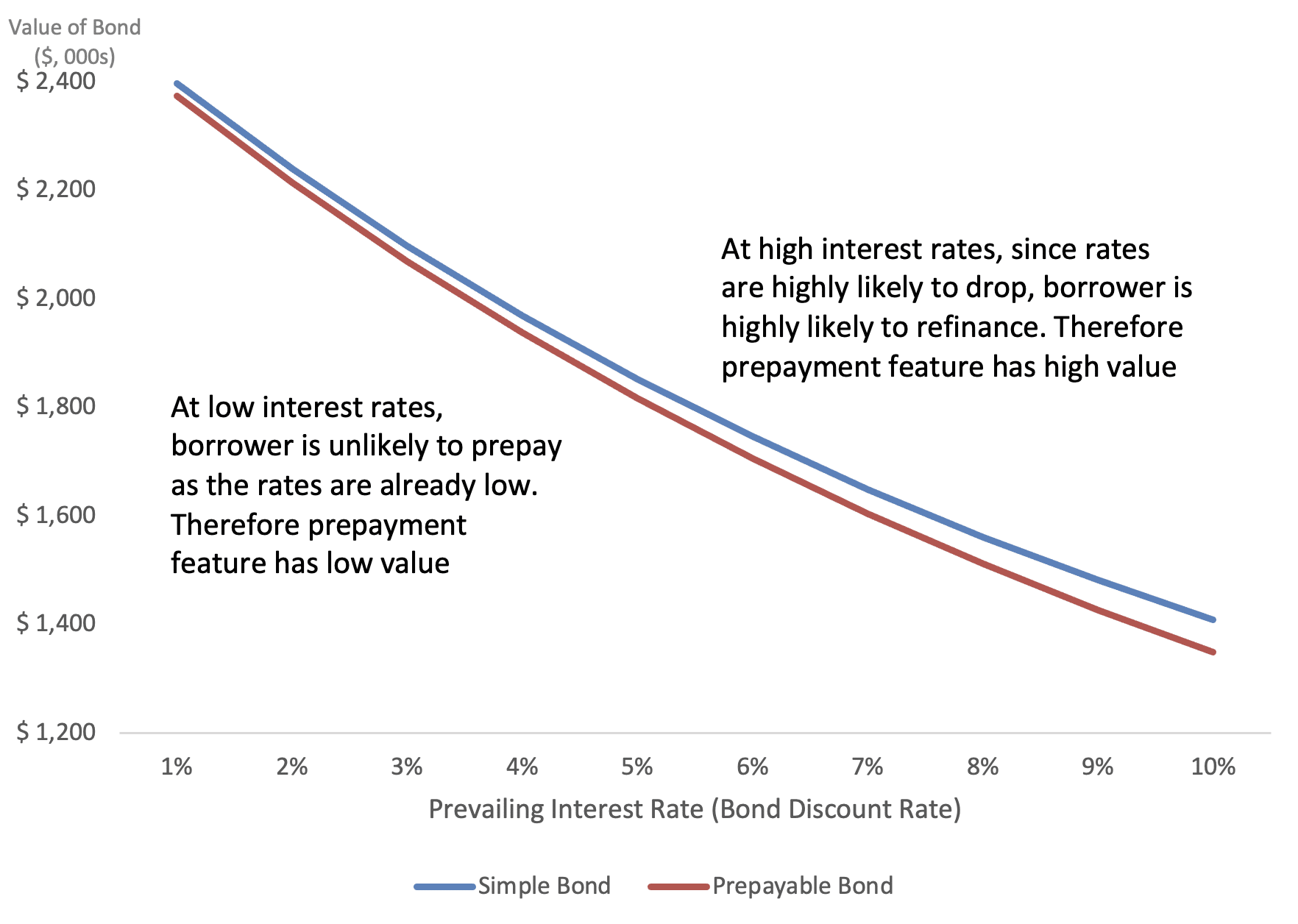

Interest rate models involve decision-making on the borrower’s part or the lender’s part, depending on how rates move, when the valuation can no longer be done using a plain DCF model. The valuation of the call feature for a bond is performed by subtracting the value of a callable bond from the value of a simple bond (without the call feature).

A Prepayment Option’s Value to Borrowers

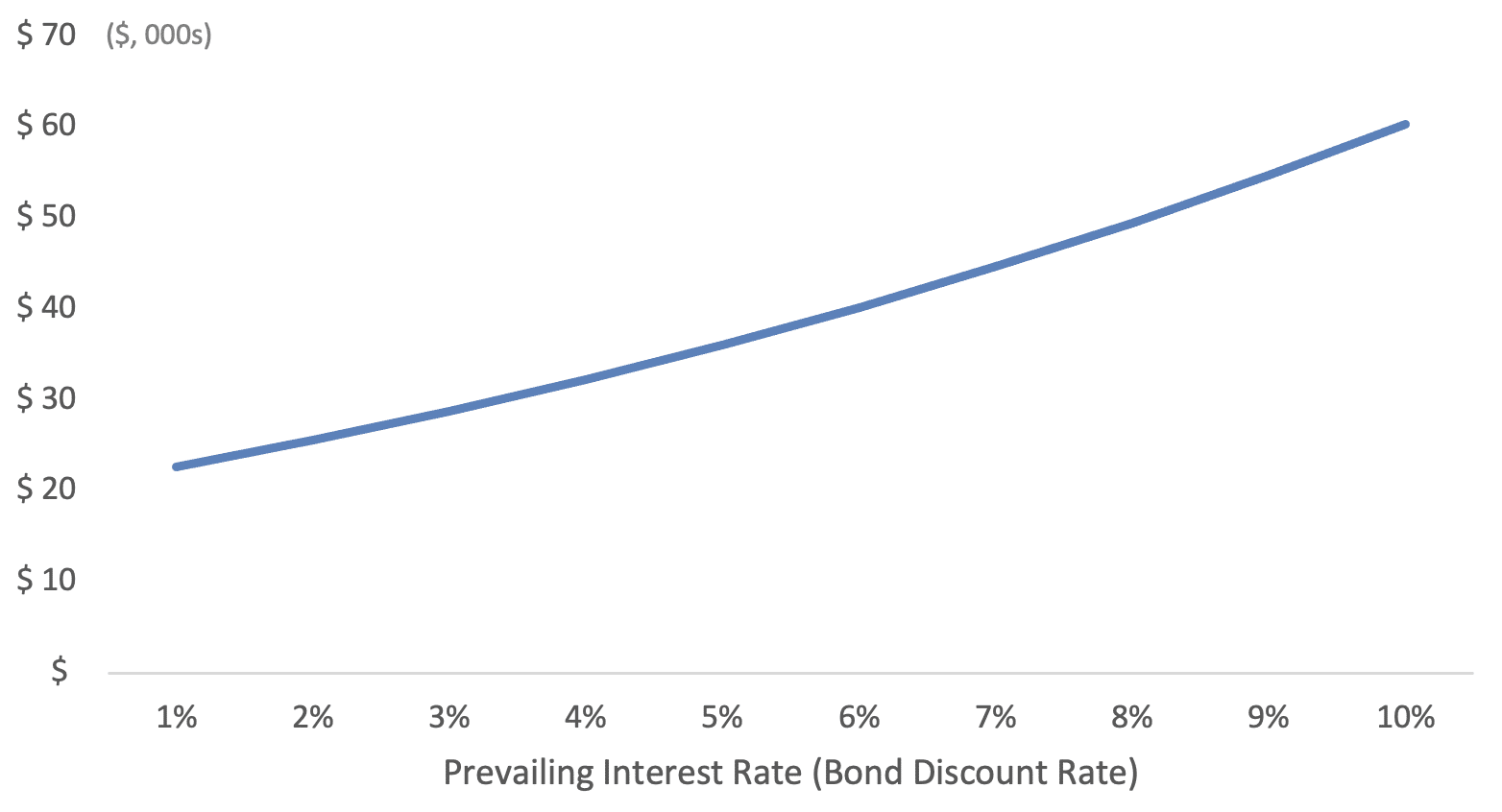

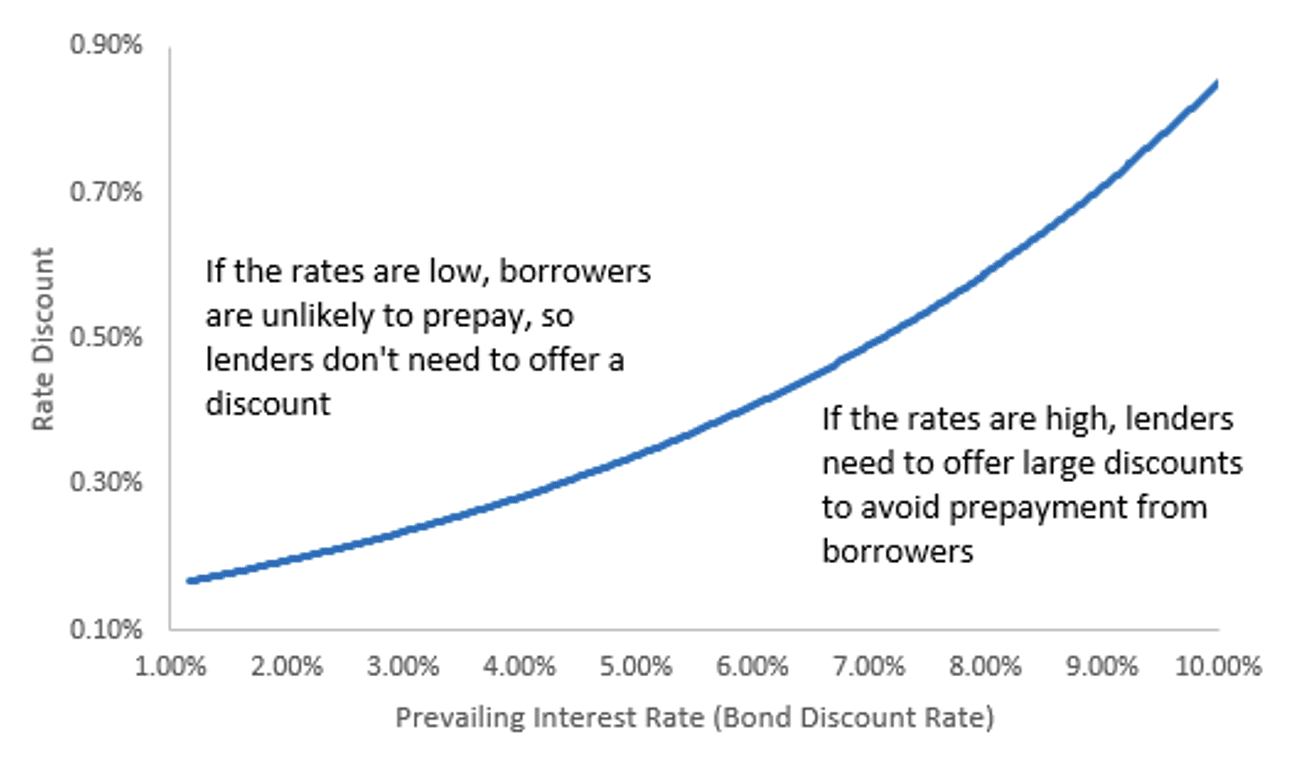

Seeing that a prepayment option could have some value, let’s look at how this option becomes more or less valuable as interest rates change. The charts below show how the value of a prepayment feature,[3] which is the difference between a prepayable bond and a non-prepayable bond, increases at higher interest rates. To avoid the risk of prepayment, lenders often issue the bond at a discounted coupon. The value of this new bond (with the lower coupon) is the same as the value of a prepayable bond with a higher coupon.

Figure 7 shows the difference between the value of the simple and prepayable bond curves in Figure 6. The chart below shows what this discount would look like. At higher rates, since the borrower would have a higher propensity to prepay, the lender has to offer to take a lower coupon (i.e., a higher discount on the original coupon) from the borrower so the borrower can give up the right to prepay the loan.

Of course, this is a single example and each company’s situation will vary. Factors include:

- Market interest rates and forward rates

- The company’s borrowing rate

- Interest rate volatility

- The term of the bond

- Whether the company expects that events may improve their credit rating, which could allow for a favorable refinance

As a result, companies should carefully consider these features in a high-rate environment.

Wrap-Up

As long as interest rates remain elevated, prepayment features will have some value. If you’ve issued or borrowed any debt that’s prepayable, be sure to talk to your accounting team to see if you need to recognize the prepayment feature as an embedded derivative. If you’re considering issuing prepayable debt, we can help you with the fair value calculations using our customized valuation models.

[1] Mean here refers to the statistical average and is not a quality judgement on the interest rate’s interaction with other financial inputs.

[2] The frequently used Black Derman Toy (BDT) model was one of the first no-arbitrage models for the term structure of interest rates. This class of models can be calibrated to fit the term structure of interest rates that are observable in the market. The BDT model can easily be represented using a binomial tree, which makes it similar to using a lattice model for stock options. Once the interest rate tree is built, a prepayment option is implemented using an exercise decision rule at each node—is there more value in prepaying the issuer, or waiting and making payments in the future as per the scheduled payments?

[3] We analyzed the value of a prepayable bond with the following terms:

- Principal amount of $1 million

- Maturity of 10 years

- Fixed coupon paid semi-annually (5%)

- Interest rate volatility of 5%

- Interest rate mean reversion factor of 1.5%

- Prepayment option is exercised at any node if expected value of payments is less than $1 million

Of course, our calculations are based on our sample bond and different assumptions will change the exact numbers. For example, borrower quality, forward structure of rates, term, and whether Mercury is in retrograde may all have significant impacts on the numbers, but the general results should hold.