Human Capital Management: Deciding What to Disclose in the 10-K

Back in November, we unpacked the new 101(c) standard for human capital disclosure that’s part of the SEC’s recent Regulation S-K modernization effort. We also looked at three companies that already have adopted the standard in their 10-K filings. In this third and final article of the series, I’d like to share five principles to consider when deciding how to structure your own disclosure.

1. What delivers good faith compliance with the rule as it’s written?

As a principles-based standard, this new human capital disclosure doesn’t contain bright lines. For example, Dolby arguably well surpasses the disclosure threshold even though they disclose less than Starbucks and much less than Visa. It wouldn’t be appropriate for an investor to claim harm on the basis of one company disclosing less than its peers. Why? Because business judgment permits wide latitude in the factors each company deems important in light of their unique organizational context and stage of life. But this yardstick will be a moving target as time passes and norms form, making it critical to reassess the disclosure every year.

Nevertheless, as we note below, there may be strategic reasons to disclose more than the minimum. When human capital is an area of excellence, devoting additional disclosure energy could have positive signaling relative to peers. Alternatively, extra disclosure may address critical investor feedback received during outreach sessions. In any event, we recommend carefully targeting where you want to be on the disclosure continuum, taking into consideration your specific human capital strategy and investor expectations for information.

2. What are the most important aspects of your human capital strategy?

The breadth of human capital topics is incredibly wide, spanning health and safety, turnover, diversity and inclusion, corporate culture, and employee engagement. For some companies, every category should be covered in some dimension whereas for others a more focused approach makes sense.

Start with this simple question: What metrics are most essential to your overall strategy for achieving competitive advantage in the market? An energy company, for example, is trying to create a safe environment for employees in order to avoid public relations problems externally and hiring, retention, and litigation problems internally. In contrast, a high-tech firm is most likely struggling to recruit enough top talent and retain that talent as they gain experience. Creating a diverse and inclusive environment addresses challenges at both the top and middle of the funnel.

In short, management and the board need to align on the specific human capital measures that most accurately capture the health of the business.

3. What metrics are investors and analysts asking about during outreach sessions?

Our experience is that investors are still deciding which metrics to care about most. Additionally, investors do not necessarily hold matching views on human capital management topics. For example, Arjuna Capital has been vocal about the need to track median unadjusted pay, not just equal pay for equal work. In contrast, many investors view equal pay for equal work as the gold standard for measuring pay equity and alternative metrics related to unadjusted pay differences as pertinent to representation, diversity, and inclusion.

Standard-setters and other non-governmental organization (NGO) bodies are emerging with opinions on metrics and reporting. Most consider the Sustainability Accounting Standards Board (SASB) to be leading the way in presenting a holistic framework on ESG metrics and disclosure. SASB provides industry-specific reports that are worth studying since investors are likely to base their questions off these types of resources.

SASB’s reports are helpful, but arguably more of a starting point than an ending point. Suppose you want to know their metrics for the software and IT services industry. By following their download process, you obtain a 32-page document with a variety of tracking metrics. The metrics, however, are vague. Examples include “employee engagement as a percentage” and “percentage of employees that are (1) foreign nationals and (2) located offshore.”

Therefore, listen closely to what your investors are saying, be ready for some conflicting requests, and know what standard-setters like SASB are thinking for your industry. But be quick to offer your own perspective and not cede control over the narrative. By and large, external parties are looking for organizations to take a step forward and articulate which metrics matter the most to them and why.

4. What metrics should you track?

We help companies track all sorts of metrics and believe this may be the most important practical question. The way to answer it is to break it down into three sub-questions. All of them matter greatly.

- What metrics are you tracking and understand in terms of how they move and what factors they’re sensitive to? It takes a few years to get comfortable with a metric and how it ebbs and flows in response to business activity. Such a metric may be ready for public disclosure.

- What metrics have you only begun tracking and must monitor further? These newer metrics tend to be more advanced (e.g., promotion velocity) and more nuanced than the more common and simpler measures. But this also means you need experience watching them move and asking questions about how they bend and flex.

- What metrics have you not begun tracking or studying but consider relevant? These will tend to be analytics and explanatory insights that fill in knowledge gaps (e.g., explanatory metrics as to why employees from underrepresented groups dwindle at higher levels once they reach band four in the organization). These metrics are typically conceived as a result of questions and conversations that arise concerning the core metrics being produced.

In short, before you can disclose a particular metric, you need to get comfortable with it—and that doesn’t happen overnight.

5. Where do you expect to see disclosure from your strongest peers?

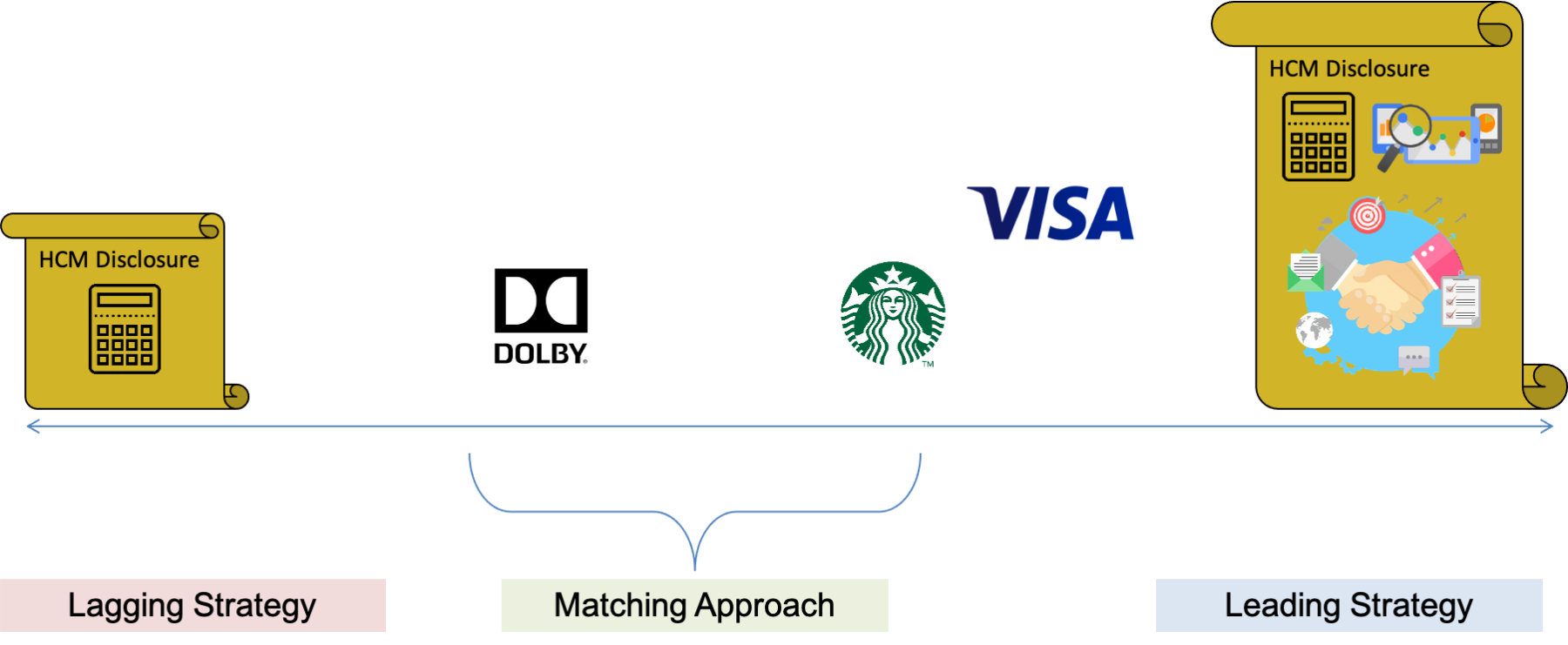

Picture a spectrum of disclosure that goes from virtually nonexistent to extensive. You might expect peers to be at the 40% mark. This implies you have a strategy that either matches theirs, lags by a negligible amount, or leads by a negligible amount. For example, here’s how we think the disclosures from the three companies we looked at in the last article might fall along the continuum.

This of course assumes you have an idea of where your peers will shake out, perhaps based on previous fiscal years. (Our assumption for Dolby, Starbucks and Visa is speculative since most of their peers haven’t yet provided their own disclosures under the new rule.)

Even if all you have is game theory, it’s possible to guess and we think the best guess is at this “slightly below median” level. Since the specific disclosure items vary by firm and context, our prediction is necessarily qualitative. We think “slightly below median” means less than Visa and Starbucks, but more than Dolby—a couple of tangible, quantitative metrics to go with some qualitative, aspirational language.

There are three potential strategies. Matching is the obvious one. A lagging strategy reduces commitment to specific disclosures (which, of course, can still appear in the proxy or CSR report) while demonstrating you’re in the game and not placing materially different weight on human capital matters. A leading strategy represents a bet that you not only are holding a good hand, but also that investors will reward you now and in the future for signaling this way about your situation.

In our opinion, now is the key time to cast the net wide in terms of metrics tracked and reviewed by management. We’ve published extensively on both pay equity and diversity and inclusion (nowadays often combined in the acronym DEI for diversity, equity, and inclusion). The various metrics within this topic area, not to mention other areas of human capital (e.g., safety, wellness, benefits, etc.) are diverse and assumption-laden. By initiating tracking now, you’ll gain time to evaluate and refine metrics, preparing for potential disclosure one or more years into the future.

With human capital disclosures, the balancing act is non-trivial. What metrics mean the most to your organization? What are peers disclosing? Are there consistent requests coming from investors? Can you reliably and consistently produce the metrics of greatest interest? And overshadowing all this is the question of what the new SEC commissioner and administration will push for in 2021 and beyond.