Impact of ASU 2023-07 on Segment Reporting for Equity Compensation

In November, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update 2023-07 (ASU 2023-07) to enhance the disclosures for a public entity’s reportable segments.

ASU 2023-07 represents a significant shift in the reporting requirements under ASC 280, Segment Reporting. Segment reporting helps investors understand an entity’s future cash flows and growth prospects. But prior to ASU 2023-07, disclosures about reportable segments were too general for investors to know what was driving segment-level performance or draw meaningful comparisons across entities.

We know from the FASB’s investor outreach that users of financial statements are looking for more insight into company cost structures, particularly costs related to human capital. ASU 2023-07 will shine a brighter light on those costs while prompting more companies to track their stock-based compensation (SBC) expense in greater detail. To understand why, let’s look at what ASU 2023-07 entails and its likely effect on SBC reporting.

Key Provisions of ASU 2023-07

ASU 2023-07 is largely principles-based, meaning it doesn’t mandate any specific costs to be disclosed. However, the framework for identifying relevant expenses is important to understand. Here are the main provisions.

Significant segment expenses. ASU 2023-07 changes the definition and disclosure requirement for “significant segment expenses.” These are expenses that are regularly provided to the chief operating decision maker (CODM) and included within each reported measure of segment profit or loss. If an entity doesn’t have any distinct expenses that meet this principle, it must disclose the nature of the expense information used by the CODM to manage the segment’s operations.

Disclosure requirements. The ASU extends certain annual disclosures to interim periods. It also clarifies that entities with a single reportable segment must apply ASC 280 in its entirety, ensuring consistency in reporting across entities with multiple segments and those with a single segment.

Determining significance of segment items. The ASU emphasizes the importance of considering both qualitative and quantitative factors in determining the significance of segment items. This includes assessing the importance of the segment to the overall operations of the entity, the size and importance of the expense item to the segment’s results, and other relevant factors.

Easily computable segment expenses. In addition to disclosing segment expenses that are “regularly provided” to the CODM, the requirement encompasses expenses that are “easily computable from information that is regularly provided.” This means that if ratios or expenses as a percentage of revenue are provided to the CODM, then these need to be translated into the original expense amounts and disclosed.

Effective dates and transition. The amendments in ASU 2023-07 are effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. Early adoption is permitted. Entities are required to apply the new disclosure guidance retrospectively unless it’s impracticable to do so.

Anticipated Effect on SBC Reporting

Stock-based compensation is a considerable expense for many companies and their segments. It also signals something about the way companies compensate employees, and the types of employees they attract and retain. Further, this is a prime area where investors can make cross-company comparisons.

Compensation strategy transparency. Under ASU 2023-07, companies must disclose SBC as a separate line item for each reportable segment if they regularly provide it to the CODM. This requirement unveils the extent to which different segments of a company rely on SBC to attract and retain talent, which helps investors understand its impact on cash flow and profitability better while gauging the sustainability of a segment’s or the overall company’s compensation practices.

Company and segment comparability. Companies rely on survey data, benchmarking from proxy advisors like ISS, and prior practice to set compensation levels. But the process is often more art than science, making it hard for investors to assess what’s too much (or even too little) dilution. Investors aren’t the only ones struggling here; CFOs and boards are also hungry for better data.

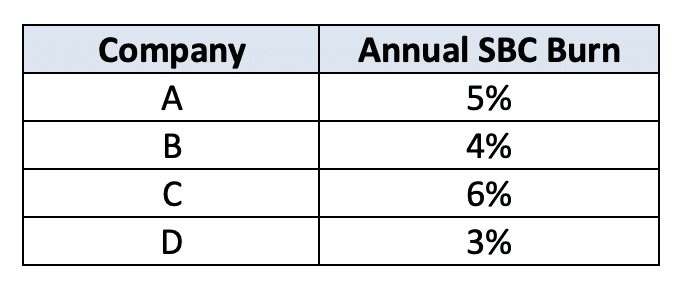

Segment-level data helps because it enables more informed benchmarking. Imagine an industry with four companies where company A benchmarks itself to companies B, C, and D.

Company A seems to be reasonably well-calibrated if not slightly high in its SBC utilization (the peer average is 4.3%). But what if Company A contains a high-growth segment that only Company C has, and what if Company D’s comparable segments to Company A are significantly smaller? This finer level of detail offers companies and investors further insight about the reasonability and sustainability of compensation practices.

Undisclosed compensation expense. ASU 2023-07 requires companies to disclose expenses that are regularly provided to the CODM. What if employee compensation, or SBC for that matter, isn’t one of those expenses? That may indicate segment management isn’t monitoring it closely enough. Another plausible explanation is that SBC isn’t heavily relied upon in that segment. Either way, we think investors and finance leaders will glean useful information regardless of whether compensation is specifically disclosed as a result of ASU 2023-07.

Financial reporting. Implementing ASU 2023-07 has its challenges. Chief among them is determining the significance of segment expenses and reperforming prior period calculations to gather detail that wasn’t available at the time but is reasonably obtainable (as required by the rule).

In theory, this shouldn’t be too onerous since the gating condition in determining a disclosable expense is one that is already being tracked internally. But internal tracking and analysis should always be more granular than anything being reported externally because it allows for more rigorous forecasting, variance analysis, and planning. Most of our clients already analyze SBC at the cost center level for these very reasons. The requirement to report segment-level expense data may motivate other companies to do the same if they’re not already.

Wrap-Up

Investors have been clamoring for more granular financial statement data in order to enhance business valuations and inform investment decisions, and ASU 2023-07 provides that in an area historically considered opaque. Analysts can now delve deeper into the financial health of each segment to understand not just the revenue being generated but the associated costs as well.

Meanwhile, companies will benefit from better benchmarking data across numerous expense categories, including SBC. Benchmarking the target of annual equity burn rates is difficult, and many companies struggle to determine whether they’re granting the right amount of stock. Expanded disclosure under ASU 2023-07 should help companies tighten their analyses.

Ultimately, ASU 2023-07 is one step forward in a broader push toward more detailed expense disclosures, wherein employee compensation is one area where more granularity is needed. Investments in agile, flexible, and precise SBC reporting processes are more important than ever.