Issuing Equity Abroad: Top Tax Challenges of International Subsidiaries

Recently, Equity Methods visited the UK offices of some of our clients, hoping to tackle the following question:

What challenges do international subsidiaries of US-listed companies face that might elude their counterparts in the US?

Here’s what they told us:

- Proving local tax deductions to the tax authorities.

- IFRS statutory reporting—in particular, tracking and proving deferred tax assets in local financial statements.

- And, with regard to both proving tax deductions and performing IFRS statutory reporting, appropriately handling employee mobility and reflecting its treatment clearly.

If you’re on the corporate accounting team of a US-listed multinational company, and you issue equity internationally, this is what your colleagues abroad are dealing with.

Why do you need to know this? For one thing, problems abroad could spell missed tax deductions and/or tax penalties, so there are real cash implications. For another, your international counterparts don’t have the data access you do, which means their hands are tied when it comes to solving problems on their own.

The US parent office has an important leadership role in getting in front of these challenges. The perspectives we’re about to share can help you take on that role and enable tighter collaboration across global controllership teams. (We’ll focus on UK subsidiaries, but the same ideas apply to other countries.)

Capturing Local Deductions

US-listed companies typically have dozens of legal entities that are registered in the different countries in which they operate. These legal entities are responsible for paying taxes locally based on the income they generate that is allocable to their local operations. As a result, their tax teams are constantly working to identify and then justify tax deductions based on local tax law.

In the UK, Part 12 of the Corporation Tax Act (CTA) of 2009 generally governs the deductibility of share-based payment awards. The rules are similar to those in the US, linking the tax deduction to the intrinsic value when the award is settled. Finance Bill 2013 amended the CTA to include a new Section 1038A by clarifying that the taxable event is not the recognition of book financial expense. Instead, it’s the actual settlement of the underlying instrument.

Leaving aside for a moment the topic of mobility, reporting and analytics are needed to capture settlements in the period in which they occur and at their intrinsic value. Most companies have dozens (or more) legal entities, so the reports must show settlement activity at the entity and person levels. Legal entity changes (the addition of new entities or the collapse of existing ones) need to be incorporated.

Employee mobility complicates this process. Finance Bill 2014 amended the CTA, clarifying how mobile employees should be treated in the course of filing for tax deductions. Prior guidance could be construed to preclude taking deductions for employees who were not in the UK either at grant or at settlement. The new guidance introduces a basic pro-ration framework, in which the portion of time spent in the UK between grant and vest governs the deduction calculation. These rules will apply to awards settling after April 5, 2015.

Our understanding is that before Finance Bill 2014, companies maintained policies stipulating a full tax deduction if the employee resided in the UK at grant or at settlement. The new guidance harmonizes deduction treatment with other areas of earnings. However, more elaborate processes are needed in order to track employee mobility and justify the pro-rations. UK tax teams often lack even the data to perform these calculations, because they can’t get into the company’s stock administration or HRIS system. At best, they might have access to local payroll data.

Let’s look at an example involving a US employee, Sally, who started an assignment in the UK on January 1, 2014.

- Sally holds 100 stock options issued on January 1, 2013 at a strike price of $50, grant-date fair value of $10, and a two-year vesting period.

- Upon completion of vesting on December 31, 2015, Sally decides to exercise 25 stock options while still residing in the UK; on the date of exercise, the stock price is $70.

- Sally exercises the remaining 75 options after returning to the US when the stock price is at $80.

Overall, the gross tax deduction/relief is $2,750 (25*($70-$50) + 75*($80-$50)), in which about 50% of the deduction should be attributed to the UK subsidiary based on Sally’s time spent in the UK. To ensure proper calculation of the tax deduction, it’s essential to track both employee transfer dates and settlement locations throughout the life of an award.

Even though prorating the tax deduction is a broadly prevalent practice in most countries, there are some countries in which the local tax laws allow either no deduction or a full deduction. For this reason, it’s important to have an up-to-date matrix of how each jurisdiction treats deductibility, including when there is employee mobility.

Key takeaway:

Tax teams in local subsidiaries will likely need support from their US counterparts to fully capture local tax deductions, especially when there’s employee mobility. Granular and comprehensive data access is needed so that you can look at the full vesting life of an award when determining how to prorate the deduction.

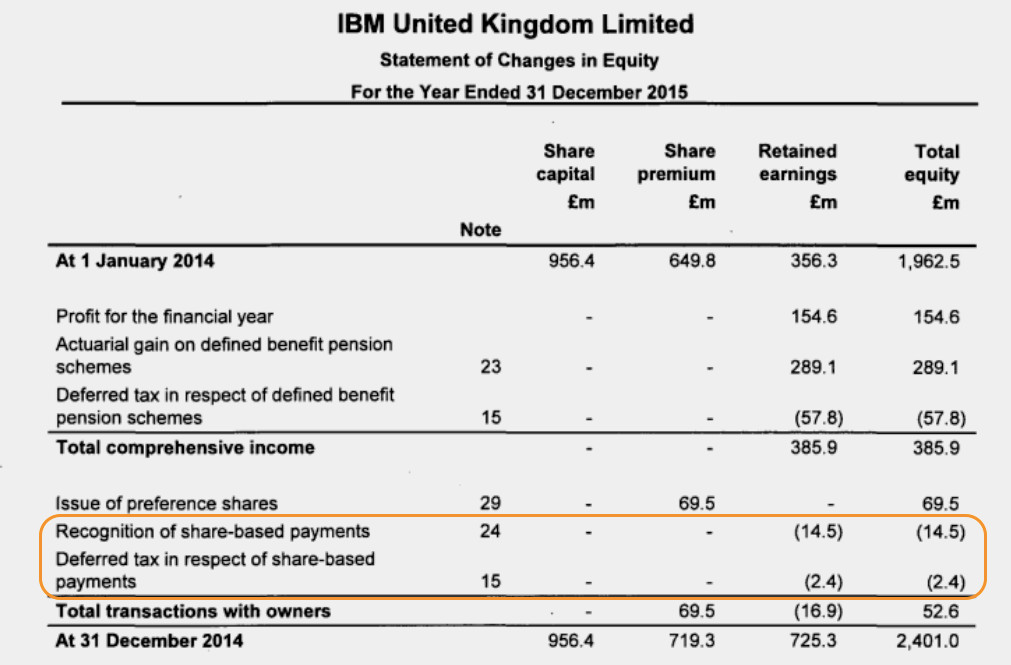

IFRS 2 Statutory Reporting and Deferred Taxes

Most US-listed organizations are familiar with the basic differences between ASC 718 and IFRS 2—namely, how IFRS 2 prohibits straight-line amortization. But the tax and disclosure rules have a much bigger deconvergence.

Local financial statements filed under IFRS 2 require that share-based payment awards be recognized in the income statement and for book-tax temporary differences to be recorded in the balance sheet (as deferred tax assets or liabilities). The IFRS deferred tax model for share-based payment awards requires setting up a deferred tax asset (DTA) based on the then-current intrinsic value, and adjusting that DTA on an intrinsic value basis through settlement. Changes in the DTA flow through income. Dips in value are offset against prior gains, but only on an award level.

This is drastically different from the US GAAP model, even after its revision under ASU 2016-09. Under US GAAP, for equity awards, a DTA is set up at grant and not subsequently adjusted. Only at settlement is the DTA compared to the tax-effected intrinsic value and that differential recorded in earnings. In short, it takes more work for IFRS 2 statutory financial reporting to handle the marking-to-market of the DTA and correctly determine gains and losses to the P&L.

Employee mobility complicates matters. The DTA is essentially an estimate of the actual deduction that is triggered at settlement. Therefore, mobility should be handled for IFRS 2 tax accounting in a manner consistent with how it’s handled when computing actual deductions. If you apply pro-ration to an actual settlement on an award issued to a mobile employee, you also should pro-rate the DTA in lockstep when an employee transfers jurisdictions.

Key takeaway:

DTA calculations under IFRS differ considerably in relation to US GAAP. Employee mobility introduces additional complexity, requiring local subsidiaries to know up-to-date employee location information.

IFRS 2 Statutory Reporting and Disclosure

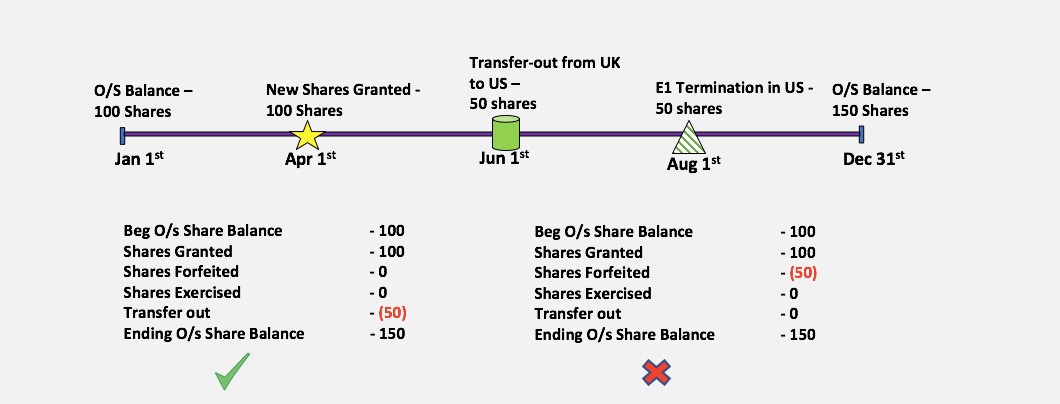

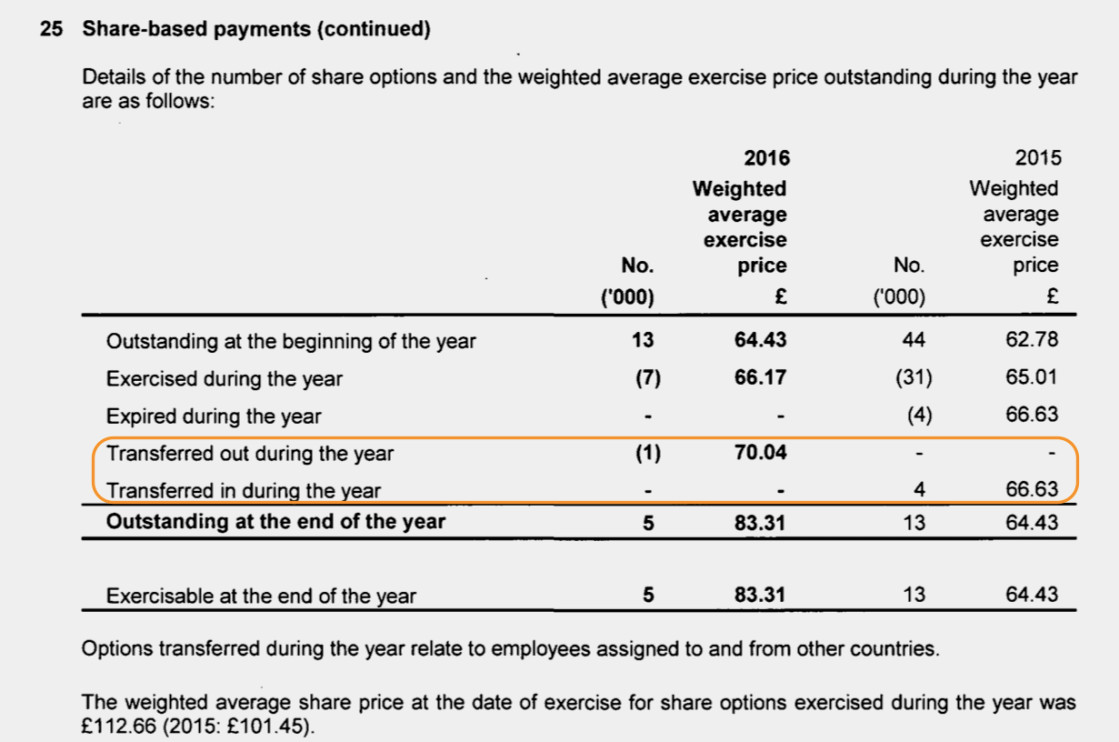

Besides recognizing expense and DTAs, foreign subsidiaries subject to IFRS must file disclosure reports for outstanding awards. As you might expect, mobile employees complicate the reporting as the disclosures must break out the awards transferred in from the awards transferred out.

Companies usually assume that employee mobility drives any roll forward variance in the share count table. Therefore they use the “transfer in, transfer out” line item as a plug to reconcile the difference. This assumption may work in simple cases, but the correct approach is to directly calculate transfers in and out using granular employee and location data.

To illustrate how IFRS disclosure reports can be misstated, consider a local UK subsidiary of company B that has four employees, each with 25 shares outstanding on January 1. On April 1, each employee receives another 25 shares. One of the employees transfers to the US in June, then leaves the firm in August. Here, failing to consider the transfer date would result in overstatement of forfeiture activities in the UK’s disclosure report while also understating the transfer out balance.

Another complication is different subsidiaries having varying fiscal years relative to the parent and to each other. Again, the problem is that most subsidiaries are shut out of the corporate database, making them dependent on the US parent for supplementary indicative data.

Key takeaway:

IFRS statutory filings require accurate share disclosures and roll-forward tables. This depends on tracking two things: employee mobility plus transfers in and transfers out of the subsidiary.

Case Study: Tracking a DTA

Consider a simple case of an employee who received an award in the US before moving to the UK.

- John Doe received 300 restricted stock units (RSUs) on January 1, 2013. The RSUs cliff-vest after three years on December 31, 2016. The award was issued at a market price of $100.

- John received the award in the US and moved to the UK at the end of year one.

- The award vests at the end of year three while John is still in the UK. At vest, the stock price is $150.

- Statutory tax rates are 35% and 20% for the US and UK, respectively.

At the end of year three, the DTA accrued in the UK subsidiary for the last two years should be equal to two-thirds of the total number of RSUs, valued at the intrinsic value on the vest date. This would be $6,000 (2/3*300*150*0.2).

In contrast, the US GAAP DTA shown in the consolidated financial statements will reflect the ASC 740 construct applied to share-based payment awards. It will also encompass all RSUs awarded, though DTAs are of course not set up on grants issued in jurisdictions that do not permit deductions.

Standard reporting systems struggle with recognizing the hybrid calculation that’s required to compute the correct DTA balances at both an entity and local statutory level. An especially big challenge is the need to prorate DTA balances as mobility occurs, and then ensure that accurate reversals are made at the time of settlement.

Wrapping It Up

Tax accounting for international employees is complicated. It will only get more so in the years ahead, as employee mobility is on the rise and financial and tax auditors abroad are becoming more scrupulous. At the same time, subsidiaries suffer from a “we don’t know what we don’t know” problem with regard to available data and reporting practices.

To address this challenge, we suggest US parent entities (and their consultants) talk to their international subsidiaries about how they might improve IFRS 2 reporting and the way they support local tax deductions. The UK subsidiary is a good place to start, if only because many multinational US-listed entities grant material equity in the UK and/or run their broader European accounting out of England.

We can take over from there, and work with all parties concerned to reach an effective solution. We’re in an ideal position to help, as we’ve become familiar with the different data challenges and how to design separate processes for each internal constituency’s reporting needs.

Don’t miss another topic! Get insights about HR advisory, financial reporting, and valuation directly via email:

subscribe