It’s Time to Adopt an SEC-Compliant Clawback Policy. Here’s How to Get Started.

On April 24, the SEC stated they would hold off until June 11 before deciding whether to approve the listing standards that the New York Stock Exchange and Nasdaq submitted on the Dodd-Frank clawback rule. This led most to conclude the SEC would approve the standards on June 11 (or shortly before or after since the 11th was a Sunday), thus triggering a 60-day clock until companies must adopt a compliant clawback policy.

As a pleasant surprise, both the NYSE and Nasdaq released rule amendments that are slated to become effective on October 2, 2023. That positions the 60-day clock to end on December 1, 2023, marking the date in which companies must adopt and follow a compliant clawback policy.

The main benefit of this slight deferral is that companies won’t need to call special off-cycle compensation committee meetings to squeeze in a rushed approval prior to the originally planned August go-live date.

Otherwise, the readiness next steps are the same, which we cover in this article. We focus on three important execution steps: educating key stakeholders, updating (and creating new) policies, and documenting a playbook of actions to take in the event a clawback is required.

1. Educating Stakeholders

Clawbacks will touch many pockets of the organization. Our clients are assembling cross-functional project teams to ensure the right departments are plugged in to how the rule will impact them and where action will be necessary.

Compensation Committee

The compensation committee will need to approve the newly drafted policies. With the deferral of the go-live date to December 1, 2023, compensation committees won’t need to call special meetings, but they will need to devote considerable agenda time to getting comfortable with the policy choices and alternatives.

The clawback rules are incredibly complex and compensation committees will benefit from having as much time as possible to ask questions, understand what decisions need to be made, and iterate to arrive at a final policy.

Finance

We’re often asked who decides whether a financial problem gets classified as a Big-R or little-r restatement, or whether the error can be relegated to an out-of-period adjustment. The short answer is that the audit committee, finance leadership, and external audit firm jointly make this decision. These are sensitive decisions that are closely scrutinized by the PCAOB and SEC in their assessments of audit quality.

We suggest advising the CFO and finance leadership of how restatements will tie into the newly created clawback procedures. In particular, if an event study needs to be performed for purposes of calculating the recoupment amount on awards with a stock price or total shareholder return (TSR) metric, then finance will be intimately involved with the economic consultant performing the event study.

Legal

Legal is likely to be the quarterback of the clawback preparation process, working closely with external counsel to draft new policies and adjust any existing voluntary clawbacks. In addition to these activities, legal will also need to redraft severance and employment agreements to support the efficient enforcement of clawbacks, especially with terminated employees who have less skin in the game and may be more prone to obstructionism.

HR

The head of total rewards and executive compensation will be intimately involved in all steps given the compensation committee’s role and external disclosure responsibilities. HR business partners should be educated. So should the talent acquisition executives who are hiring candidates at levels where a clawback applies.

The compensation committee is likely to ask HR whether award designs should change given the new clawback rules. Although reasonable people may disagree, our own view is no. Restatements affect less than 10% of companies; it seems imprudent to meddle with something as strategic as an award’s design and incentives over an unlikely future event. A related question is whether certain performance metrics are safer than others to work with in a clawback situation, such as using top-line metrics or TSR instead of bottom-line metrics. But obviously a long-term incentive plan can’t be exclusively top-line oriented and TSR suffers from its own problems.

2. Policy Drafting

We’ll cover just the basics on drafting changes to existing clawback policies and standing up new ones. Your legal counsel will have more to say here and best practices are continuing to emerge.

Single or Dual Policy

Most companies already have a discretionary clawback policy that provided a bridge to a Dodd-Frank clawback while giving the compensation committee a way to take action where and if needed. As a result, companies must decide whether to modify their existing clawback to conform with the Dodd-Frank framework, abandon their existing policy for a new one that’s compliant with Dodd-Frank, or maintain both separately.

We anticipate most companies adopting a two-policy framework in which the Dodd-Frank-mandated clawback will sit next to a broader but more flexible (discretionary) clawback. A discretionary clawback is valuable because:

- More employees can be subject to it

- The potential trigger events can be broader

- The compensation committee can exercise discretion on when and how to enforce it

In contrast, a Dodd-Frank clawback has extremely prescriptive, bright line trigger events. It also gives the compensation committee virtually no enforcement discretion and applies to a smaller (though still sizable) segment of the employee base. A dual framework may ensure full Dodd-Frank compliance while affording the compensation committee maximum flexibility when there are bad acts by employees not subject to the Dodd-Frank clawback or bad acts that are not trigger events under the Dodd-Frank clawback.

What if you don’t already have a clawback policy? Keep the Dodd-Frank policy separate anyway. Whether you stand up a second vehicle to sit next to the Dodd-Frank program depends on whether you think it makes sense to give the board additional discretionary authority of this nature, which dovetails on the possibility of adversarial board members showing up in a universal proxy world. One contrarian view is that even without a voluntary clawback program, you still have ways to deter bad actors, including for-cause termination and litigation. As a general rule, the larger the organization, the more useful a secondary (voluntary) clawback program will be.

Calculation Methodology

The best way to think about how much compensation to recoup is to ask how much would have been delivered had the financial statements been correctly presented the first time.

The exact language in the SEC rule centers around the definition of erroneously awarded compensation, which is “the amount of incentive-based compensation received that exceeds the amount of incentive-based compensation that otherwise would have been received had it been determined based on the restated amounts.” The focus is gross compensation paid and there is no net-of-tax adjustment.

If a stock price or TSR metric exists, then an event study or other suitable technique must be used to recast what the stock price would have been had there never been a restatement. If the performance metric is an accounting metric like EPS or revenue, then the parallel universe can be determined through simple “mathematical recalculation” of what would have been delivered under the payout grid.

Although we expect the use of an event study to be the de facto standard, our advice is to not commit to a particular calculation methodology for stock price or TSR-based awards. Instead, we suggest drafting the clawback policy to state that the compensation committee will evaluate the facts and circumstances and select a methodology that, in its judgment, yields a reasonable estimate of the accounting restatement’s effect on the stock price or TSR metric.

Method of Enforcement

The policy should also consider how the compensation committee will enforce the clawback. This will be much tougher for terminated employees than current employees. Terminated employees may have left on bad terms, may be retired and not worried about what obstructionism would do to their reputation, or may simply be unresponsive. These risks are amplified for restatements spanning a longer historical period.

The final rule intentionally doesn’t specify how the compensation committee should recoup erroneously awarded shares, only that they must do so reasonably promptly (which is not defined). Some techniques referenced in the rule include:

- Canceling unrelated unvested compensation awards

- Offsets against nonqualified deferred compensation and unpaid incentive compensation, future compensation obligations, or dividends owed to the recipient

This implies a level of fungibility in which the compensation committee must simply demonstrate that the dollar value overpaid was recouped dollar for dollar through some mechanism. The final rule even allows the company to establish a deferred repayment plan, but also suggests this should include a reasonable adjustment for the time value of money.

Therefore, companies will need to decide whether to set up multiple platforms and give the executive a choice or mandate a particular repayment approach. We think practices will evolve, so we suggest drafting the policy to confer flexibility. We have experience setting up web-based choice platforms and think it may improve the odds of success if participants have multiple repayment options.

3. Drafting the Playbook

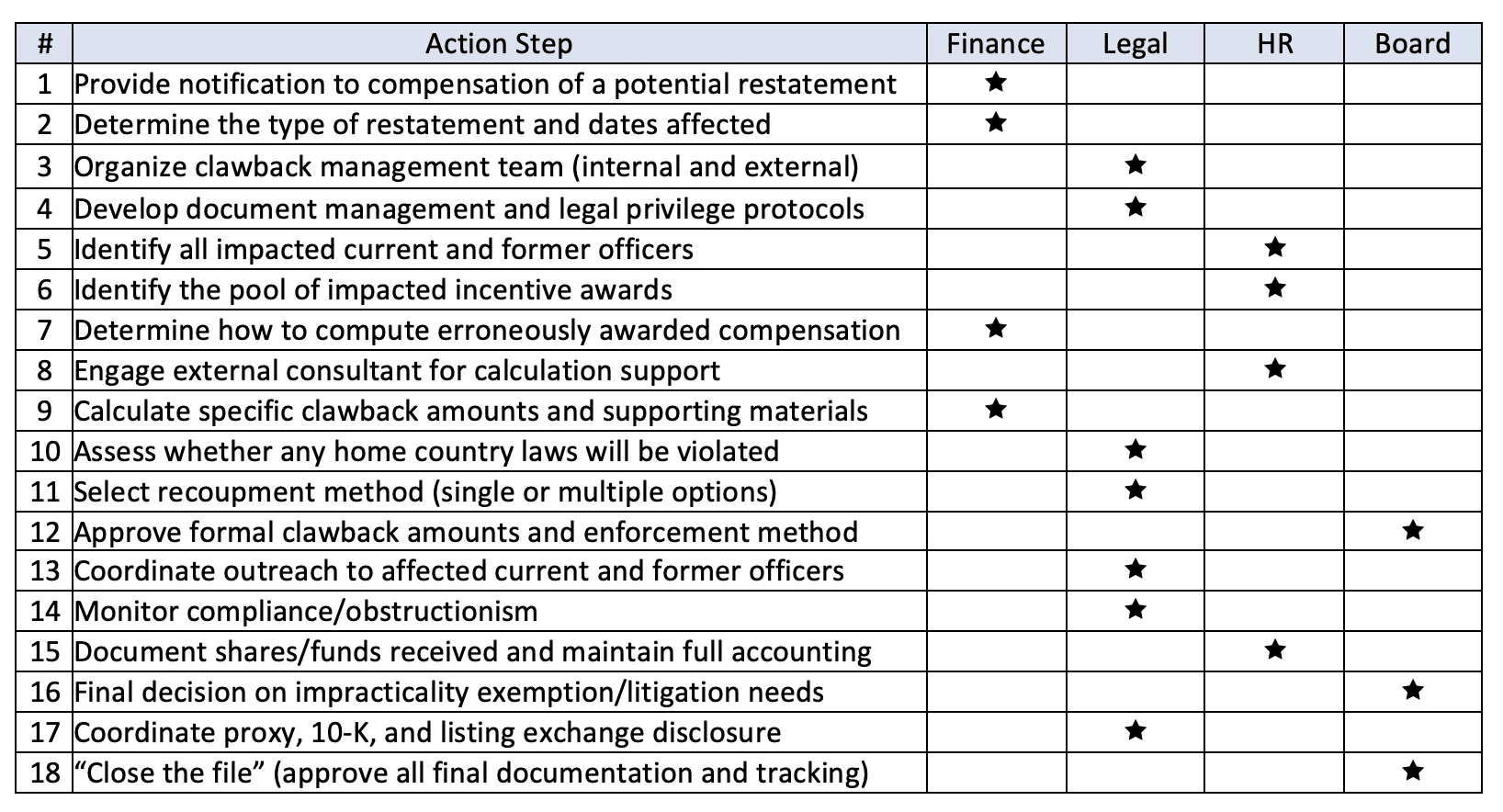

We expect most companies to adopt simple policies that aren’t overly prescriptive. Even so, consider producing work papers that sit outside the policy to explain the logic behind the policy. The work papers should include a playbook that can be pulled off the shelf to guide actions and decisions that will need to be made in a hurry. This has become a common best practice across cybersecurity, crisis communications, divestitures, and other sensitive corporate events.

A playbook can be as detailed or high-level as desired. It’s not a policy because it doesn’t commit the company to a particular action. Instead, it outlines who needs to talk to whom, what decisions must be made, and the corresponding timing.

Simple Playbook

Here’s a very simple playbook to illustrate the concept.

Playbook Narrative

A playbook is usually footnoted or accompanied by narrative content that contextualizes each play. Remember, a restatement might occur 10 or more years after drafting the policy, so it’s important to leave breadcrumbs to those charged with carrying out the policy in the future. In the same way, it’s useful to periodically reassess both the policy and the playbook every few years.

One way to create breadcrumbs is to briefly discuss line items in the playbook. For example, you might add the following notes to an illustrative playbook:

Note 3—Team Assembly

The internal project team should include at least the CFO, chief legal officer, and CHRO. They may deputize action steps to a CAO, assistant general counsel, and head of total rewards, respectively. Outside legal counsel, the board’s independent compensation consultant, and management’s share-based payment accounting and valuation consultant should also be engaged.

**************

How can Equity Methods assist?

In addition to providing data and external calculation support, we can run an event study to calculate the erroneously awarded compensation in the context of a stock price or TSR metric. We can also provide a platform that gives affected current and former employees a way to choose how they will commit to returning excess compensation paid. Finally, we can provide economic consulting on the rule itself and a complementary perspective to legal counsel’s focus.

**************

Note 7—Calculation Methodology

Erroneously awarded compensation may be straightforward to compute if the metrics are accounting goals where “mathematical recalculation” is available. If a stock price or TSR metric exists, then an event study or other reasonable technique should be used.

An event study is likely to become the de facto standard even though the SEC’s rule doesn’t mandate one. However, practices may evolve and the company and its economic consultant should review market practices alongside the facts and circumstances of the restatement to arrive at a reasonable determination.

Since the initial analysis will likely be performed under attorney-client privilege, it may also be appropriate to run more than one methodology to gauge robustness and assumption sensitivity. Therefore, our policy doesn’t prescribe a single method and encourages the project team to initiate discussion as promptly as possible with the outside economic consultant to arrive at a framework that is appropriate.

Note 13—Monitor Obstructionism and Exception Possibilities

It’s possible that some former employees are obstructionist and refuse or ignore efforts to retrieve excess paid compensation. The listing standard requires that recoupment be done “reasonably promptly” and provide only a limited-scope exception that recoupment is not required if the total direct costs exceed the amount being pursued.

Additional disclosure is required if such an exception is activated for any of the covered employees. The optics of any such disclosure are unlikely to be favorable such that pursuit of an exception should be a last resort alternative. In any event, the company should document and tabulate the costs incurred in its overall efforts to retrieve excess compensation and individual efforts directed toward obstructionist employees.

Tabletop Exercises

In the cyber security space, companies have playbooks for responding to a cyberattack. They often rehearse the plays via tabletop exercises. In a tabletop exercise, the stakeholders get together and talk through actions, roles and responsibilities, decision points, failure points, and other issues.

Consider doing the same with the clawback playbook. Like playbooks, tabletop exercises can be as detailed or high-level as the stakeholders deem appropriate. We think simpler but more frequent exercises may be helpful on a topic like this one. An annual meeting may be enough to ensure that key stakeholders are aligned.

Wrap-Up

The SEC’s rapidly approaching clawback rule will hopefully never affect your organization beyond some upfront effort in 2023 to draft a thoughtful policy, followed by minor ongoing maintenance. Maintenance includes disclosure, monitoring market practices, and periodically refamiliarizing internal stakeholders with relevant issues.

Every year, some 400-600 companies undergo a restatement. Not all restatement situations will impact incentive plan metrics. But some will. The rules adopted by the NYSE and Nasdaq, as dictated by the SEC, have sharp edges in that noncompliance will trigger delisting.

In this regard, the clawback rule presents a low probability of a high consequence event. A fraction of infinity is still infinity. We anticipate most clawback policies to be relatively brief so as to confer flexibility. That makes it even more important to create upfront and ongoing institutional knowledge so that players can act quickly, thoughtfully, and in tandem should such a catastrophic event occur.

We don’t think the clawback rule is the end of incentive-based compensation or that wholesale plan design changes are warranted. Rather, stand up a measured policy, draft a playbook to guide execution against the policy, and ensure stakeholders remain familiar with the contents as the years pass.