Key Considerations for Performance Equity Settlements and New Issuances

As year-end reporting wraps up for many companies, the focus within stock compensation shifts to the annual equity grant. While we’ve written at length about considerations for a company’s annual grant, we think market and performance-based awards deserve special attention given the additional complexity of establishing processes for both new awards and those that are settling. We’ve organized the key considerations into four overarching questions around the settlement of existing awards and the issuance of new awards.

1. How will underperformance and overperformance achievements be reflected in the stock administration system?

Market and performance-based awards often have a scaled payout range, commonly between 0% and 200%. Since the final payout won’t be known until vesting, the target level (typically 100%) is what gets loaded into the stock administration system on the grant date. If attainment is above or below that target level once the performance period ends, an adjustment is needed.

To properly manage financial and other reporting requirements, all stakeholders must understand how these non-target payouts will be layered into the stock administration system. In practice, we see adjustments come through in many different ways. We’ll focus on the most common solutions below.

Final payout above target

The performance period has ended and you’ve outperformed the target goals, so your awards are paying out above 100%. Congratulations! Here’s what you might expect to see in the data.

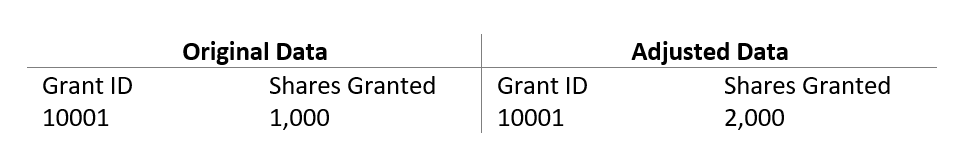

Administration solution #1: Update all share count data from target payout to the final payout level. Under this approach, the units granted and vesting schedule are updated to reflect the final shares earned, which are also shown as the amount exercised/released. This allows the final exercised/released shares to tie back to the grant and vesting data. As an example, if performance for Grant ID 10001 comes in at 200%, the data would be updated as below.

This approach is fairly intuitive. But simply changing the data to reflect the final payout could erase the original target shares, which can cause major headaches for awards with only market conditions where expense is unaffected by the final payout. If this is the solution applied to the data, it’s important to build any necessary workarounds to get the financial reporting right. We’ll discuss these in the next question, including what to do for market-based awards’ expensing.

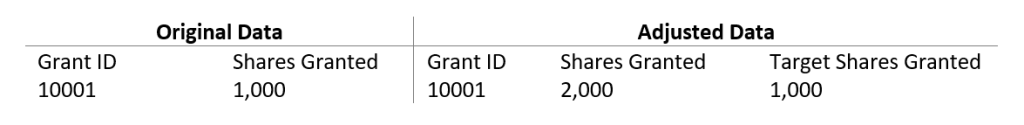

Administration solution #2: Both target and final shares are tracked for market and performance-based awards. The corresponding vesting schedules and release records are updated based on the final shares that have been earned. This is an extension of the prior solution, with target shares now stored in an additional data field. Using the 200% payout example, data would appear as below.

Tracking the target share counts reveals additional insight for administration purposes while also aiding the downstream financial process. Workarounds will likely still be needed, but the data for those is more readily available. From a financial reporting perspective, this is our preferred solution (albeit somewhat rare in practice).

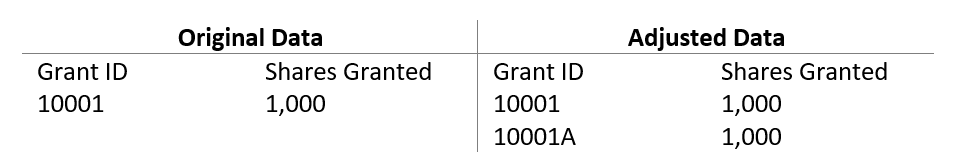

Administration solution #3: There’s a new grant created to separately capture the above-target shares. Continuing with the 200% payout multiplier example, the table below shows the original award retaining the target shares and a new award for the above-target shares.

This approach does provide flexiblility for financial reporting purposes since any necessary treatment can be applied to the additional shares. However, it’s critical that the original grant ID can be linked to the new grant ID to facilitate any financial reporting processes. Otherwise, the new awards may unintentionally be viewed as entirely new without consideration for fair values and other attributes that should align with the original award.

Final payout below target

Now let’s explore the common approaches for cases when our final performance payout is below the target number of shares.

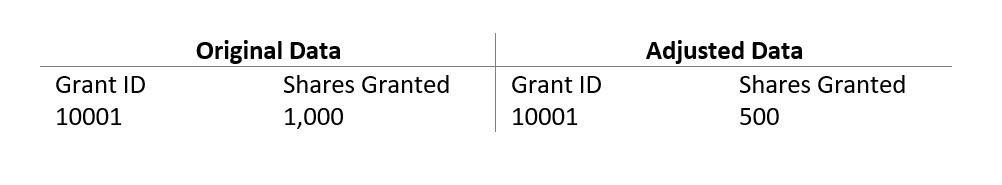

Administration solution #1: Update all share counts to the final payout level. The total units granted and corresponding vesting schedules are reducted to the final shares that have been earned. The final exercised/released shares will then tie to the updated grant and vesting data.

This is the same approach as the first solution in above-target payouts. But by simply changing the data to reflect the final payout, the original target share counts are lost. Again, losing the target share counts can cause major headaches for market-based awards in particular, where under-performance should not impact expense accrual.

Administration solution #2: Create cancellation records for any unearned shares. As a simple example, if the final performance payout is 75% of target, then a cancel record is created for the 25% of the award that was not earned.

This is the most common approach, and our preferred solution for below-target payouts. One valuable addition to this solution is the use of a “cancel reason” to identify the shares that are being canceled due to performance. This helps isolate shares canceled due to under-target performance versus shares that forfeited due to termination.

2. What are the important financial reporting considerations?

The first step to ensuring that the downstream financial reporting is handled appropriately is to understand how the administration data will be updated. Even then, there are numerous considerations to ensure each calculation is correct. We’ll review different reporting impacts individually.

Expense

Market-based awards are valued on the grant date using a Monte Carlo simulation. The guidance which describes the option-like nature of market awards is ASC 718-10-30-14. Importantly, there shouldn’t be any expense reversals (or true-ups) other than pre-vest forfeitures. This means that the expense amortization is effectively based on the target shares regardless of the final payout, and makes understanding any data changes imperative to ensure the total expense is locked at target share values. In cases of over-target performance, any additional shares added to the data should be excluded from an expense perspective. In cases of under-target performance, the key is to ensure that no reduction of shares or performance-related forfeitures created make it into the expense calculation.

For awards with only performance conditions, or awards with both market and performance conditions that are multiplicative, the final expense should reflect the final payout and therefore any adjustments to shares are appropriate to flow through the expense calculation. Note that if the final payout shares do flow into the expense calculation, there should be no further multiplier/factor applied that could result in double-counting. This is noteworthy because there may have been a multiplier applied before the final payout and data adjustments.

EPS Dilution

Market-based awards require close attention in your EPS dilution calculation. The weighted shares outstanding of these awards should be based on the final payout, so having data updated accomplishes that. If the target shares remain in the data, this impact can be accomplished through the application of a dilution multiplier. When calculating the average unamortized expense component of the treasury stock method, however, the unamortized expense should be based on the target shares, consistent with how the expense is calculated. (We go into more detail on the theory of such EPS considerations in this white paper.)

Tax

When settling market and performance-based awards, it’s important to consider each component of the tax calculation individually. The build-up and ultimate reversal of the deferred tax asset (DTA) balance should match the expense values. As noted in the expense section, this means market-based awards should reflect target share counts (or have adjustments to per-share value made to maintain consistent grant-date fair value). Again, non-market performance awards will have expense reflective of the final payout shares.

Recall that the actual tax deduction received by the company is based on the value given to employees on the exercise date, which would reflect the final payout shares at the settlement price. Again, for market-based awards, it’s important to note this very likely differs from expense, as the final payout shares would be needed for this component of the calculation. This highlights the importance of knowing the data and being able to identify the target shares as well as the final payout shares. The spread between this tax deduction and the DTA/expense value is what would be calculated as the excess tax benefit.

Disclosure

How do under or over-performance shares come through your footnote disclosure share roll-forward tables? The answer isn’t explicit in the stock compensation disclosure guidance of ASC 718-10-5-2. Many companies initially disclose performance awards based on the target units, then adjust at the end of the performance period based on the final attainment. When the final payout occurs, we often see the shares paid above target represented as an additional line in the share roll-forward. Depending on materiality, the additional shares may be lumped into the amount granted in the period (with no separate line item for performance-related adjustments).

Awards paying out below target are often represented in one of two ways. The first is to add a line in the share roll-forward for target shares not paid out due to under-performance, similar to the common approach for above-target payout. The other way is to include the shares not paid out due to under-performance in the “shares canceled” line of the roll-forward. In this case, it may also be helpful to add a footnote detailing this combination. (For a thorough discussion of approaches we see in practice, read our article on 10-K disclosures.)

Share count tracking

As your market and performance-based awards settle, one final consideration we want to call attention to is reviewing the impact to your share pool tracking. The common approach we see clients take is to withhold shares at the maximum possible payout when they initially grant market and performance-based shares. Once the final payout is known, any amount below the maximum may be added back to the share pool if the overarching stock plan allows.

We’ll now transition to questions for any new market and performance awards.

3. Did you review the terms of the latest award agreement to identify any changes from prior year grants?

As LTIP design practices evolve, accounting implications must be carefully reviewed as well. Conversation with the Compensation team and review of award agreements should help identify new or changing market and performance conditions. Given that market-based conditions are valued using a Monte Carlo model, the valuation needs to be completed in a timely manner in order to allow for proper accounting. Even if you previously issued awards with market conditions, changing structure or payout logic may impact the fair value factor (i.e. discount or premium). If this is the case, we may want to forecast the impact ahead of the grant to ensure there are no expense surprises after the awards are issued.

4. How will performance be tracked on an ongoing basis?

For expense purposes, you’ll need the expected future payout of any performance metrics during each reporting period throughout the vesting life. This means it’s necessary to have a way to calculate the progress of your performance metrics over time so that the expense is calculated correctly based on that estimated future payout. From an EPS dilution perspective, however, the multiplier we layer in should be based on performance as of the current reporting period (instead of the future expectation used in the expense calculation).

Awards with only market conditions are simpler from an expense perspective given that we have a fixed amount of expense as of the grant date (assuming equity classification). However, for the EPS dilution multiplier, it can be very tricky to calculate the performance as of the current period for contingently issuable shares purposes — especially when comparing performance to an index or large group of companies. At Equity Methods, we employ an automated tool, AwardTraq, which can be used to calculate the current payout of a market-based award at any point in time.

While this isn’t an exhaustive list of considerations for market and performance-based awards, we do hope it will help smooth the financial reporting process as the annual awards are paid out and new awards are issued. If there are any questions or considerations you’d like to discuss further, we’re always here to help.