Public Reaction to ASC 718 Revisions Reveals Companies’ Strategic Priorities

In October, we’ll be at the NASPP (National Association of Stock Plan Professionals) conference, where one of our presentations will cover the FASB’s proposed revisions to ASC 718. Over the past few months, we’ve had hundreds of conversations with Equity Methods clients about the proposed amendments. In advance of the conference and the FASB’s final guidance which we expect to receive in November, we’d like to share some of our updated perspectives with you.

The proposed APIC pool elimination is by far the most controversial issue on the table.

Nearly all our clients (plus the public comment letters) have taken a strong stand against the proposed revision. There are two general arguments. First, any marginal reduction in tracking complexity is substantially offset by the extra effort that will be required to manage heightened income statement and effective tax rate volatility. Second, some argue from the technical angle that the current “symmetrical equity” approach is more conceptually rigorous than allowing for tax accounting true-ups in the income statement when corresponding true-ups for differences between the grant-date fair value and settlement value are not permitted.

Many commenters suggest that excess tax benefits and shortfalls should flow through APIC permanently, thereby removing the complexity of tracking the APIC pool while shielding the income statement from volatility.

If the proposed revision goes through, tax settlement forecasting will become particularly important for accounting departments.

Will the FASB ultimately decide to eliminate the APIC pool and run windfalls and shortfalls through the income statement? Our guess is a 60% probability that FASB will not, judging from the extent of critical feedback in the comment letters and what we hear from our clients. If the proposed revision is not adopted, we expect the FASB will either keep the accounting the same as it is today, or eliminate the APIC pool and require all windfalls and shortfalls to flow through equity.

In contrast, the share withholding revision is receiving unanimous praise on multiple grounds.

Companies have struggled with the current guidance that requires withholding at or below the minimum statutory level. Challenges include:

- Tracking withholding rates (and rate changes) to prove compliance,

- Selecting withholding rates for employees in foreign jurisdictions that lack minimum statutory rates, and

- Managing the complexities associated with employee mobility

Switching the liability trigger to the maximum statutory rate will largely reduce these tracking and compliance challenges that have been perplexing companies for so many years.

There are a few open questions companies are struggling with in regard to this proposed revision. Can a blanket withholding rate be applied to all employees in a jurisdiction to simplify tracking? A literal reading of the exposure draft suggests the withholding rate should be determined at the employee level (even though a principles-based read suggests a single withholding rate at the country level would be acceptable). Some companies are therefore worried that they might be expected to withhold at different rates for different employees, thus retaining the challenge of tracking tax withholding rates at the employee level.

On the other hand, some companies are worried about the very opposite challenge. They find value in the current model, whereby they withhold at the same rate for all employees in a jurisdiction. (Currently, when executives ask to have a higher withholding level, it’s easy to say no on the basis that doing so would trigger liability accounting.) Under the proposed rules, it becomes theoretically possible to apply different withholding levels to different employees in the same jurisdiction, thus potentially increasing complexity.

Companies will need to carefully consider their processes and how they plan to balance the tradeoffs between employee customization and process simplicity.

The option to stop applying a forfeiture rate and, instead, recognize forfeitures as they occur is receiving very different reactions.

Most of the companies we work with aren’t planning on doing away with a forfeiture rate in their expense accrual models. Processes for applying a forfeiture rate are automated and working. From their perspective, the forfeiture rate is particularly important in reducing budget-to-actual variances—which is the real battle they’re fighting. But other companies in the market are stuck using spreadsheets for some or all of their accounting. When running ASC 718 expense reporting from spreadsheets, a forfeiture rate is naturally one more tricky variable to apply and manage.

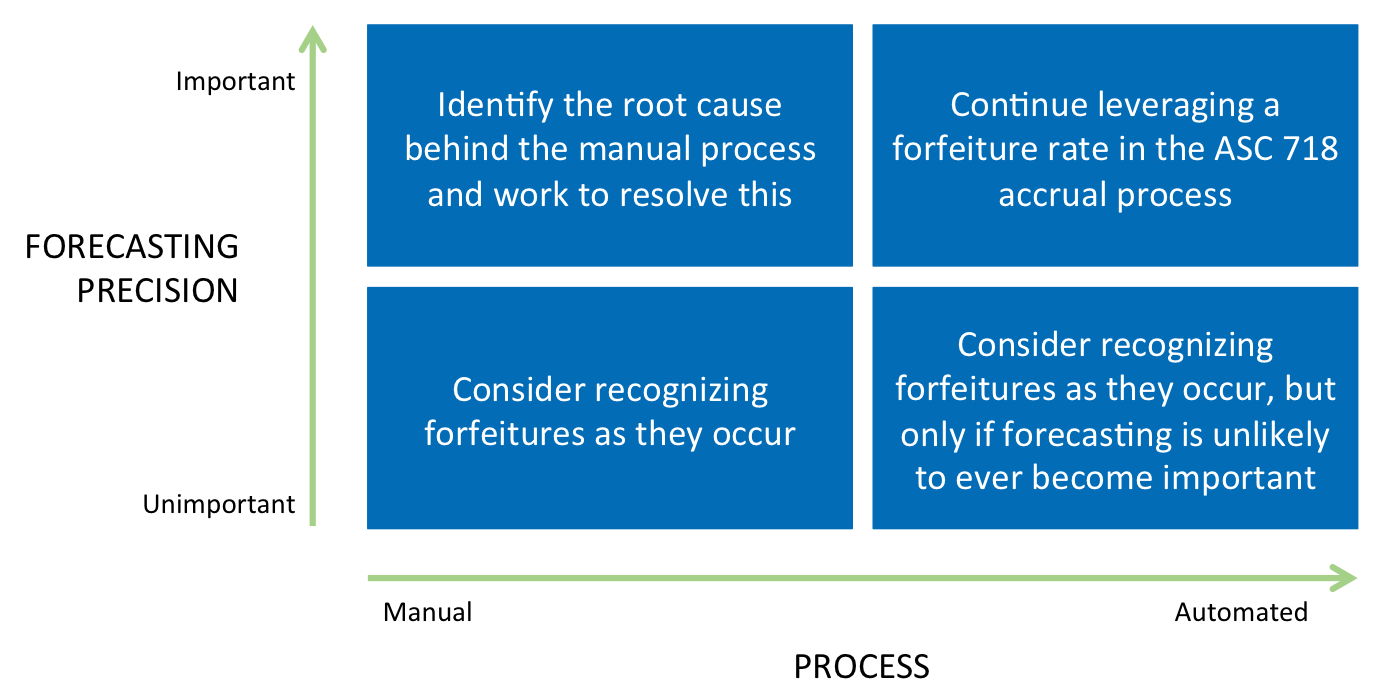

Here’s one way to approach this policy election. First, decide how important forecasting precision is to your organization. Second, evaluate how manual your process is and whether forfeiture rates are the cause. Then put your conclusions in a 2×2 matrix like the example below.

Are precise forecasts important while the process is manual? That’s arguably the toughest quadrant to be in. Companies that find themselves in this place might consider finding out why their process is so dependent on spreadsheets since this, and not a forfeiture rate, is really the root problem. Our concern for these companies is that undoing the forfeiture rate requirement is unlikely to improve their situation, since a manual process will continue to pose other challenges as time passes (e.g., when new awards are designed, new management reporting is required, etc.). Because forecasting is important for these companies, the best bet may be to explore ways of automating the process.

Companies with automated processes that do not place much importance in forecasting precision are in an interesting place. On the one hand, eliminating their use of a forfeiture rate will not create friction due to larger forecasting variances. But on the other hand, if the process is automated, applying a forfeiture rate is arguably a non-issue. Given the difficulty in switching back and forth (the decision to apply or not apply a forfeiture rate would be deemed a change in accounting principle), if the cost and benefit is low today, we encourage companies to continue using a forfeiture rate since the benefit tomorrow might be higher (while the cost would ostensibly remain low).

Assuming the proposed changes go through, how much time will companies have to prepare for adoption? We expect final guidance to be released in November 2015, with transition slated for fiscal years beginning after December 2016. Companies with volatile stock prices and material equity compensation programs should begin making preparations early to understand the downstream impact from any revisions to the current APIC pool accounting model. For companies with relatively small equity-based compensation programs, early adoption might be granted to ease their current accounting processes.

We applaud the FASB for the energy and thoughtfulness they’ve devoted to simplifying the accounting in ASC 718. However, for better or worse, the technical GAAP components of ASC 718 are not creating nearly as much complexity today as they did in the past. In fact, finance functions are trying to move beyond pure compliance so they can focus on higher levels of impact. These include architecting more predictive models (forecasting and budgeting), influencing award design decisions, designing processes to allocate expenses down to cost center levels to facilitate better business unit profitability analysis, implementing recharge programs, and a host of similar priorities.

These “higher order” activities aren’t driven by the underlying GAAP. Neither will changes to the GAAP move the needle much, since these focus areas are all about finance functions becoming more influential in driving business decision-making.

If this describes your company, we think the best strategy is to improve your processes so that new capabilities can be accommodated without disruption. This can be achieved through automation, customized controls, staff training and development, and thoughtful investments in technology.

Was this post helpful? Join our mailing list to receive alerts of future articles!