Summarizing the CARES Act’s Impact on Executive and Equity Compensation

In response to the public health crisis caused by COVID-19 and the uncertainty and disruption—or worse—facing our population, Congress passed the CARES Act in late March. Formally titled the Coronavirus Aid, Relief and Economic Security Act, the $2.2 trillion CARES Act offers many forms of relief to people and organizations impacted by COVID-19. This includes assisting businesses through loans and guarantees designed to preserve jobs and keep businesses afloat.

CARES Act assistance, similar to the Troubled Asset Relief Program (TARP) executed in the last recession, comes with strings attached. Most relevant for equity and executive compensation professionals are the compensation limits, which take effect when you enter into the loan or guarantee arrangement and end one year after the arrangement is no longer outstanding.

In this article, we’ll explore what you need to know—and what we still don’t know—about these limitations at this early stage.

What are the limits on compensation?

In short, companies that receive assistance under section 4003 of the CARES Act will have total compensation limits affecting all employees who made over $425,000 in 2019. The text of this part of the law is actually quite brief, so we’ve included it at the end of this article in its entirety as an appendix. We’ll unpack the basic idea of the restrictions here, and also address some of the unanswered questions in light of the brevity.

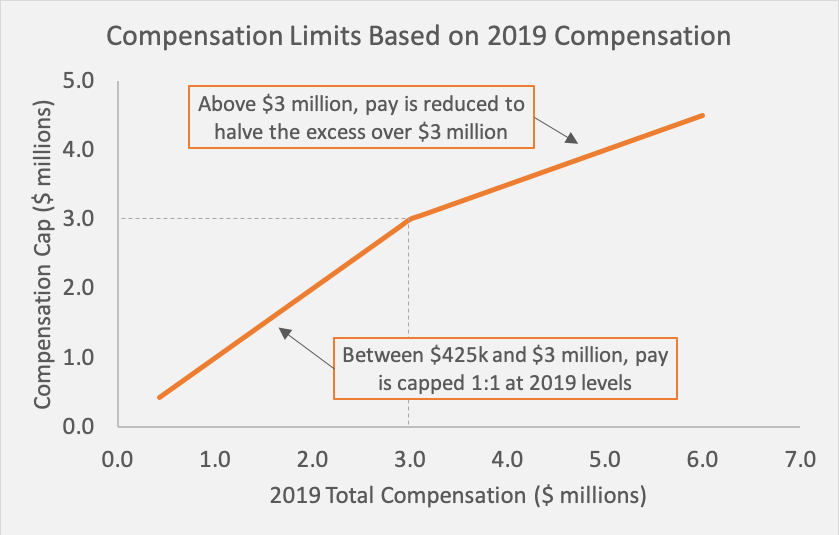

The limitations on compensation for highly compensated employees are tied to the amounts they earned in 2019. Any employee who made at least $425,000 (but less than $3 million) in 2019 cannot make more than that 2019 amount in any 12-month period during the loan life.

In addition, employees who made over $3 million in 2019 must have their pay lowered to halve their excess earnings over $3 million. For example, if an executive made $5 million in 2019, then they cannot receive more than $4 million during any 12-month period covered by the loan. Their excess pay over $3 million was $2 million, which is cut in half and added to the $3 million base. Or to put it mathematically: $3M + (0.5* ($5M – $3M)).

These employees also cannot receive severance pay—or other benefits upon termination—that exceeds more than two times the maximum total compensation received in 2019 as defined by the limitations above.

Whereas TARP required a firm universal cap of $500,000, the CARES Act creates a dynamic compensation cap that varies based on prior compensation levels, with a bend in the slope at the $3 million point:

What are the big open questions?

With many implementation details yet to be ironed out and other parts of the Act receiving more attention, there are many open questions about exactly how the compensation limits will be applied. These may not be the driving factors behind business decisions to pursue government assistance, but it’s nonetheless crucial to understand them up front. Even aside from standard sorts of compliance consequences, getting this wrong can easily look like “company overpays executives with taxpayer money,” which is a public relations nightmare.

Under the act, total compensation includes salary, bonuses, awards of stock, and other financial benefits provided by the business to an officer or employee of the business. This would be easy enough to manage if all compensation were cash and there were no timing differences between granting, earning, and paying an arrangement. However, given the complexity of executive compensation packages, there are unanswered questions that will have a material impact. For example:

How and when is total compensation valued?

This is most acutely a question for equity compensation. Is it valued at grant (akin to accounting and proxy disclosure rules) or at vest (akin to tax rules)? Should the value be simply the intrinsic value of the grant, or a fair value-based measure? There is not yet an answer to these questions, so we must await further guidance. (We also can’t look to TARP for precedent, as that cap exempted grants of long-term restricted stock units that vested after the government was paid back.)

Beyond equity compensation, there is also a question of timing for annual incentive plans or bonuses. Is the 2019 baseline computed using the 2019 payout (based on 2018 performance) or the bonus earned in 2019 (paid in early 2020)?

In this period of volatility, the timing of measurement may greatly impact whether an executive’s compensation is capped and at what level.

How are employment contracts treated?

If an executive has a binding employment contract entitling them to higher compensation, something has to give. Exactly how to restructure contracts (and what to do if an executive doesn’t agree to a cut) is unclear. Further, decisions must be made about which aspect(s) of total compensation any cuts should come from, which is especially difficult if the forthcoming compensation is tied to long-term arrangements (such as restricted stock) granted in prior years. Note that if a contract is a part of a collective bargaining agreement, it’s entirely exempt from the limits. Otherwise, it remains undecided how companies should unwind and fix the conflict between one legal obligation to the government and another legal obligation to its employees.

Who is covered under these limitations?

The limitations under section 4004 clearly cover certain people, such as executives with high salaries. But even leaving aside the compensation measurement questions that might push borderline employees over the threshold, it’s unclear whether other categories of service providers are affected. For example, the law is silent on the treatment of non-employees such as directors, partners, or independent contractors. A literal reading of the law would seem to exempt these non-employees, but this may change as implementation details become available.

In addition, it’s unclear if individuals hired in 2020 would be considered covered employees. Without any 2019 compensation from the company, there would be no way to set a limit on go-forward compensation under the rules. However, a blank check seems unlikely in the final rules.

How is compensation computed for 2019 hires?

Another boundary case the law doesn’t address is 2019 hires. For example, consider an employee who joined in July on a $1 million salary. If that was the only aspect of their pay, their 2019 compensation would be $500,000. That would make for a draconian cap that is much more stringent than for an equally paid individual who merely had a different hire date.

Practically speaking, the final rules may allow for annualization in such cases. This would need to be thoughtfully executed to avoid unintended consequences, considering unique onboarding situations like large one-time signing bonuses or new-hire equity grants that are larger than expected annual grants.

What other restrictions are there, and how might those affect compensation?

Recipients of assistance may not issue dividends or execute stock buybacks. Narrowly looking at the direct impact on equity compensation, lower dividends translate into higher values for options under the Black-Scholes model, all else equal. So if companies grant awards based on a target value, this means fewer options granted for a given target value. On the flipside, all else again equal, this means that option payouts would be higher since shareholder returns that would have been paid as dividends (not received by option holders) will instead manifest as higher price growth (which option holders do receive). There will be a similar set of effects for restricted stock units that do not participate in dividends or equivalents.

In addition, there are various stipulations on maintaining most or all of the company’s pre-crisis workforce. Although these stipulations have no direct impact on compensation, there will be an effect on accounting for equity compensation. In particular, this may mean reduced forfeiture rates to account for the fact that layoffs won’t happen and voluntary turnover is likely lower in a poor job market.

What are the steps to take right now?

As we await more information and clarification on CARES Act assistance and related rules, there are a few steps that companies can take to prepare and set expectations.

- Look out for updates. Naturally, businesses taking assistance under section 4003 should pay close attention to any updates relating to the act. We expect further guidance and clarifications from the Treasury Department on the open questions above, but there is no clear timetable currently.

- Plan with available information. To get ahead of planning, we recommend computing 2019 pay for employees under a variety of feasible interpretations to figure out who may be impacted and quantify the impact of the cap on each person. This will help with managing the expectations of affected employees and will allow the company to act quickly to comply when rules are finalized.

- Consider methods to track compensation levels. Be prepared to put new processes in place for tracking compensation levels for impacted employees. For example, if the realized value of stock awards at vest is limited, know where that limit is and be ready to implement it rather than let awards vest on auto-pilot. If the grant value for 2020 is limited but you’ve already issued, understand how the award may be rescinded or modified.

- Be ready for the accounting impact. As discussed above, the various limitations may have an accounting impact either directly or indirectly on equity compensation. Companies would need to adjust valuation assumptions due to the dividend limitation, adjust expense assumptions due to reduced forfeitures, and apply modification accounting to any award adjustments triggered by the compensation limitations. On top of it all, companies should to adjust forecasts for all of the above impacts, plus any other plan changes driven by COVID-19.

- Consider more efficient compensation alternatives. As rules are finalized and attention turns to the longer-term future, we may find that certain compensation arrangements fail to provide an optimal level of incentive or retention benefit under the Treasury limitations. For this reason, companies should plan to actively consider alternative compensation or benefit arrangements for key individuals where there may be retention risk. This may mean simple adjustments; for instance, if the final rules define compensation as counted when taxable, companies can implement deferral arrangements for future-vesting RSUs. It may also mean more substantive adjustments, like shifting more pay to long-term incentives or directly tying payouts to loan repayment.

As always, please don’t hesitate to contact us to discuss your specific situation. We also invite you to keep tabs on our COVID-19 equity compensation resource center for updates on the situation as it evolves.

Appendix – Text of Section 4004 of the CARES Act

LIMITATION ON CERTAIN EMPLOYEE COMPENSATION.

(a) In General.—The Secretary may only enter into an agreement with an eligible business to make a loan or loan guarantee under paragraph (1), (2) or (3) of section 4003(b) if such agreement provides that, during the period beginning on the date on which the agreement is executed and ending on the date that is 1 year after the date on which the loan or loan guarantee is no longer outstanding—

(1) no officer or employee of the eligible business whose total compensation exceeded $425,000 in calendar year 2019 (other than an employee whose compensation is determined through an existing collective bargaining agreement entered into prior to March 1, 2020)—

(A) will receive from the eligible business total compensation which exceeds, during any 12 consecutive months of such period, the total compensation received by the officer or employee from the eligible business in calendar year 2019; or

(B) will receive from the eligible business severance pay or other benefits upon termination of employment with the eligible business which exceeds twice the maximum total compensation received by the officer or employee from the eligible business in calendar year 2019; and

(2) no officer or employee of the eligible business whose total compensation exceeded $3,000,000 in calendar year 2019 may receive during any 12 consecutive months of such period total compensation in excess of the sum of—

(A) $3,000,000; and

(B) 50 percent of the excess over $3,000,000 of the total compensation received by the officer or employee from the eligible business in calendar year 2019.

(b) Total Compensation Defined.—In this section, the term “total compensation” includes salary, bonuses, awards of stock, and other financial benefits provided by an eligible business to an officer or employee of the eligible business.