Tax Reform Implications for Fiscal Year Companies

Earlier this year, we discussed how deferred tax assets (DTAs) need to be trued down due to the new corporate tax rate of 21%. Let’s look at how this can play out for companies with a fiscal year that ends on some day other than December 31.

Under ASC 740, DTA adjustments should occur on a cumulative-effect basis in the year of enactment, such that transactions anticipated to occur after the effective date of the tax rate change are updated based on the new tax rate.

The new tax rate took effect on January 1, 2018, so if your company’s fiscal year ends on December 31, the transition is straightforward. Any transactions occurring in 2017 are taxed at 35% and the DTA balance covering future transactions after December 31, 2017 is adjusted to 21%.

But if your company’s fiscal year ends on any other date, then the tax rate application gets tricky. The reason is IRC Section 15(a), which states that

if any rate of tax imposed by this chapter changes, and if the taxable year includes the effective date of the change (unless that date is the first day of the taxable year), then 1) tentative taxes shall be computed by applying the rate for the period before the effective date of the change, and the rate for the period on and after such date, to the taxable income for the entire taxable year; and 2) the tax for such taxable year shall be the sum of that portion of each tentative tax which the number of days in each period bears to the number of days in the entire taxable year.

In other words, companies with a fiscal year that includes but does not start on January 1, 2018 should apply a blended tax rate.

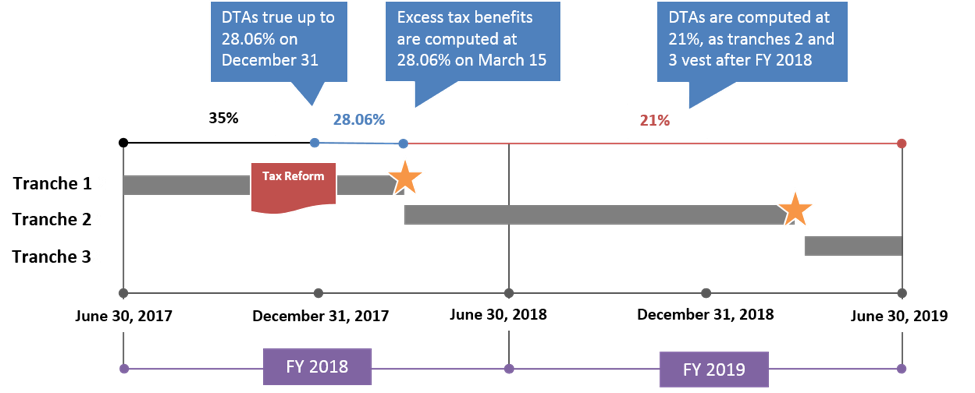

Let’s look at an example. Suppose Company ABC grants 6,000 restricted stock units (RSUs) on March 15, 2017 at a market price of $15, and a graded vesting with a 1/3 vest on each anniversary. The RSUs are released to the participants on the vest date. There is no forfeiture rate. Let’s assume Company ABC’s fiscal year 2018 ends on June 30, 2018.

As Figure 1 illustrates, there are several considerations regarding the DTA and excess tax benefit computations in FY 2018.

- At December 31, 2017, the DTA for the first tranche (vesting on March 15, 2018) needs to be trued-down from 35% at the blended tax rate of 28.06%. This is calculated as 28.06% = ((184*35%)+(181*.21))/(184+181).

- The 28.6% tax rate should be applied to the release of the first tranche when computing excess tax benefits on March 15, 2018.

- As tranches 2 and 3 give rise to a DTA, a tax rate of 21% should be used because both tranches vest after FY 2018.

Keep in mind this is a simplified example because it involves only one tax rate at a time. First, there’s the blended rate for the tranche that straddles the effective date of the tax rate change. Then, once that tranche finishes vesting, there’s the reduced statutory tax rate for tranches vesting after the culmination of the fiscal year.

Some companies may need to apply multiple tax rates for an award at the vesting tranche level. For instance, suppose you issue awards that vest on a quarterly basis and the awards have an accelerated amortization period due to retirement eligibility. In that case, for tranches that vest within FY 2018, the blended tax rate applies. For tranches that vest after FY 2018, a 21% tax rate applies since this is the rate for computing deductions at vesting. The key difference of this example is that those tranches may have DTAs at the same time due to the shortened expensing period of retirement eligibility.

Given the potential complexity resulted from IRC Section 15(a), companies with a fiscal year including but not starting on January 1, 2018 should be proactive in examining the DTA impact of their stock-based compensation instruments. Be aware that off-the-shelf software generally doesn’t support multiple tax rates at the tranche level. At the same time, workarounds involving manual calculations can raise the risk of error.

We’ve been helping clients with the tax reform transition, including applying tranche-level tax rates. If you have any questions, please contact us.