Transitioning between US GAAP and IFRS: Stock Compensation Focus

Financial reporting for equity compensation is difficult no matter what accounting language you speak. While most polyglots are exposed to multiple languages at a very young age, accountants usually learn only one set of accounting standards, and later in life. This late start is the first fundamental challenge in the process of transitioning between US generally accepted accounting principles (US GAAP) and International Financial Reporting Standards (IFRS).

IFRS is a principles-based set of accounting standards that provides a globally converged framework. Its primary goal is to enhance financial statement comparability across borders, making it widely used outside the US. Most multinational firms based in the US must prepare financial statements under US GAAP, then perform statutory reporting for international subsidiaries under IFRS.

We’ve previously detailed the major differences between the accounting for stock-based compensation under US GAAP and IFRS in our ASC 718 vs IFRS 2 white paper. Here, we’ll focus on what companies need to consider when transitioning between the two frameworks.

Converting from US GAAP to IFRS or vice versa is more than an accounting exercise. It imposes significant complexities on accounting systems, processes, and personnel. Transparency and alignment with senior management and external auditors are essential. There are numerous other parties involved as well—Accounting, Finance, FP&A, Tax, Legal, HR, Internal Audit, and IT, to name a few. Everyone will need to fully understand the variations in accounting in order to apply the newly adopted framework and assess the impact of the transition, then contribute to updating processes and documentation.

We’ll now unpack some common reasons for transitioning, notable challenges and risks, and key considerations before and after transitioning between US GAAP and IFRS.

Transition Reasons

Companies or their subsidiaries may transition from US GAAP to IFRS or vice versa for a number of reasons. Most often, a fundamental change in the business is taking place. Sometimes, it may result from a simple cost-benefit analysis. Let’s look at the common triggers.

Regulatory requirements. Changes in the regulatory environment or country-specific requirements may prompt a transition. For instance, a foreign subsidiary that follows US GAAP for consistency with its US parent might be required to adopt IFRS if those accounting standards become mandatory in the subsidiary’s jurisdiction. Again, IFRS is used by more countries than any other set of standards.

Global expansion. Depending on its specific footprint, as a company expands, it may be advantageous to adopt IFRS given broad recognition around the world. A common global accounting language can facilitate cross-border transactions and enhance comparability. However, the first priority will always be explicit reporting requirements for the jurisdictions in which the company does business.

Mergers and acquisitions. If a merger or acquisition involves entities that follow two different accounting standards, the newly combined company might decide to adopt a common set of standards to streamline financial reporting and save resources.

Cost efficiency. In some cases, a company may find that a particular set of accounting standards is more cost-effective for its operations. This could be due to lower complexity of reporting requirements, simplified internal and external audit functions, or other factors influencing the total cost of compliance.

Challenges and Risks

Transitioning between accounting systems comes with many challenges. The inherent knowledge gap is the first obstacle to overcome. The key personnel involved in the transition project need to understand the accounting differences between US GAAP and IFRS. They and their advisors also need to deliver tailored training to all relevant parties within the firm to bridge the knowledge gap and ensure proper adoption of the new standards. Sufficient documentation of the transition will be essential to provide assurance to auditors and regulators. This includes accounting policy changes, process assumptions, and the impact on financial statements.

An accounting transition may also incur nontrivial costs and require a potentially significant time commitment from internal stakeholders for internal training, impact assessment, control and process updates, external advisory services, additional audit requirements, and any dual booking. Therefore, companies must establish a realistic transition project plan and allocate adequate budget. Successfully navigating these challenges naturally requires collaboration across departments as well as strong project management throughout the process.

Key Differences between ASC 718 and IFRS 2

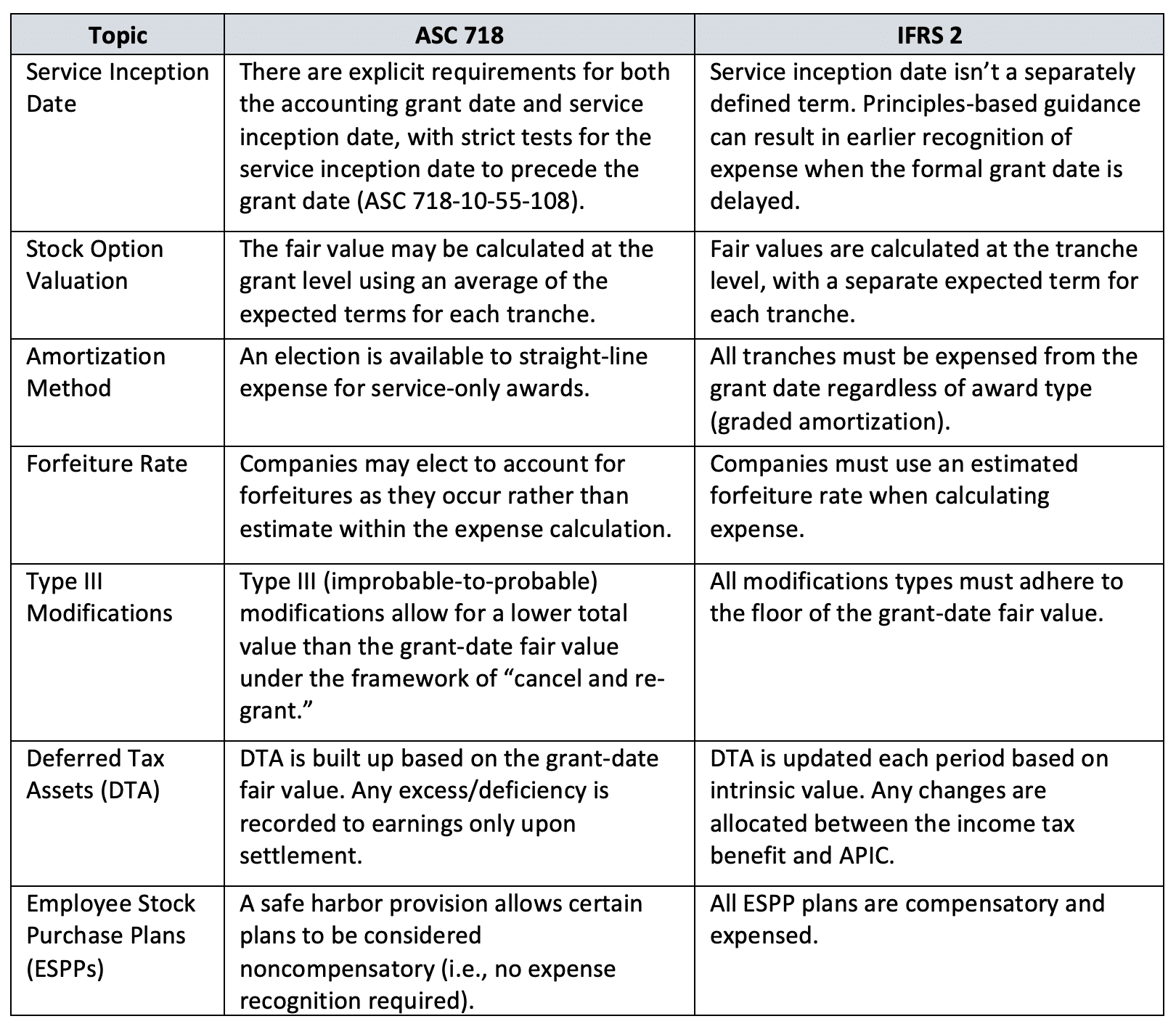

The most critical aspect of any transition is understanding the differences between US GAAP and IFRS. The following table has the highlights. (See our white paper for a more exhaustive list.)

We know this is a lot. But with these differences in hand, companies can begin evaluating the impact of transitioning. This typically includes back-testing in order to restate prior financial statements or determine a life-to-date adjustment for outstanding equity awards. In addition to historical adjustments, the go-forward impact is determined by running forecasts under both US GAAP and IFRS. Any short, medium, and long-run plans are updated once the differences between accounting standards have been reconciled and approved by management and auditors. As companies establish transition timeframes, ample time should be allocated to this testing and parallel reporting.

Transition Planning

Understanding the accounting differences between US GAAP and IFRS doesn’t alone guarantee a smooth transition. Careful planning and preparation in the pre-transition phase, effective execution among multiple parties during transition, and close monitoring afterward are all essential. Let’s put everything together with a checklist of the major steps of a transition along with the best practices.

1. Review with internal and external audit: Engaging in a comprehensive review with both internal and external audit teams is paramount. This collaborative effort ensures alignment with audit standards and expectations. Companies should engage auditors early and gather input regarding the accounting changes, new processes, and financial statement impacts.

2. Provide internal training: Comprehensive training is essential for all teams involved in financial reporting, data management, and forecasting, from junior team members to senior management. This ensures proper application of the accounting standards as well as adequate review.

3. Revise accounting policies and procedures: The reliability and sustainability of any financial reporting process is built on robust documentation. This avoids risks such as key person dependency and confusion during the busyness of financial close periods. Companies need to identify specific variations between the old and new standards and translate that into how processes are affected. For example, if a company that doesn’t apply a forfeiture rate under US GAAP is transitioning to IFRS, it will need to research methodologies of estimating forfeitures and potentially engage an expert to determine the best approach, then make careful adjustments to ensure compliance with the new accounting framework.

4. Set up the reporting system under the new framework: Make careful adjustments to ensure compliance with the new accounting framework. For example, a company adopting IFRS that expenses service-based awards using the straight-line amortization method will need to adjust its reporting system to use the graded amortization method instead.

5. Calculate any changes in estimate: It’s required to review any change in estimate calculations before the official transition period to avoid surprises and manage stakeholder expectations. Ideally, companies estimate the impact as early as possible and monitor the impact fluctuations over several financial reporting periods. The expense change in estimate will most likely come from different amortization methods for time-based awards. However, different grant-date fair values for stock options, forfeiture rate application, and service inception date methodology may also play a role. For deferred tax assets, there will also be a change in estimate due to US GAAP recording the DTA based on grant-date fair value and IFRS remeasuring the DTA at intrinsic value each period.

6. Back-test and forecast under the new framework: Any major accounting policy changes need to be carefully evaluated for the past and future impact. Back-testing for at least one year helps validate the new system and accounting assumptions by comparing predicted outcomes with actual results from historical data. A forecast of the next one to three years then helps companies to identify future impacts. Ideally, multiple scenarios are run to fine-tune assumptions and sensitivity analyses.

7. Perform parallel reporting: Identifying one-time changes in estimate is the bare minimum during a transition. Parallel reporting is valuable for identifying variances that only present themselves under certain circumstances and highlighting variances that grow or shrink over time. It also provides teams an opportunity to stress-test new procedures before going live.

8. Record adjustments and go live: Once all testing is complete and sign-off is received from internal management and external auditors, it’s time book any one-time adjustments and move into the ongoing reporting phase. Transparent communication and clear documentation ensure this happens seamlessly.

9. Perform dual booking, if necessary: For some companies, the transition doesn’t end with going live on a new set of accounting standards. Dual booking under both US GAAP and IFRS may be necessary for statutory reporting purposes or for additional assurance in the periods directly following the transition. If this is the right answer for your company, carefully plan for the complexities of maintaining two sets of books.

Companies that approach these phases strategically—collaborating with internal and external stakeholders to revise policies and evaluate impacts, meticulously documenting changes, and adopting thoughtful post-transition practices—are better positioned for a successful transition.

Parting Thoughts

With so many factors to consider when transitioning between US GAAP and IFRS, it’s important to construct a thoughtful plan and give teams plenty of time for testing and process updates. As always, we recommend working closely with both internal and external stakeholders to ensure a smooth transition. If you need a helping hand, you know where to find us.