What to Expect from a Pay Equity Study

Our recently published Pay Equity FAQ booklet contains 40 commonly asked questions regarding pay equity studies. You can request a copy of the booklet by filling out the form on this page (to the right if viewing on a desktop or at the bottom if viewing on mobile).

Here we hone in on Question 19: What are the typical findings from a pay equity study?

Key Takeaways:

For pay equity, the ideal is that there are no statistically significant pay differences between each category being compared (males and females; people of color and non-POC) after applying appropriate controls. While it’s hard to point to a typical result, we see many companies that have pay equity between 95% and 100%, most commonly in the middle of that range. Unadjusted pay gaps, on the other hand, can be much wider.

More Detail:

The ultimate goal for any organization is to have full pay equity—that is, to have no discernible gaps in pay after controlling for valid factors. Some companies have achieved this, but even among those that haven’t, pay equity is typically at 95% or above. Then again, no two cases are identical and situations also change over time as employees enter, exit, and get promoted, and as mergers and acquisitions take place.

For the raw, unadjusted gender pay gap, national averages are typically around 80%. Larger gaps may exist when looking at subgroups like women of color. Although these figures make up the bulk of statistics cited in popular media, they address questions of representation and not pay equity. (See the sidebar, “Perfect Pay Practices, but Large Pay Gap,” for an example.) The difference between pay equity and the unadjusted pay gap points to progress (or lack thereof) in achieving diversity and inclusion across the organizational hierarchy. As we explain later, representation goals and pay equity objectives are intertwined and can make sense to study together.

Perfect Pay Practices, but Large Pay Gap

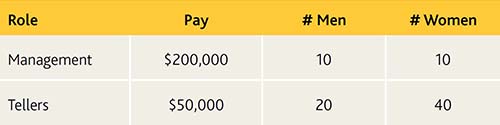

Imagine you work for a bank. The bank has two types of employees: management and tellers. All management employees earn the same amount, and all tellers earn the same amount. Let’s also assume the management layer has equal gender representation, but twice as many tellers are women.

Pay for Bank Management and Tellers, by Gender

What does this mean for the pay gap? This company would have perfect (100%) pay equity, as men and women with the same role earn the exact same amount. However, they would have quite a large unadjusted pay gap. The average male earns $100,000, whereas the average female earns $80,000—that’s 20% less!

This illustrates why unadjusted pay gaps can be difficult to compare from one firm to the next. Compensation practices and representation are both important issues, but the analysis underpinning each is different. So are the solutions. Still, we consider it a best practice to connect the annual pay equity study with diversity and representation monitoring because the insights in one study can be relevant to the other.

As far as benchmarking is concerned, most companies don’t disclose their adjusted pay equity gaps, so we generally benchmark using our institutional experience working with a diverse slate of companies. Be ready for the board and senior leadership to be extremely interested in how to interpret the results against market practices and benchmarks.

Despite the lack of widespread publicly available benchmarking results, the trend (albeit gradual) is toward more disclosure. A few independent sources provide insight into average pay equity levels. One is Arjuna Capital, the activist investor that pushes companies to publicly disclose data related to adjusted and unadjusted gender pay gaps. Nearly all companies cited by Arjuna have a pay equity gap of 1% or less (pay equity of 99% or better), but this prevalence is likely overstated since companies with positive figures are more enthusiastic about disclosure.

Other sources include aggregators like Glassdoor. Glassdoor’s 2019 US data revealed an average unadjusted pay gap of 21% (women earning 79 cents for every male dollar) and an average adjusted pay equity gap of 5% (women earning 95 cents for every male dollar). While the results from data aggregators and survey houses are interesting, there’s no substitute for benchmarking your own organization’s progress on pay equity and representation over time using comprehensive internal data.

In this regard, companies that have been performing annual pay equity studies for many years will tend to focus on their own journey. The questions addressed by annual studies will gradually evolve to consider root cause factors, connections to diversity and inclusion initiatives, and pockets of the organization where problems seem to be reoccurring. In a labor market like 2021, it’s also normal to assess how volatility in entry and exit may have exacerbated problems or created new ones.

This marks the end of Question 19 in the Pay Equity FAQ Booklet. To obtain a copy of the full booklet, please fill out the form on this page.