The First Batch of SEC Comment Letters on Pay vs. Performance Has Dropped. Here’s What We Learned.

The SEC recently uploaded its first batch of comment letters on pay vs. performance (PvP) disclosures. The letters point out missing content, incorrect calculations, and unclear nomenclature. They’re a stark reminder that clean, crisp compliance is priority one.

The comment letters are the outcome of an ongoing effort in the SEC’s Division of Corporation Finance to examine PvP disclosures based on randomly selected proxy filings. It seems the goal is to understand where there is diversity in practice and basic disclosure shortcomings, whereas the recently published C&DIs focus more on addressing rule ambiguity and open interpretive matters.

We looked at 17 comment letters dated between July 27 and August 22. Our analysis reveals 44 concerns that the SEC had with the target companies’ disclosures (most of the letters cite multiple concerns). Here’s a summary of the top themes.

Comment Letter Universe and Conclusions

The 17 target companies span six industry sectors. Most have a market capitalization of $1 billion or more.

In this batch of letters, the SEC is inquiring about unambiguous aspects of the rule, not gray areas such as retirement eligibility. We mainly see three kinds of issues:

- Calculation problems (there’s a mistake or inconsistency with the numbers)

- Disclosure problems (a component of the disclosure is missing, incorrect, or incomplete)

- Presentation problems (something in the disclosure’s formatting or organization is incorrect or unclear)

We’ll go through each category one by one.

Calculation Problems

These are breakdowns in the math, such as a disconnect between the summary PvP table and the breakout table (what the SEC calls the “reconciliation table”). The SEC’s hands are somewhat tied in this area because its staffers lack access to the detailed calculations, which means they’re confined to ticking and tying related values for consistency.

In a letter to Corcept Therapeutics, for instance, the SEC addresses the controversial practice of using a broad market index as the peer group. Although this was a widely debated topic, the PvP rule points to Item 201(e)(1)(ii); it’s the preceding paragraph, Item 201(e)(1)(i), that references a broad market index, and this paragraph isn’t referenced in the PvP rule [emphasis added]. The SEC signals its intent to require only indices that meet the provisions of Item 201(e)(1)(ii). Its comment letter to Corcept states:

We note footnote (5) to your pay versus performance table states the Nasdaq US Benchmark TR Index is your Peer Group for purposes of your Total Stockholder Return comparison. This index appears to be a broad equity market index used for purposes of Regulation S-K Item 201(e)(1)(i) and not the index or issuers used by you for purposes of Regulation S-K Item 201(e)(1)(ii). Please ensure that your peer group total shareholder return column and related disclosure uses the same index or issuers used for purposes of Regulation S-K Item 201(e)(1)(ii) or the companies you use as a peer group for purposes of disclosure under Regulation S-K Item 402(b).

We may see more commentary like this as the SEC turns its attention to more substantive matters of methodology.

Disclosure Problems

Disclosure problems reflect omissions in required content or incorrect analysis. These differ from calculation problems because the emphasis is on a block of text or a disclosure component that’s missing (and shouldn’t be) or presented incorrectly. Unlike in the prior section, the SEC isn’t questioning the calculation of a particular value in the disclosure.

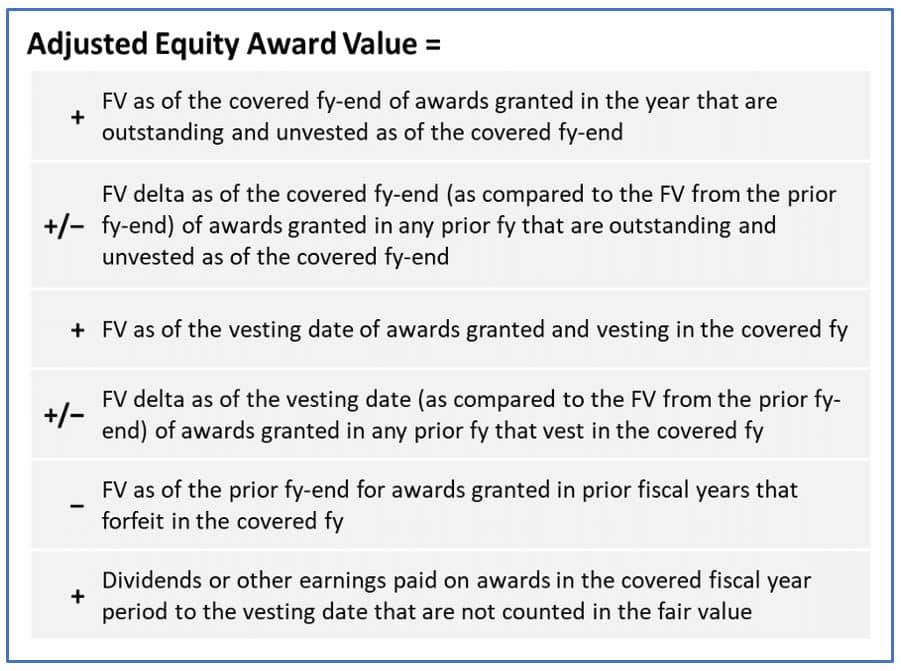

The best example is a missing or incomplete reconciliation table. That’s the table that breaks out the equity adjustment to compensation actually paid, or CAP, by its six core components (shown below).

A comparable breakout is also required for pension service cost.

Another common disclosure problem is missing or incorrectly structured relationship disclosures as per Item 402(v)(5). Some companies used a non-GAAP company-selected measure, or CSM, which is perfectly fine. But you still have to provide the customary reconciliation to the measure’s GAAP equivalent.

Disclosure problems boil down to either omitting an essential component of the required disclosure or misunderstanding what the component is supposed to include. In addition to the proprietary tools we use for client projects, we consider this disclosure checklist a useful resource. We also suggest reading this review of over 600 actual PvP disclosures, which highlights a variety of common problems.

Presentation Problems

Finally, the SEC flags problems like incorrect table headers and descriptions.

This is the most benign set of comments, but it shows the SEC is very focused on basic compliance and disclosure clarity. For example, Xylem titled a row in its breakout table, “Plus (less), year over year change in fair value of equity awards granted in prior years that vested in the year.” The SEC saw the reference “year over year” and notes this is unclear because technically this calculation component should subtract the vesting date fair value from the prior fiscal year-end value. Xylem responds that it did perform the calculation correctly and will use a more precise label going forward.

Although we believe the SEC will continue to flag presentation issues, they’ll become less common as disclosures become more standardized.

Wrap-Up

The SEC’s first round of comments give us a window into what the agency is focused on. Our view is the SEC is coming to terms with the complexity of the PvP rules, and if we were to put ourselves in their shoes, it wouldn’t even be clear where to begin. The SEC chose to begin at square one.

First, the SEC looks for logical tick-and-tie relationship breakdowns—calculations that appear off simply based on the data provided. (It remains to be seen how and whether they can identify more advanced calculation problems down the road.)

Most of the SEC’s comments focus on disclosure problems, especially missing components or incorrectly drafted content. These are the easiest to identify because they jump out when you compare a disclosure’s text and components against a checklist of all the requirements.

Finally, the SEC flags basic presentation problems like mislabeled row and column headings.

These comment letters dropped in close proximity to the SEC’s release of C&DIs on PvP. The two events indicate that disclosure quality and accuracy on PvP are priorities. As companies prepare for year two, they should continue to help senior management and the board understand the moving parts and value drivers of PvP. But it’s also a good idea to get back to first principles and ensure the disclosure itself is airtight and compliant.

Since it looks like these were handled in a batch capacity and with some delay after the actual company correspondence dates, we expect to see additional batches uploaded in the coming months. Stay tuned.